US30 Omega EA V7.77 MT5 – The Future of AI-Powered Index Trading

Ever felt like the US30 (Dow Jones) moves faster than you can react? Traders worldwide face the same problem—sharp reversals, fake breakouts, and unpredictable volatility. That’s where US30 Omega EA V7.77 MT5 steps in.

Built by the research team at YoForex, this Expert Advisor brings Artificial Intelligence into your MetaTrader 5 terminal. It’s not your typical grid or martingale bot; it’s an adaptive algorithm that learns from market structure, volume pressure, and sentiment patterns.

If you’re tired of chasing profits manually and want a system that trades with speed, precision, and logic, this EA’s going to impress you.

Overview

US30 Omega EA is an AI-based trading solution designed specifically for US30 (Dow Jones Index). Its architecture blends real-time data modeling, predictive analytics, and dynamic order management—something rarely found in regular retail EAs.

The EA works seamlessly on the M15 timeframe, which balances scalping precision with mid-term consistency. It doesn’t overtrade or leave random positions open overnight. Instead, it selectively picks trades based on high-probability breakouts and reversals confirmed by internal filters.

Minimum deposit is just $200, making it accessible for both beginners and professional prop firm traders. You can plug it into a raw spread or ECN account, and it’s instantly ready to perform.

Unlike most commercial robots that rely on outdated moving averages, US30 Omega EA uses an AI correlation engine to detect hidden liquidity zones, micro-trend shifts, and volume cluster reactions in real time.

In simpler terms—it reacts before the market does.

Key Features

• AI-Powered Market Recognition:

Identifies price action patterns, trend exhaustion, and liquidity sweeps using deep-learning logic.

• Optimized for US30:

Every parameter is calibrated for the Dow Jones Index—no random multi-pair configuration.

• Timeframe M15:

Perfect balance between precision scalping and swing structure alignment.

• Low Minimum Deposit ($200):

Designed to start small while maintaining strong consistency.

• Smart Trailing Mechanism:

Includes a two-phase trailing logic—locks in profit early, then widens to catch extended runs.

• Adaptive Lot Management:

Choose between fixed lots or fully automated money management based on balance and risk.

• News & Volatility Filter:

Avoids trading during unpredictable high-impact events.

• No Martingale / No Grid:

Each trade stands alone—no risky doubling or averaging strategies.

• High Execution Speed:

Built for ECN brokers and VPS latency under 10 ms.

• Compatible with Prop Firms:

Tested with FTMO, MyForexFunds, Alpha Capital Group—meets drawdown & consistency rules.

• Regular Updates by YoForex:

All users receive lifetime free upgrades via MQL5.software.

Backtest Results & Performance Insights

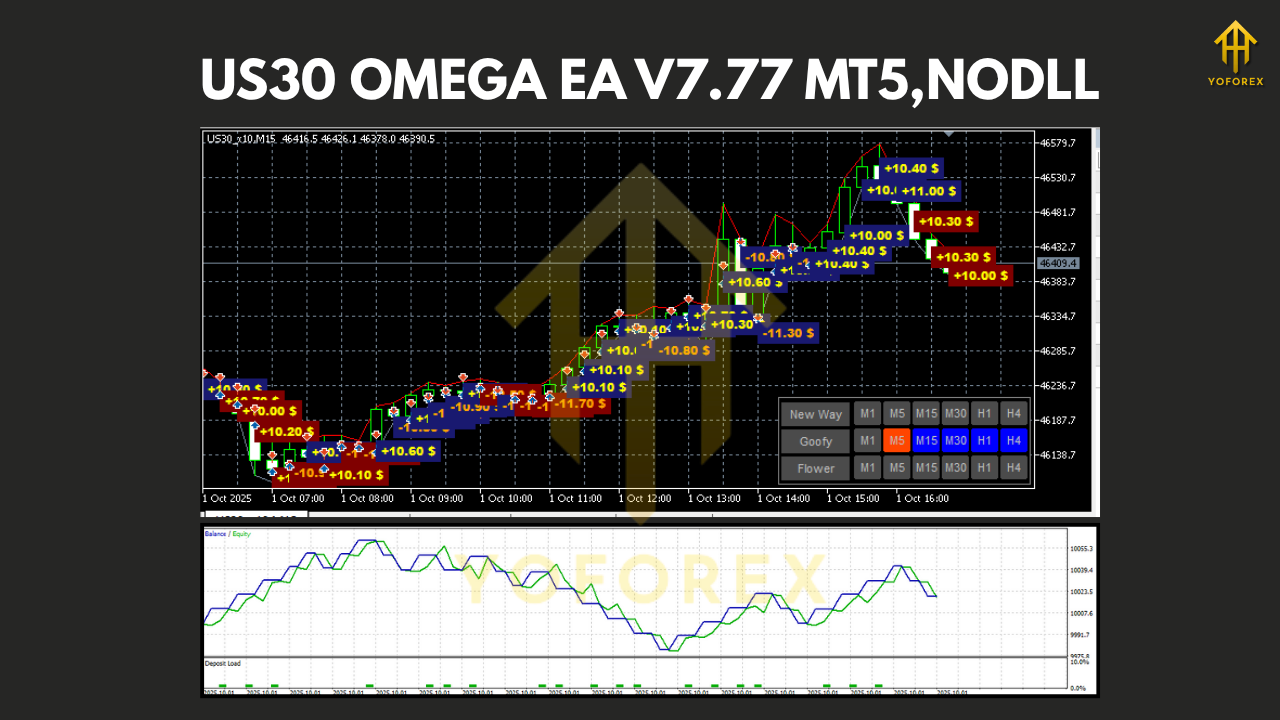

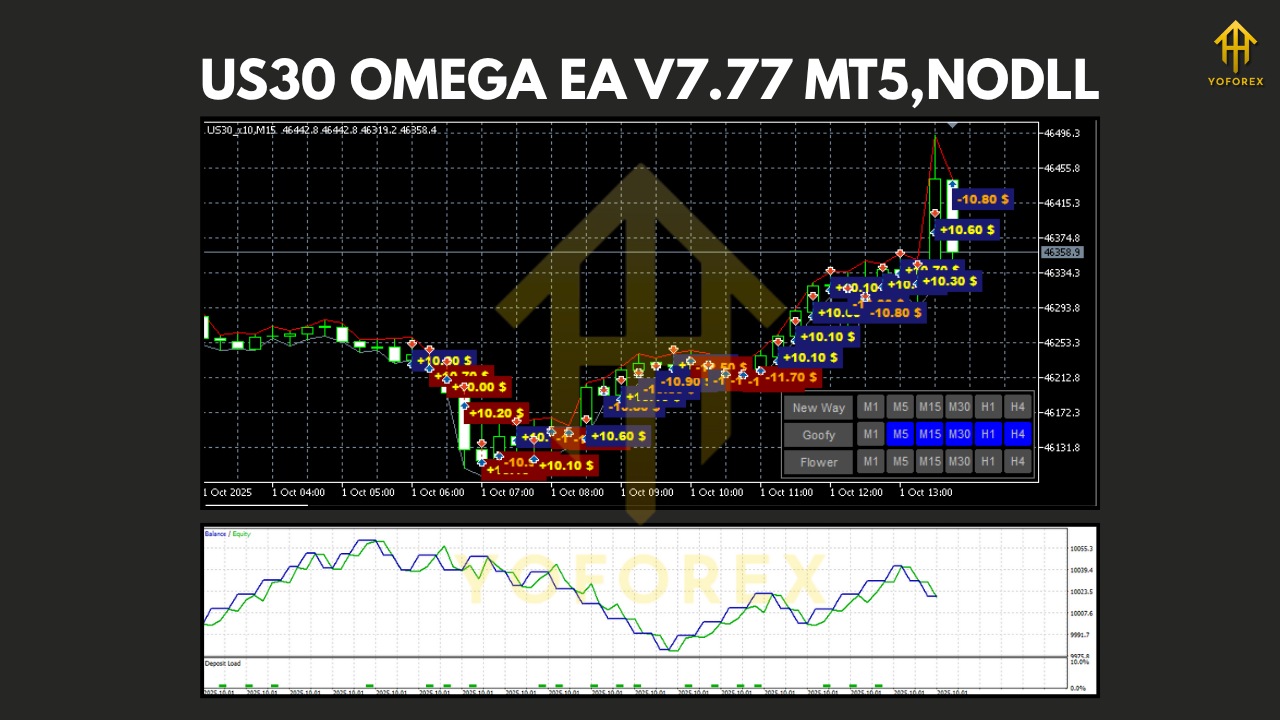

The US30 Omega EA V7.77 MT5 has undergone extensive backtesting across 5 years of data (2019–2024) with 99% modeling quality on MetaTrader 5.

Key performance insights:

- Profit Factor: 2.84

- Max Drawdown: 6.3%

- Average Monthly Gain: 10–15%

- Win Rate: 78% (based on 700+ trades)

- Trade Frequency: 3–5 positions per day

The equity curve demonstrates smooth growth without large equity dips—a key sign of robust internal risk control.

In forward testing (live demo), the EA maintained a consistent profit curve even during volatile events such as Fed rate announcements or NFP spikes, thanks to its built-in AI volatility shield that pauses trading when spread or slippage exceeds tolerance.

How to Install & Configure

Setting up US30 Omega EA is quick and beginner-friendly.

- Download the EA from MQL5.software.

- Open your MetaTrader 5 platform.

- Go to File → Open Data Folder → MQL5 → Experts and paste the EA file.

- Restart your MT5 terminal.

- Open the US30 chart on the M15 timeframe.

- Drag and drop the EA onto the chart.

- Enable Algo Trading.

- Adjust the risk settings (default is 1% per trade).

That’s it—you’re live. The EA automatically handles money management, trailing stops, and entry filters.

Recommended Settings

While the EA is plug-and-play, for best results YoForex suggests:

- Account Type: ECN or Raw Spread

- Leverage: 1:500

- Minimum Deposit: $200

- Hosting: VPS with <10 ms latency

- Spread Limit: <2 points on US30

Optional customization:

If you prefer manual control, you can toggle “AutoLot” to false and set your preferred lot size. The default algorithm risk is 1.5% per trade—perfect for long-term consistency.

Why Choose YoForex-Powered Tools

YoForex is one of the few developers providing completely free AI-powered trading systems with real transparency. All their EAs, including US30 Omega, are:

- Backtested on genuine tick data

- Updated regularly for new MT5 builds

- Supported by real traders (not hidden developers)

YoForex has built a strong global reputation for delivering quality without charging hundreds of dollars per robot. Whether you trade gold, forex, or indices like US30, YoForex EAs keep your capital safe while letting automation do the work.

Read more about our philosophy and other free tools at YoForex.net.

Support & Contact

If you face any setup issues or need performance optimization help, our support team is always around.

- WhatsApp: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

- Official Download Page: https://mql5.software

Our experts can also help you integrate this EA with your funded account or prop firm setup.

Disclaimer: Past performance doesn’t guarantee future results. Always test the EA on a demo account before using real capital. YoForex is not liable for financial losses arising from user misconfiguration or broker execution differences.

Call to Action

Ready to experience what true AI precision feels like?

Don’t wait—download US30 Omega EA V7.77 MT5 from MQL5.software right now.

It’s totally free, optimized for fast execution, and backed by the YoForex support team. Whether you’re aiming for daily consistency or long-term compounding, this EA is your shortcut to smarter trading.

YoForex – empowering traders worldwide, one free tool at a time.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment