SMC Strategy EA V10.0 MT5 is one of the most advanced institutional-style Expert Advisors available in the modern forex trading environment. Built entirely around Smart Money Concepts (SMC), this EA is engineered to read market structure, identify imbalances, detect liquidity shifts, and execute high-precision trades aligned with professional trading models. As traders increasingly move away from outdated indicator-based strategies, systems like SMC Strategy EA V10.0 MT5 are gaining significant traction due to their disciplined logic and consistent approach.

This professional review covers the EA’s methodology, technical design, risk-management framework, expected performance, compatibility, and suitability for different trader profiles. Every aspect is evaluated objectively so traders can make informed decisions before deploying this EA in live markets.

Introduction to SMC Strategy EA V10.0 MT5

SMC Strategy EA V10.0 MT5 is a fully automated trading algorithm built for MetaTrader 5. Unlike conventional EAs that rely on lagging indicators or repetitive patterns, this EA uses institutional mapping of price to determine what the market is actually doing. Smart Money Concepts is the foundation behind the EA, enabling it to analyse liquidity zones, breaks of structure, Fair Value Gaps (FVG), trend direction, and continuation models.

The goal of SMC Strategy EA V10.0 MT5 is not to trade frequently, but to trade accurately. It prioritizes quality over quantity, waiting for well-confirmed confluences before executing a position. This is the same logic used by institutional desks and professional price-action traders.

Core Trading Methodology

SMC Strategy EA V10.0 MT5 follows a rule-driven, mechanics-first approach rather than relying on predictive indicators.

1. Market Structure Identification

The EA continuously monitors:

- Break of Structure (BOS)

- Change of Character (CHOCH)

- Liquidity sweeps

- Trend continuation signals

These parameters help the system define directional bias and eliminate counter-trend trades. This alone dramatically improves overall trade quality.

2. Fair Value Gap (FVG) Mitigation

Fair Value Gaps represent inefficiencies created when liquidity aggressively leaves the market. Institutions often revisit these zones to rebalance price.

The EA:

- Detects imbalances

- Waits for price to retrace into them

- Executes trades only when the trend aligns

This creates precise entries with optimized stop loss placement and strong risk-to-reward ratios.

3. EMA Trend Confirmation

An adaptive EMA filter ensures that trades follow the broader momentum rather than opposing it. This reduces drawdown and keeps the strategy consistent with institutional direction.

4. Professional Risk-to-Reward Framework

The EA is designed to target structured setups with projected R:R ratios beyond 1:2.

This allows the system to maintain profitability even in weeks where win rate may fluctuate.

Key Features of SMC Strategy EA V10.0 MT5

SMC Strategy EA V10.0 MT5 incorporates several technical and professional-grade features:

1. No Martingale, No Grid, No Averaging

The EA avoids all high-risk money-management techniques. Every trade is independent with a fixed protective stop loss.

2. Institutional Logic Integration

The EA interprets market behaviour based on how liquidity providers move price rather than depending on indicators.

3. Low Drawdown Strategy

Because entries are clean and tightly managed, the drawdown remains significantly below typical grid-based or volatility-scalper systems.

4. Built-in Daily Equity Protection

A dedicated system can limit daily exposure, making it suitable for disciplined trading and challenge-based evaluation environments.

5. Stable Operation Across Brokers

The EA does not rely on ultra-tight spreads, latency arbitrage, or abnormal execution techniques. This makes it stable across most MT5-supported brokers.

6. Beginner-Friendly Setup

Its intelligent automation allows even beginners to deploy it within minutes.

Most settings are pre-optimized and require minimal manual intervention.

Recommended Settings for Best Performance

- Platform: MT5

- Timeframe: M15

- Preferred Pairs: EURUSD, GBPUSD

- Minimum Deposit: $200 or higher

- Leverage: 1:200 or above

- Risk Per Trade: 0.5% to 2%

- Execution Mode: Auto

These settings balance safety, consistency, and long-term account growth.

Performance Overview

Although performance always depends on broker conditions and market environment, traders can generally expect the following characteristics:

1. Selective Trading

The EA does not trade excessively.

It looks for institutional confluence, which typically results in 2–8 trades weekly.

2. High-Quality Trade Entries

Its FVG-based approach ensures entries are logical, price-action aligned, and placed within clear structural zones.

3. Consistent Risk Control

Every trade is executed with defined risk parameters.

The EA does not rely on adding more positions to recover losses.

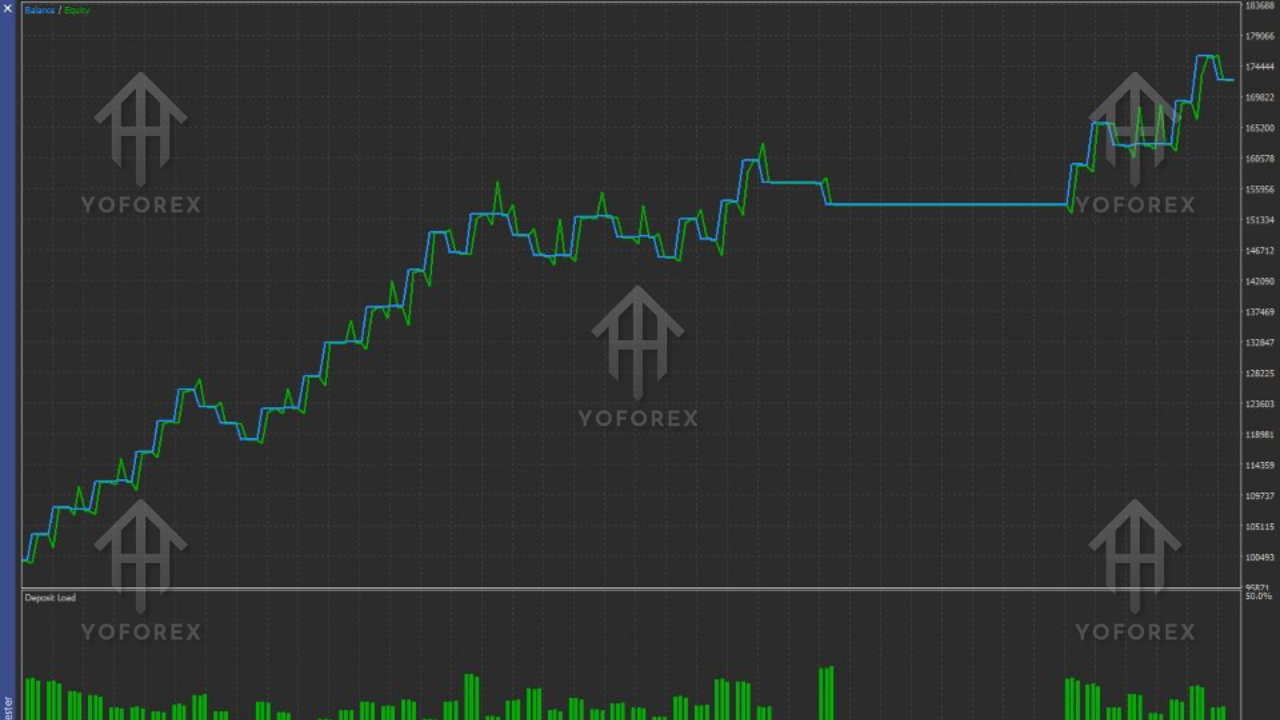

4. Sustainable Profit Curve

The strategy is designed for steady growth rather than erratic, high-risk returns.

5. Resilience During Volatile Sessions

By focusing on structure and imbalance rather than speed-based logic, the EA maintains reliability even during news volatility.

Benefits of Using SMC Strategy EA V10.0 MT5

- Uses advanced Smart Money Concepts

- No martingale or grid strategies

- Clean, structure-based entries

- Low drawdown potential

- Beginner-friendly

- Works with widely available currency pairs

- High R:R opportunities

- Suitable for long-term trading strategies

- Professional execution model

- Strong alignment with institutional methodologies

Considerations Before Using This EA

While the EA is technically solid, traders should consider:

- It does not trade frequently, so results compound slowly

- Works best on EURUSD and GBPUSD; other pairs may not match its optimization

- High-impact news events can temporarily disrupt performance

- Requires disciplined expectations—no EA can win in every market condition

This system is built for stability and precision, not fast or reckless profit generation.

Who Should Use SMC Strategy EA V10.0 MT5?

1. Professional and Semi-Professional Traders

Traders who understand institutional logic will appreciate the EA’s structure-based execution.

2. Beginners Seeking Safe Automation

Its clean approach and fixed-risk model make it ideal for newcomers.

3. Long-Term Investors

The EA is designed for sustainable, steady performance rather than aggressive equity curves.

4. Traders Avoiding High-Risk Systems

If you prefer controlled exposure and planned entries, this EA fits perfectly.

5. Analytical Traders Who Prefer Strategy Over Speed

This EA is about confluence, price action, and timing—not rapid trade execution.

Final Professional Verdict

SMC Strategy EA V10.0 MT5 stands as a refined and disciplined Expert Advisor built on Smart Money Concepts. Its focus on market structure, Fair Value Gaps, liquidity mapping, and trend confirmation aligns it with modern institutional trading philosophies. With fixed stop losses, controlled risk exposure, and a selective trading model, it provides a dependable option for traders who prioritize precision and long-term performance.

For those looking to integrate a high-quality SMC-based automated system into their MT5 environment, SMC Strategy EA V10.0 MT5 offers an excellent combination of professional logic, technical reliability, and strategic sophistication.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment