In today’s competitive forex market, traders demand more than just an ordinary Expert Advisor. They need an EA that not only identifies opportunities but also adapts to unpredictable market movements while protecting capital. WallStreet Recovery PRO EA V1.7 MT4 is one such advanced system — built for traders who value precision, consistency, and control.

This article explores how this EA works, its risk-management framework, and why it has become one of the most discussed recovery-based trading systems among disciplined traders.

What Makes WallStreet Recovery PRO EA Unique

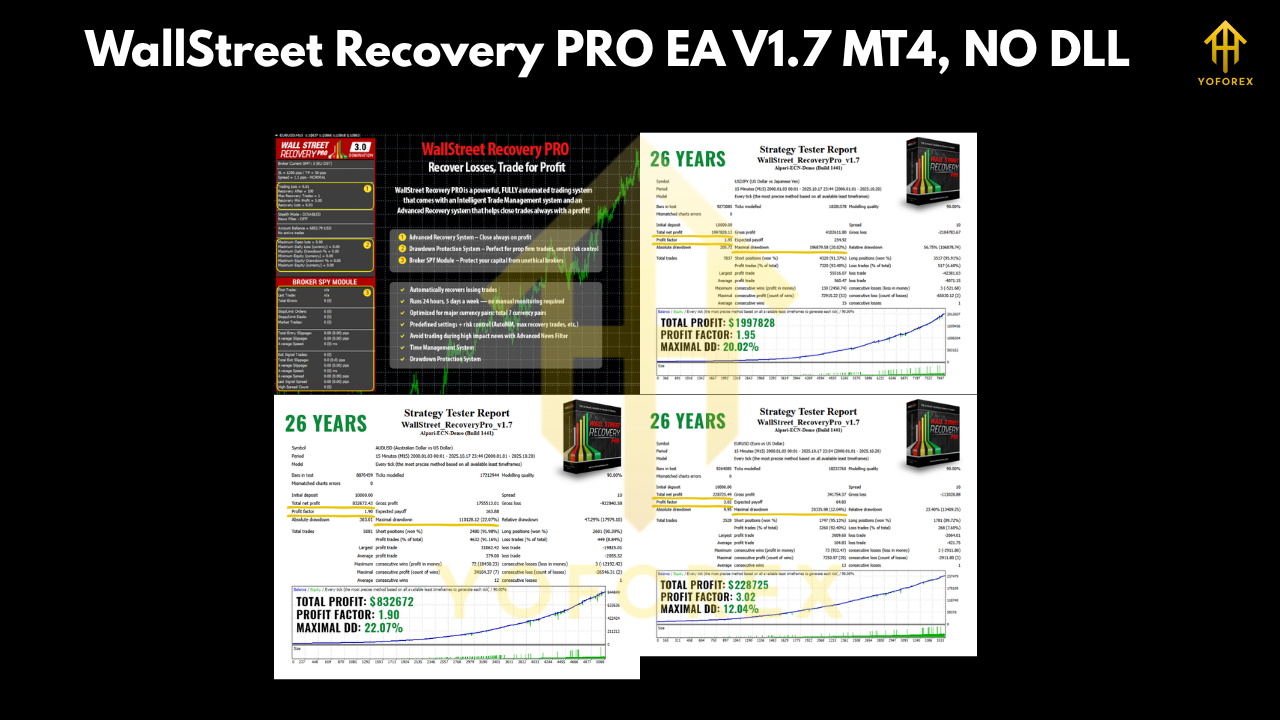

WallStreet Recovery PRO EA is a fully automated Expert Advisor designed to trade on MetaTrader 4. It implements a recovery mechanism that actively works to regain temporary losses and restore equity during drawdowns — a feature that sets it apart from typical EAs.

Unlike grid or martingale bots that rely on exponential lot increases, WallStreet Recovery PRO EA uses a mathematical, rule-based recovery algorithm. This algorithm calculates the optimal trade volume and timing for each new entry, ensuring that recovery happens gradually and intelligently without over-leveraging.

The version 1.7 update introduced better trade logic, adaptive filters, and more efficient control of execution speed, helping it perform across diverse market conditions.

Trading Concept and Logic

At its core, WallStreet Recovery PRO EA applies retracement and momentum detection techniques. It looks for overextended price movements and places trades in anticipation of a pullback or correction. If the trade temporarily goes against the position, the system activates its recovery function.

The recovery logic works as follows:

- Trade Analysis: The EA assesses price direction, volatility, and spread before placing each trade.

- Recovery Activation: If the price deviates beyond a predefined threshold, it calculates the ideal follow-up trade.

- Capital Preservation: Each position includes a pre-defined stop-loss, and the EA limits exposure by tracking total open trades.

- Profit Extraction: Once recovery is achieved, the system closes all positions together at a net profit.

This structure ensures the EA maintains controlled exposure while optimising recovery during temporary drawdowns.

Key Features of WallStreet Recovery PRO EA V1.7 MT4

1. Advanced Recovery System

The EA employs a layered recovery algorithm that manages drawdowns with precision. It focuses on turning negative floating positions into profitable results.

2. Risk Management Engine

It features multiple protective layers — including equity stop, balance protection, and dynamic lot adjustment — helping safeguard capital even in volatile conditions.

3. Smart Trade Filters

Before every trade, the EA scans spread, slippage, and news volatility filters to avoid low-probability setups.

4. Adaptive Lot Control

Automatic lot-sizing based on account balance ensures proportional risk-taking, preventing overexposure.

5. Prop-Firm Compatibility

Because of its disciplined recovery model and drawdown control, the EA is suitable for use on prop firm challenges and funded accounts.

6. Plug-and-Play Setup

All settings are pre-optimised for specific pairs. Users can simply install and run the EA without importing additional configuration files.

7. Session Filter and Timing Control

The EA restricts trading to high-liquidity sessions for better spreads and execution accuracy.

Recommended Settings and Conditions

To ensure optimal performance, follow these recommended parameters:

- Platform: MetaTrader 4

- Timeframe: M15

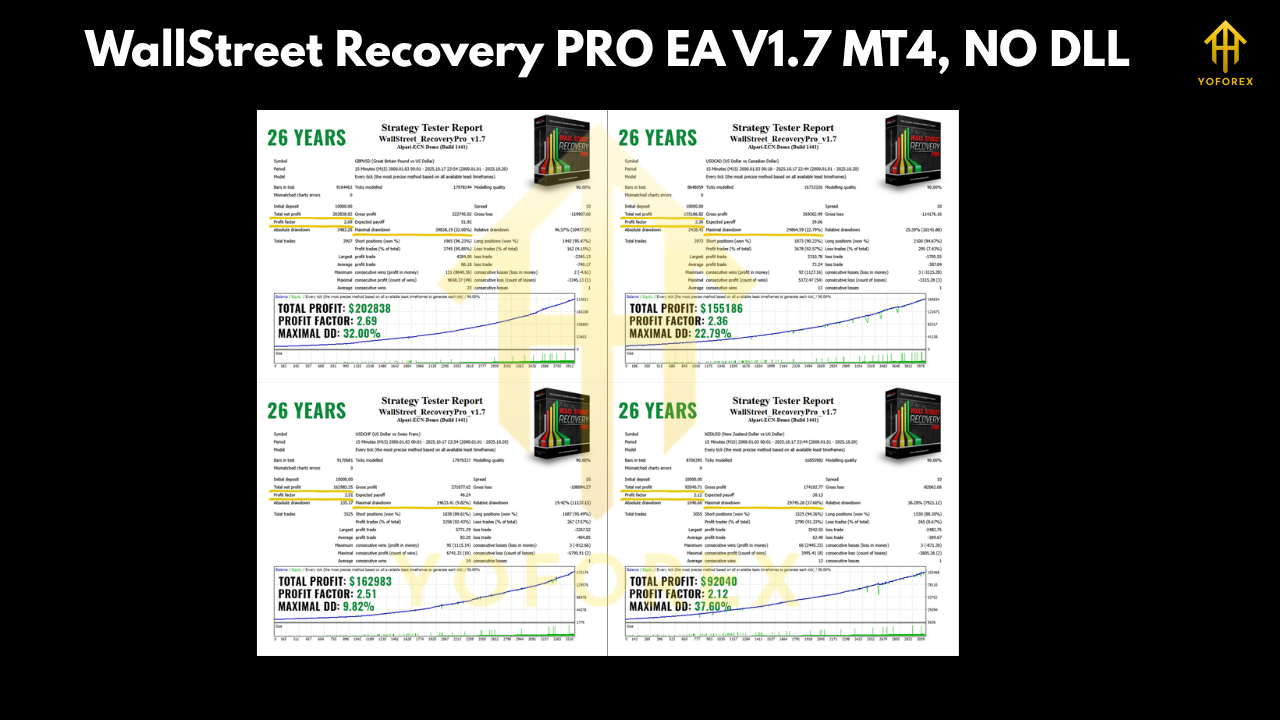

- Currency Pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, USDCAD, USDCHF

- Minimum Deposit: $200 (Recommended $500+)

- Broker Type: ECN or STP with low spreads

- Leverage: 1:100 or higher

- VPS Hosting: Recommended for uninterrupted 24/7 operation

By maintaining these conditions, the EA can execute trades efficiently and deliver stable performance with reduced slippage.

Benefits of Using WallStreet Recovery PRO EA

1. Safe and Controlled Automation

The EA’s foundation lies in disciplined automation. Its built-in protection layers prevent aggressive overtrading, giving traders confidence to let it run continuously.

2. Consistent Recovery and Growth

The unique recovery logic enables the system to manage floating losses effectively while aiming for gradual equity growth.

3. Flexible and Adaptive

Unlike rigid systems that fail in certain markets, this EA adapts its logic to evolving volatility, ensuring smoother performance.

4. Ideal for Beginners and Professionals

Whether you’re new to forex or an advanced trader, its easy setup and adjustable parameters make it accessible to all experience levels.

5. Capital Preservation Focused

It prioritises longevity over high-risk short-term gains — helping traders sustain consistent profitability.

Best Practices for Maximum Performance

To make the most out of WallStreet Recovery PRO EA V1.7, follow these tips:

- Start with Recommended Pairs: Stick to the listed major pairs to ensure stability.

- Run the EA on a Reliable VPS: Keep execution continuous and latency minimal.

- Avoid Manual Interference: Allow the EA to manage trades based on its algorithmic logic.

- Monitor Drawdown Occasionally: Review the recovery performance weekly and adjust lot risk if required.

- Keep Broker Conditions Clean: Use brokers that offer tight spreads and allow Expert Advisors.

These steps ensure optimal trading efficiency and consistent recovery outcomes.

Why WallStreet Recovery PRO Stands Out

What makes this EA stand out is its balance between automation and safety. Many robots promise high profits but ignore drawdown management. WallStreet Recovery PRO, however, takes the opposite approach — it focuses first on protecting the trader’s capital and only then on compounding gains.

Its ability to sustain itself through unfavorable market cycles while maintaining controlled exposure makes it one of the more dependable systems in the recovery-based EA segment.

Limitations to Consider

No trading system is perfect, and users should be aware of potential limitations:

- Recovery logic works best in moderately volatile markets, not during extreme spikes.

- It requires a consistent connection (VPS recommended).

- Short-term profits may vary depending on broker conditions.

- Still needs monitoring for rare market anomalies like flash crashes.

By understanding these boundaries, traders can manage expectations realistically and maximise long-term outcomes.

The Ideal Trader Profile

WallStreet Recovery PRO EA is best suited for:

- Traders who prefer low-risk automation over aggressive strategies.

- Beginner traders seeking a ready-to-run EA with minimal setup.

- Intermediate and advanced users are managing multiple pairs for diversification.

- Prop-firm participants who require controlled drawdown behaviour.

This EA rewards patience, discipline, and consistent use — making it a strong candidate for traders aiming at steady portfolio growth.

Long-Term Performance Perspective

The real strength of this EA is its durability. Instead of chasing short-term spikes, it compounds gains slowly while maintaining manageable equity curves. Traders who let it run consistently on multiple pairs often experience smoother results compared to those who intervene manually.

Its recovery structure, when combined with conservative lot sizing, can sustain profitability over longer cycles — especially when the system runs continuously across major pairs.

Final Verdict

WallStreet Recovery PRO EA V1.7 MT4 is a comprehensive automated system built for traders who prioritise recovery, safety, and sustained performance. It’s a balanced combination of logic-driven trading, capital preservation, and adaptive strategy control.

This EA is not meant for overnight success but for long-term growth with reduced emotional stress. For traders who prefer structured, rule-based trading, WallStreet Recovery PRO provides the right blend of automation and risk management.

If your trading philosophy values consistency over chance, this EA deserves a place in your automated trading toolkit.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment