SuperTrend Indicator V1.0 MT4 — A Simple, Powerful Way to Ride Trends

If you’re tired of cluttered charts and confusing signals, the SuperTrend Indicator V1.0 for MT4 might just be your new favorite tool. It’s simple, it’s visual, and it doesn’t try to be overly clever. Instead, it gives you a clean trend overlay right on the price chart — so you can spot direction fast, trail your stops intelligently, and avoid those emotional, “hmm maybe I should hold a bit longer…” moments. Traders love it coz it’s quick to read during live markets and easy to backtest after hours.

Unlike many “kitchen-sink” systems, SuperTrend focuses on trend continuation and dynamic stops. When the line flips, you see it instantly. When the price holds above the line, you stay with the move. And when volatility picks up, the line adapts; no need to babysit every tick. That’s the whole promise: stay on the right side of momentum and cut losers quicker, without eighty indicators fighting on your screen.

What is the SuperTrend Indicator?

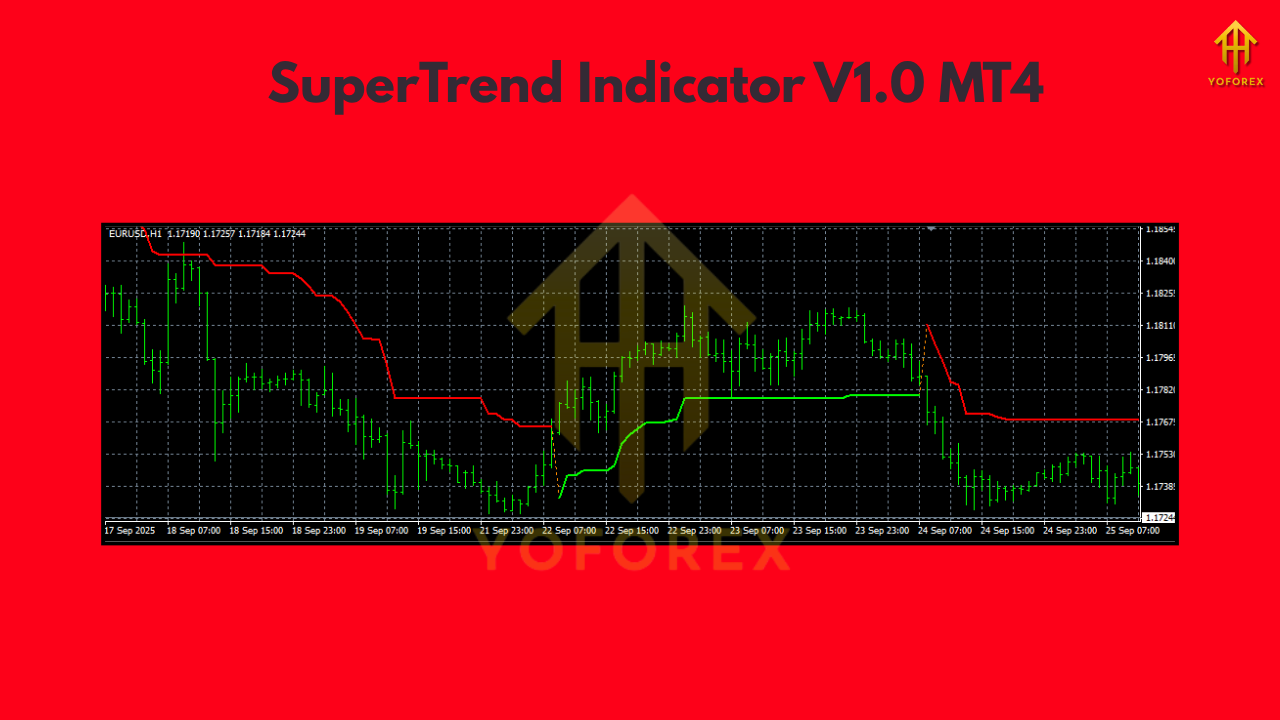

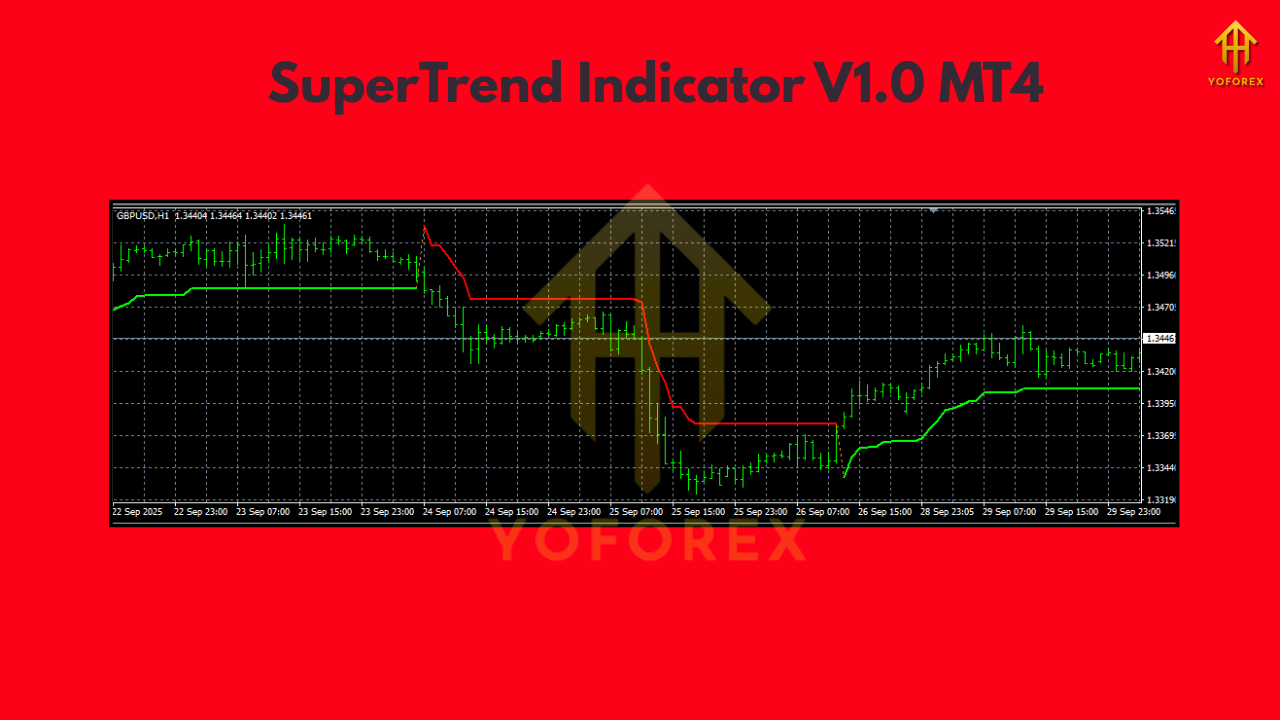

SuperTrend is a trend-following overlay that shifts above or below price based on volatility (typically ATR) and a multiplier. When the market is bullish, the line sits below price and acts like a dynamic support; in bearish phases, it flips above price and acts as dynamic resistance. This simple “flip” makes it very beginner-friendly, while still being robust enough for advanced traders who layer it into multi-timeframe strategies.

Key idea: Ride the trend, exit when the line breaks, re-enter when the trend resumes. That’s it. No secret sauce, just disciplined execution.

Recommended Pairs & Timeframes

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold). The indicator works across most FX majors and gold; you can test indices or crypto CFDs if your broker supports them, but start with liquid pairs.

- Timeframes: M15, M30, H1 are the sweet spot for most.

- Scalpers: M5 (expect more noise; use tighter risk).

- Swing: H4 for cleaner signals, fewer trades, potentially larger moves.

Why SuperTrend V1.0 for MT4 stands out

A lot of custom SuperTrend builds float around. This V1.0 iteration for MT4 keeps things clean, light, and responsive. It’s optimized for MetaTrader 4, so you can attach it to multiple charts without freezing your terminal; it also includes straightforward inputs so you can tweak it to your preferences without needing a PhD in indicator engineering.

How It Works (Plain English)

- ATR Measures Volatility: The Average True Range expands during high volatility and contracts when markets calm down.

- Multiplier Builds the Buffer: SuperTrend uses a chosen multiplier times ATR to create a dynamic offset.

- Band Sits Above/Below Price:

- Uptrend: Band beneath price.

- Downtrend: Band above price.

4. Flip = Potential Trend Change: When price closes beyond the band, the line flips sides — this is your cue to consider switching bias or exiting.

That’s the whole machine. Simple, transparent, and surprisingly effective when you pair it with basic risk rules.

Practical Trading Playbook

Entry:

- Buy when the line flips below price and the candle closes above the band.

- Sell when the line flips above price and the candle closes below the band.

Stop-Loss:

- Place your stop just beyond the SuperTrend line. This keeps your risk dynamic and aligned with volatility.

Take-Profit Ideas:

- RR-based: Aim for 1.5R–2R on M15/M30; 2R–3R on H1/H4.

- Trail-out: For trend riding, trail behind the SuperTrend line and let winners run.

Filters (optional but helpful):

- Trade with higher-timeframe bias (e.g., use H1 direction for entries on M15).

- Avoid major news spikes if you’re on lower timeframes.

- Combine with a volume or momentum filter (RSI > 50 for longs, < 50 for shorts, etc.) — optional, but reduces chop.

Default & Suggested Settings

- ATR Period: 10 (default)

- Multiplier: 3.0 (common baseline)

- Applied Price: Close

- Alerts: On (if your build supports alerts)

Tuning tips:

- If you get too many flips (chop), increase the multiplier (e.g., 3.5–4.0).

- If signals feel late, decrease the multiplier (e.g., 2.5–2.8), but expect more whipsaws.

- On H4, you can often use a lower multiplier since noise is reduced.

Example Strategy (EURUSD, M30)

- Rule 1: Only buy when SuperTrend is green (below price).

- Rule 2: Confirm with higher timeframe (H1) also green.

- Rule 3: Stop goes a few pips below the SuperTrend line.

- Rule 4: First target at 1.5R; scale out and trail remainder behind the line.

- Rule 5: If flip occurs (line turns red), close remaining longs and look for shorts after a clean candle close.

This simple framework — trend + dynamic stop + partials — is often enough. You don’t need 15 indicators to be consistent; you need one reliable bias tool and strict risk control.

Risk & Money Management (Don’t skip this, seriously)

- Risk 0.5%–1% per trade for M15/M30; up to 1%–2% on H1/H4 if you prefer fewer, higher-quality setups.

- Daily loss limit: Stop trading for the day if you hit −2R.

- Weekly cap: Consider a −5R weekly cap to protect mental capital.

- Always test on demo before risking real funds. Markets change; you want your muscle memory built in a safe place.

Pros & Cons

Pros

- Incredibly easy to read (color-flip clarity).

- Adaptive to volatility via ATR.

- Works across many pairs/timeframes.

- Great as a trailing stop tool.

Cons

- Being trend-following, it lags by design.

- In range-bound conditions, expect more whipsaws.

- Requires discipline to wait for flips and closes.

Installation (MT4)

- Download the SuperTrend Indicator V1.0 file (

.mq4or.ex4). - Open MT4 → File → Open Data Folder.

- Go to MQL4 → Indicators and paste the file.

- Restart MT4 or right-click Navigator → Indicators → Refresh.

- Drag SuperTrend V1.0 onto your chart, set your ATR period and multiplier, click OK.

- Save a template so you can load it fast across pairs.

Backtesting & Optimization Tips

- Use visual mode in MT4 Strategy Tester (attach SuperTrend to a dummy EA or manually review historical charts).

- Test one pair at a time; EURUSD and XAUUSD are great starters.

- Log win rate, average R, max drawdown, and number of flips per day.

- Optimize ATR period and multiplier only after you’ve got a baseline. Small tweaks often beat big overhauls.

- Keep a journal with screenshots of flips and exits; patterns show up quickly.

Final Thoughts

SuperTrend Indicator V1.0 MT4 is perfect if you want something that’s not overcooked. It’s trend bias, stop logic, and a hint of timing — in one line. Give yourself a week on demo, learn the flips, feel the rhythm on your chosen timeframe, and keep risk tight. You’ll be surprised how much stress goes away when your chart tells you, plainly, “we’re up” or “we’re down.”

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment