Valkyrie AI EA V1.1 MT4 is an advanced Expert Advisor designed for traders who want a disciplined, technically solid robot instead of another “set and pray” script. Built for MetaTrader 4, it combines adaptive ADX and ATR filters with an AI-optimised decision engine to trade only when the market structure is favourable. Every component of the system has been engineered to push MT4 close to its technical limits in terms of execution speed, stability and risk control.

Many traders search for EAs that can survive changing volatility and avoid catastrophic drawdowns. Valkyrie AI fits that profile by focusing on clean trend participation, volatility-aware exits and a strict non-martingale philosophy. This review takes a deep look at how the robot works, which setups it prefers and how you can integrate it into your own automated trading plan.

WHAT IS VALKYRIE AI EA V1.1 MT4?

Valkyrie AI is a high-performance Expert Advisor for MT4 that focuses on identifying structured, directional markets and trading them with controlled risk. Instead of using aggressive grids or doubling strategies, it opens well-defined positions, manages them dynamically and then steps aside when conditions are not suitable.

According to the official description, Valkyrie AI has been built around three core pillars:

- AI-optimised trade logic to refine timing, lot sizing and volatility behaviour.

- ADX-based trend recognition to separate trending markets from flat ranges.

- ATR-based volatility analysis for smarter stop and target placement.

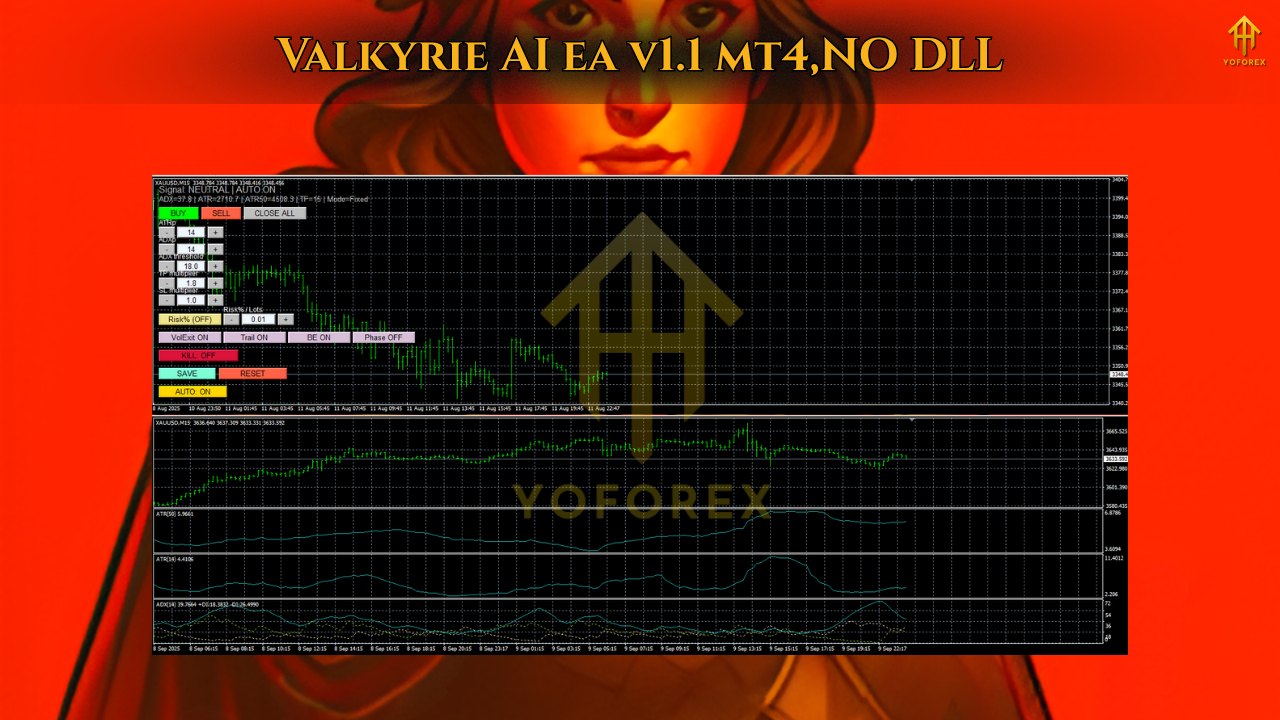

The EA can run fully automatic or in a semi-automatic style where you manually trigger trades and let Valkyrie AI handle exits, stops and trailing logic. This flexibility makes it useful both for pure algorithmic traders and for discretionary traders who want a “risk manager on autopilot”.

HOW THE CORE STRATEGY WORKS

Valkyrie AI’s strategy is designed around reading the market first and acting second. The EA does not try to trade every candle; it waits for conditions that fit its rule set.

First, it measures trend strength using ADX (Average Directional Index) and related directional movement signals. When ADX is below a defined threshold and the slope of ADX and ATR suggests a sideways regime, the robot simply does not trade. This built-in “do nothing” filter is one of the reasons why the EA avoids overtrading in choppy environments.

Second, the EA evaluates volatility using ATR (Average True Range). ATR tells Valkyrie AI how wide the market is swinging, and that information is used for:

- Setting the distance of stop-loss and take-profit

- Adapting to quiet versus highly volatile sessions

- Feeding the Smart Volatility Exit logic, which can close trades when volatility turns unfavourable

Third, Valkyrie AI applies an AI-optimised decision layer. The developer ran hundreds of optimisation cycles to tune parameters such as entry timing, exit conditions and risk handling across different market phases between 2022 and 2025. The goal is not just to fit one “perfect” backtest, but to create stable behaviour under varied conditions.

This three-step process turns Valkyrie AI into a structured trend-trading system that favours quality setups over quantity.

KEY FEATURES TRADERS SHOULD KNOW ABOUT

The feature set of Valkyrie AI EA V1.1 MT4 is built around practicality and control. Some of the most important elements are:

- AI-optimised entries based on ADX and ATR trend/volatility recognition.

- Choice between dynamic risk-based position sizing or classic fixed-lot trading.

- ATR-based stop and target calculation plus Smart Volatility Exit.

- Break-even and trailing stop system with adjustable sensitivity.

- Partial take-profit and runner management for trend continuation.

- Session filter and daily drawdown guard to limit risk during tough periods.

- Phase filter using ADX/ATR slope to avoid flat, directionless markets.

- High-timeframe ADX confirmation so trades align with broader structure.

- On-chart control panel with live toggle buttons and status display.

For mql5.software users, this combination means you get fine control over how aggressively or conservatively the EA behaves without having to touch the internal logic of the strategy.

RECOMMENDED PAIRS, TIMEFRAMES AND RISK SETTINGS

The developer provides clear recommendations so traders are not left guessing where to run Valkyrie AI.

- Pairs: EURUSD, GBPUSD, NZDUSD, USDJPY are suggested as primary symbols.

- Timeframes: M5 to H1 are supported, with M15 highlighted as the ideal balance between signal frequency and control.

- Risk: Start around 0.5–1.0% risk per trade in percentage mode, or very small fixed lots such as 0.01–0.05 while you become familiar with the system.

- Test period: The EA has been evaluated over the years 2022–2025 to cover a wide range of volatility conditions.

You can extend Valkyrie AI to other major pairs after your own backtesting, but following the recommended settings at the beginning is the safest way to understand its personality.

WHY VALKYRIE AI EA FITS THE MQL5.SOFTWARE AUDIENCE

Traders who visit mql5.software usually care about two things: technical quality and realistic risk behaviour. Valkyrie AI addresses both.

From a technical standpoint, the EA is coded entirely in pure MQL4 and designed to run efficiently on multiple charts without lag. The AI-driven optimisation process is not only about finding “good parameters” but also about refining how the EA reacts across changing environments, from quiet markets to sharp breakouts.

From a risk perspective, Valkyrie AI is explicit: no hidden martingale, no grid escalation. Instead, it uses a single-trade model with ATR-based stops, clear risk per position and optional daily drawdown protection. For traders who are tired of robots blowing accounts after a few strong trends, this transparent structure is a major advantage.

STEP-BY-STEP: HOW TO GET STARTED WITH VALKYRIE AI

To integrate Valkyrie AI EA into your own MT4 environment, it is wise to follow a step-by-step plan rather than jumping straight into high-risk trading:

- Install the EA on MT4 and attach it to one recommended pair (for example, EURUSD) on the M15 timeframe.

- Use the default configuration or the suggested starter settings from the documentation. Do not change too many parameters at once.

- Start on a demo account and let the EA trade across multiple trading sessions and at least a few weeks of market activity.

- Observe how many trades it takes, how drawdowns unfold and how the equity curve looks under different volatility conditions.

- Gradually add one or two more pairs if the performance and behaviour match your expectations.

- When you are comfortable, move to a small live account with the same conservative risk settings.

This process allows you to treat Valkyrie AI as a tool that you learn to operate, rather than a “black box” you hope will magically generate profit.

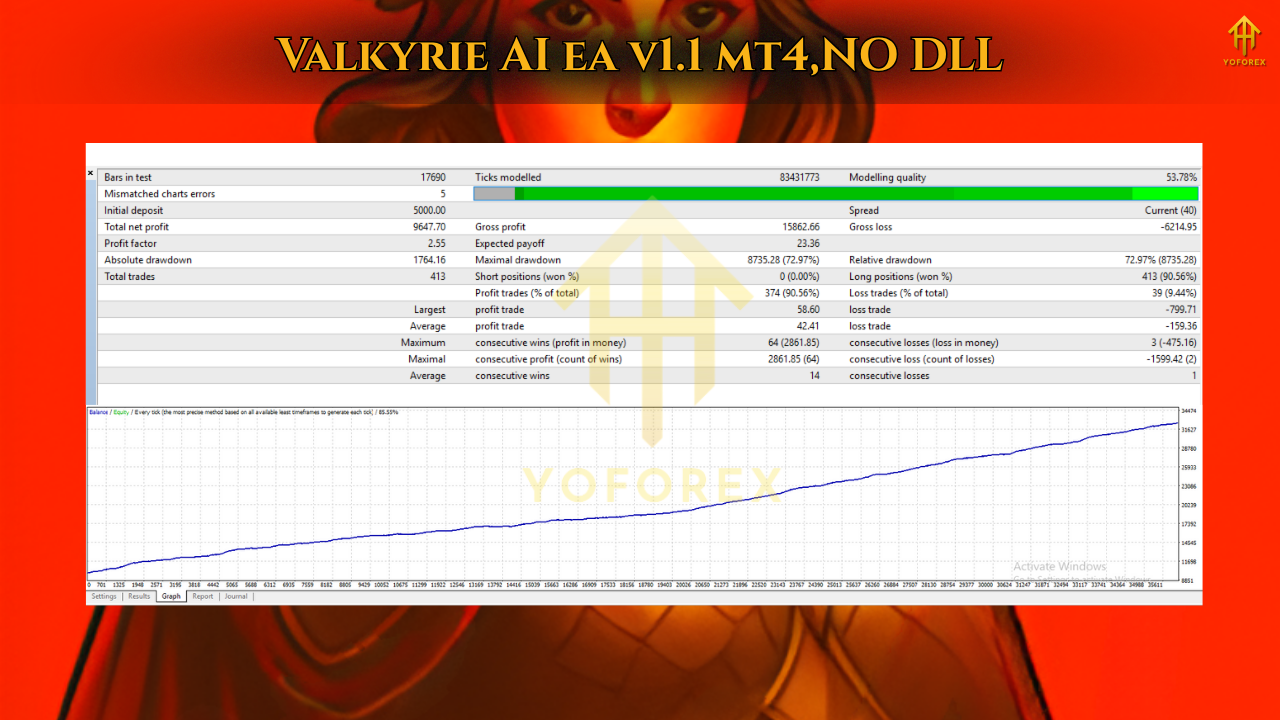

BACKTESTING AND OPTIMISATION BEST PRACTICES

Even though Valkyrie AI has already undergone extensive optimisation, running your own tests is a key part of understanding any EA.

When backtesting:

- Use high-quality tick data from your broker if possible, so the results reflect your real trading environment.

- Test at least several years of data, including quiet phases and high-volatility spikes.

- Focus not only on net profit, but also on maximum drawdown, average trade duration, and longest losing streak.

If you decide to optimise, keep the process realistic:

- Do not over-optimise every parameter; small, robust adjustments are better than chasing a perfect curve.

- Use out-of-sample data (periods not used in optimisation) to confirm that performance remains stable.

- Avoid making drastic changes to risk behaviour unless you fully understand their impact.

Valkyrie AI’s built-in AI-optimised structure is already tuned for varied conditions, so your goal is to align it with your own risk tolerance, not to rebuild the system from scratch.

RISK MANAGEMENT AND PROP-FIRM COMPATIBILITY

One of the important selling points of Valkyrie AI EA V1.1 MT4 is its compatibility with strict risk rules, making it attractive for traders working with prop-firm or funded accounts.

The EA’s daily drawdown guard allows you to specify a maximum daily loss. Once that level is hit, Valkyrie AI stops opening new trades, protecting you from breaching daily loss limits.

In addition, the single-trade model with clearly defined risk per position fits well with prop-firm requirements for consistent behaviour. You can keep your risk per trade at a conservative level and still benefit from structured trend participation.

Of course, no EA can guarantee profit, and even the best risk controls cannot remove the inherent uncertainty of the market. That is why combining Valkyrie AI with your own rules for withdrawals, maximum account exposure and “reset” conditions is essential.

LEGAL NOTICE AND EXPECTATIONS

The developer explicitly states that Valkyrie AI EA, while developed to a very high technical standard and supported by AI-driven optimisation, comes with no guarantee of profit. Trading Forex and CFDs always involves risk, and each user remains responsible for their own results.

This reminder is important: a sophisticated robot can be a strong edge, but only when combined with disciplined risk management, realistic expectations and patience.

CONCLUSION – SHOULD YOU TEST VALKYRIE AI EA V1.1 MT4?

Valkyrie AI EA V1.1 MT4 stands out as a carefully engineered Expert Advisor that tries to solve a real problem: trading trends with discipline while respecting volatility and risk. With its AI-optimised engine, ADX/ATR filters, ATR-based stop and target logic, daily drawdown protection and flexible operation modes, it offers a professional approach to automated trading rather than another gambling script.

For mql5.software readers who want a structured, rule-based EA that avoids martingale and focuses on capital preservation, Valkyrie AI is definitely worth adding to your testing list. Approach it methodically on demo first, take time to understand its behaviour, and only scale up when you are fully comfortable with both its strengths and its limitations.

Used in this way, Valkyrie AI EA V1.1 MT4 can become an important component of a long-term, sustainable automated trading strategy.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment