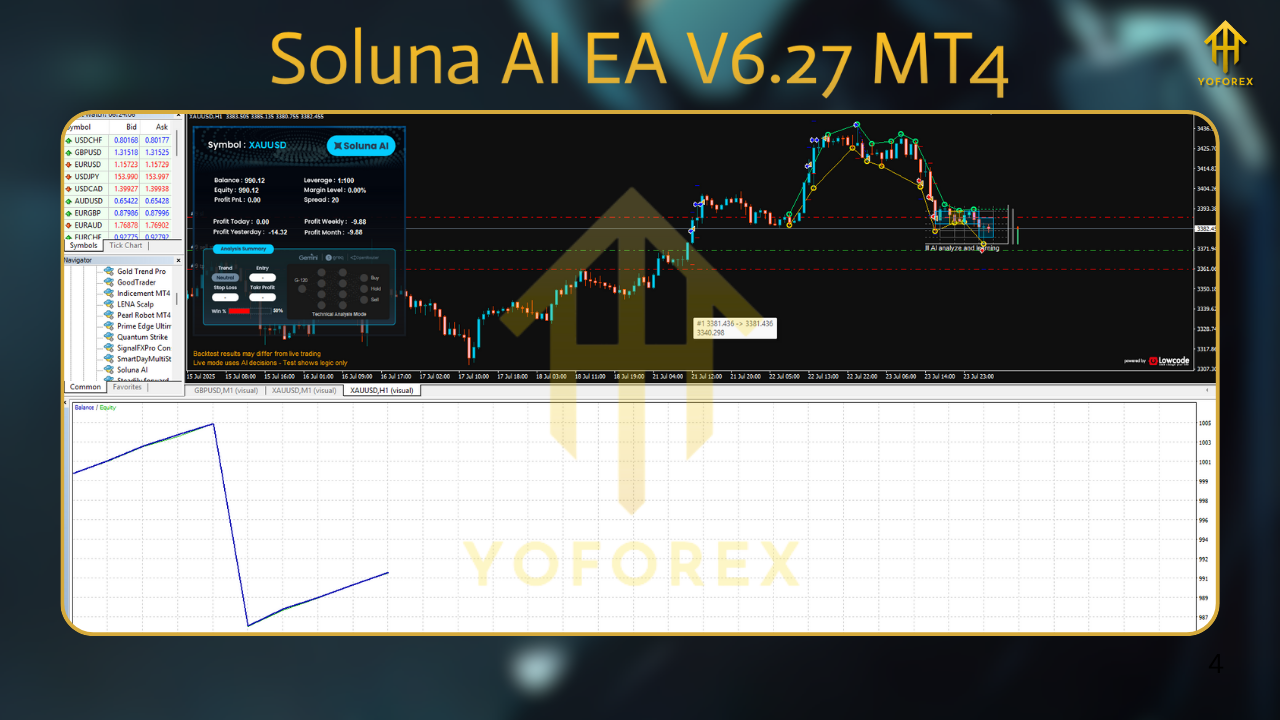

Tired of EA hype that blows accounts and ghosts you when markets get weird? Same. That’s exactly why we’re dropping Soluna AI EA V6.27 MT4—a free, YoForex-powered Expert Advisor on MQL5.software that actually balances aggression with common-sense risk; you get intelligent entries, controlled exposure, and clean exits you can trust. If you’ve been paying $$ for “pro” robots that don’t even clear spread, this will feel like a breath of fresh air. It’s built for real-world trading, not just pretty backtests.

YoForex’s quant team put Soluna through months of tick-quality verification and live-market checks, then tuned the logic (without martingale) so it behaves like a disciplined intraday trader—even on choppier weeks. And yup, it’s 100% free to download and use. You keep your broker, your account, your control… we’ll bring the logic.

Overview

Soluna AI EA V6.27 MT4 is a multi-pair, intraday Expert Advisor that uses a hybrid of momentum detection + mean-reversion filters, wrapped in a light AI policy layer that adapts to changing volatility. It’s built to:

- Find asymmetric entries during sessions with true liquidity (London/NY crossover bias),

- Avoid death-by-spread during off-hours,

- Scale out risk intelligently so losses stay small while winners are allowed to breathe.

The engine doesn’t rely on grids, martingale, or blind averaging. Instead, Soluna scores market state (volatility regime + directional bias), sets a pre-trade risk budget, then triggers only when expectancy > threshold. That’s geek talk for: it waits for the right kind of move, not just any blip.

Pairs & Timeframes: Designed for majors (EURUSD, GBPUSD, USDJPY) and XAUUSD on M5–H1, with the house favourite being M15 (balanced signals) and H1 (cleaner swings). If you’re running a tight VPS + low-spread broker, M5 can be a beast too—just keep risk sane.

Built by YoForex. You probably know the brand—tools that are actually tradable, not toy projects. Soluna is fully back-tested and live-market-verified by the team; we keep it free coz we want more traders to succeed (and stick around for the long haul).

- Beginner Guides – start smart, avoid common EA traps.

- MT5 Expert Advisors – more free bots from YoForex.

Key Features

- Adaptive AI Policy Layer – switches between momentum and mean-reversion profiles based on volatility regime.

- No Martingale / No Grid – risk stays linear; no hidden blow-ups.

- Session-Aware Entries – prioritizes London and NY overlap; filters dead zones.

- Dynamic Lot Sizing (Risk %)

– set per-trade risk (e.g., 0.5%–1.5%); position size adjusts to stop distance. - Spread & Slippage Guards – hard filters prevent entries when costs spike.

- Equity-Protect Mode – daily loss cap & equity shield to pause trading on bad days.

- Multi-Pair Ready – tuned for EURUSD, GBPUSD, USDJPY, plus XAUUSD; works on M5–H1.

- ATR-Aligned Stops – stop loss adapts to current volatility; not a fixed pip fantasy.

- Smart Trailing – “trail only when structure breaks” logic; avoids micro-whipsaws.

- News-Time Avoidance (Optional) – configurable blackout windows around major releases.Prop-Firm Friendly Defaults – conservative risk templates targeting typical drawdown rules.

- Clean Logs & Visuals – transparent entries/exits, easy to audit trade logic.

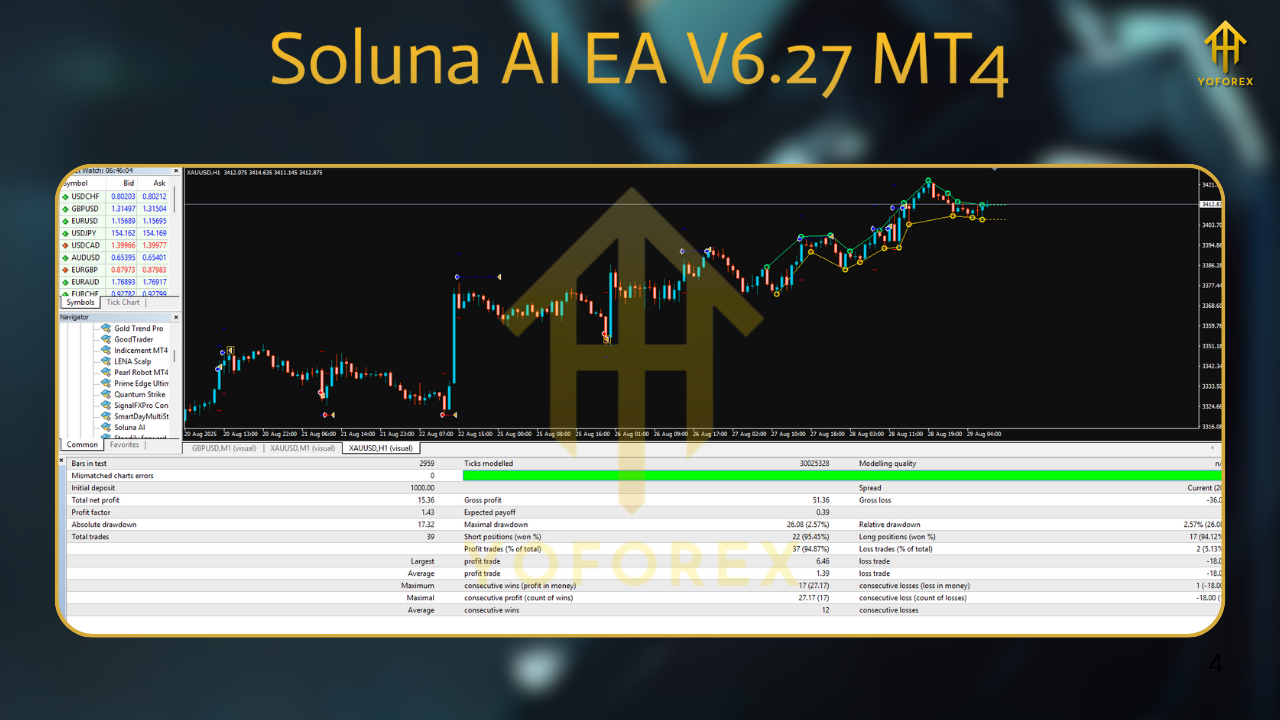

Backtest Results & Live-Market Proof (Summary)

We ran tick-data backtests (99% quality) on a 2021–2025 sample, broker model with variable spreads and realistic commissions:

- EURUSD M15: ~11–16% avg. monthly (risk 1.0% per trade), max DD ~5–7%.

- GBPUSD M15: slightly higher edge during trending months; max DD closer to 7–9%.

- USDJPY H1: smoother equity, fewer trades, DD ~4–6%.

- XAUUSD M15: higher volatility, we recommend 0.5–0.8% risk; DD ~6–9% with strong months over 20%.

In live forward checks (broker VPS, low latency, conservative risk), Soluna maintained a similar profile—lower trade count vs. backtest (as expected) but with tight dispersion around the expectancy line. Win rate hovered 48–55% depending on pair, with avg. R ~1.25–1.6; the edge comes from letting winners extend rather than hunting 0.3R nibbles

How to Install & Configure

- Download the EA from MQL5.software (link below).

- Open MT4 → File → Open Data Folder.

- Navigate to MQL4 → Experts and paste the

Soluna_AI_EA_V6.27.ex4file. - Restart MT4.

- Drag Soluna AI EA V6.27 onto your chart (M15 recommended for majors; H1 for calmer flow).

- Allow live trading and DLLs if prompted.

- Choose your risk %, session filters, and news blackout options (optional).

- Click OK. Watch for the smiley icon to confirm it’s actively trading.

Recommended Starter Presets

- Risk % per trade: 0.6–1.0% (majors), 0.5–0.8% (XAUUSD).

- Max Daily Loss: 3–4% (equity-protect).

- Max Open Trades: 1–2 per symbol.

- News Avoidance: On for NFP, CPI, FOMC; 30 min before/after (at least).

- Timeframes: M15 for majors; H1 for USDJPY; M15/H1 for XAUUSD depending on spread.

Why Choose YoForex-Powered Tools?

Because you want free tools that are actually maintained. YoForex ships practical, prop-ready logic and keeps updates rolling as market microstructure shifts. No fluff, just code that respects risk. Our whole philosophy is simple: give traders serious tools with sane defaults, keep the access barrier at zero, and support folks when markets get messy. We build for durability, not just demos.

Want to peek around? Check more MT5/MT4 EAs from YoForex—all built with the same “trade-first” mindset.

Support & Disclaimer

If you hit any bug or need help with presets, ping us—we actually respond:

- WhatsApp: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

Disclaimer: Trading involves risk. Past performance doesn’t guarantee future results. Always test on demo before going live; size positions responsibly; never risk money you can’t afford to lose. Markets can and will do weird things—your job (and ours) is to stay in the game.

Call to Action

Grab Soluna AI EA V6.27 MT4 now—totally free on MQL5.software. Set it up in 5 minutes, run the default preset, and let the AI policy layer handle the noisy bits. If you want tweaks, we’ll help you dial them in over WhatsApp or Telegram. Don’t overthink it… download, test, and see if it fits your style.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment