Navigating the forex market effectively requires more than just technical knowledge. You need tools that can adapt to market conditions, respond to sudden price shifts, and still follow a logical trading path. SMART TRENDGRID EA V1.0 MT5 is one such tool that blends strategy and automation to offer an edge.

Built for the MetaTrader 5 platform, SMART TRENDGRID EA brings together two powerful trading principles—trend-following and grid trading—and intelligently merges them into a structured trading system. The goal is to stay in sync with market direction, while managing pullbacks with precision.

Let’s explore how this EA works, its key features, and how you can use it to improve your automated trading strategy without falling into the typical pitfalls of grid-based systems.

What is SMART TRENDGRID EA V1.0?

SMART TRENDGRID EA V1.0 is an expert advisor designed specifically for the MT5 trading environment. It is built to identify clear market trends and enter trades in the direction of that trend. Unlike most trend-based EAs, it doesn't exit trades on small retracements. Instead, it adds positions using a grid system—but in a way that respects overall market structure and risk.

It uses a set of pre-defined technical indicators to determine the strength and direction of a trend. If price pulls back temporarily, the EA adds more positions at defined intervals (grid spacing), aiming to improve the average entry price.

However, what makes it stand out is that it doesn’t rely on risky methods like martingale or doubling lot sizes. It sticks to smart order sizing, uses trailing stops, and includes a safety mechanism to exit all trades when a major reversal is detected.

How the Strategy Works

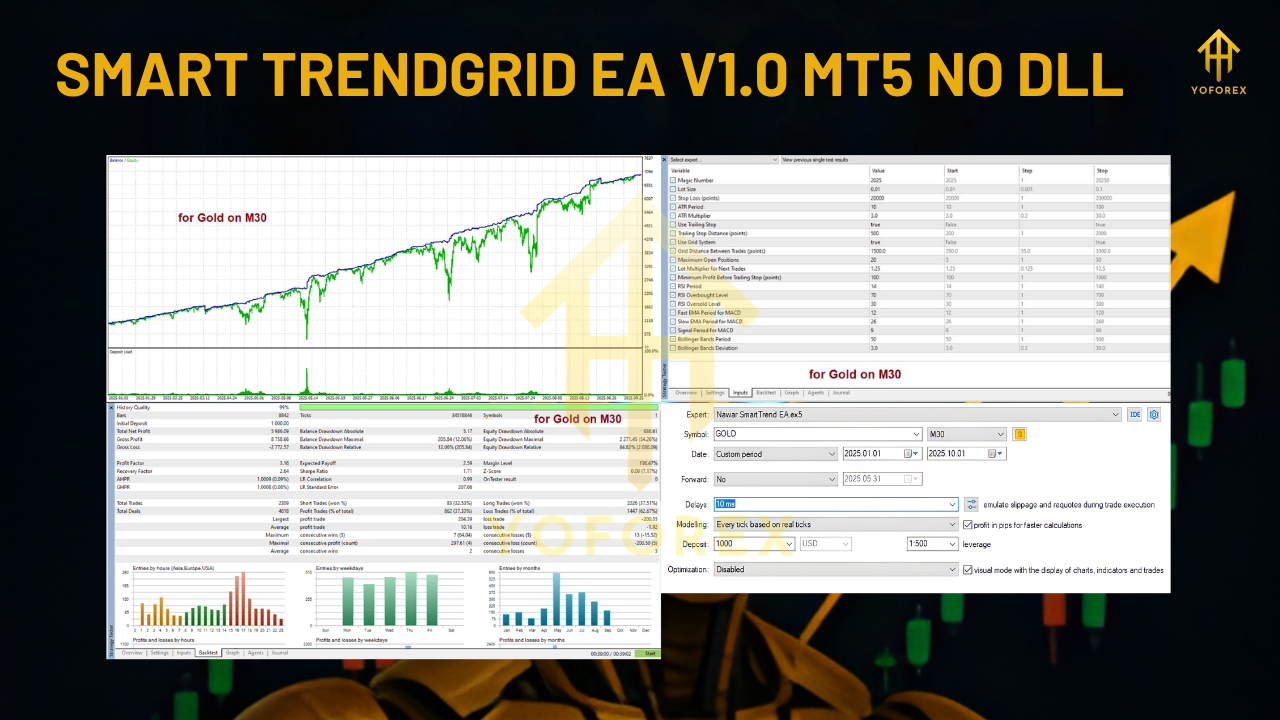

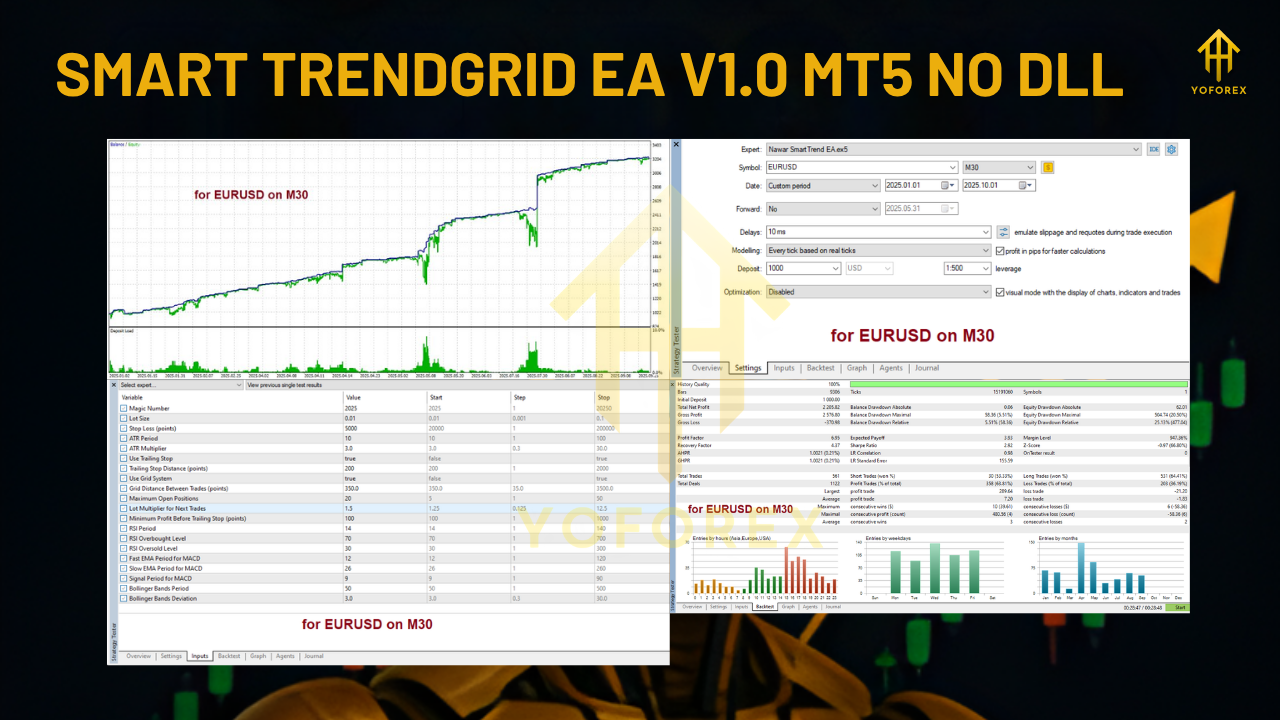

1. Trend Identification

The EA scans the market for valid trend conditions using multiple confirmation indicators:

- SuperTrend to determine the overall direction.

- MACD and RSI to validate momentum and overbought/oversold conditions.

- Bollinger Bands to monitor volatility and breakout zones.

Once a trend is confirmed, the EA places the first trade in that direction.

2. Grid Layering During Retracement

If the price moves slightly against the initial trade, SMART TRENDGRID begins to layer in additional entries—always in the same direction as the original trend.

- The spacing between each trade (grid step) is configurable.

- All trades remain within a capped limit to avoid exposure risk.

- No increase in lot size is used—each trade maintains the same or user-defined lot volume.

This method allows the EA to benefit from temporary price corrections while still holding a directional bias.

3. Exit Logic with Trailing Stop

Instead of setting a fixed take profit, the EA uses a dynamic trailing stop to exit trades. As the market moves in favour of the trade:

- The stop loss adjusts automatically to lock in profit.

- If a trend reversal is detected, all open trades are closed to avoid loss expansion.

This flexible exit structure is designed to maximise gains during trending conditions and protect capital when trends fail.

Key Features of SMART TRENDGRID EA

- Built for MetaTrader 5

- Hybrid strategy: combines trend-following and grid trading

- Multi-indicator confirmation system

- Trailing stop & full position closure on reversal

- Configurable grid spacing, trade limits, and stop-loss

- No martingale or aggressive lot scaling

- Best suited for M30 timeframe

- Supports all major currency pairs

Recommended Use

Timeframe

The EA is designed for M30, offering a balance between signal clarity and trade frequency. It can be tested on H1 for longer trades, but M30 remains optimal.

Currency Pairs

SMART TRENDGRID EA is compatible with all major forex pairs, including:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- USDCAD

- Choose pairs with relatively lower spreads for best performance.

Lot Size and Risk

The default setting uses 0.01 lots per trade, which is suitable for smaller accounts. You can increase lot size based on your capital, but it's recommended to stay within safe risk parameters.

- Use percentage-based risk for scalable performance.

- Limit the number of trades in the grid to avoid margin stress.

- Adjust grid spacing based on pair volatility.

Pros of Using SMART TRENDGRID EA

Strategic Combination

Unlike most bots that rely only on a single strategy, this EA combines two complementary approaches. It enters in trend direction, but doesn’t panic during minor pullbacks. This helps to stay in the market longer and capture bigger moves.

Low-Risk Logic

By avoiding lot size increases and limiting trade volume, SMART TRENDGRID EA provides more consistent risk control compared to traditional grid systems.

Adjustable Settings

All aspects of the EA can be modified to suit different market environments or trading styles—from grid spacing and max trades to trailing stop distance.

Fully Automated

Once installed, the EA can trade with little to no intervention. You only need to monitor overall performance and adjust parameters based on your trading plan.

Possible Limitations

No system is without drawbacks, and understanding them helps manage expectations.

- Sideways markets may trigger false trends, leading to unnecessary entries.

- Sudden news releases can cause erratic price behavior and widen spreads.

- Grid logic, even when capped, still requires sufficient margin—avoid small accounts with high leverage and tight stop settings.

- Requires tuning to match different pairs and market phases.

Running the EA on a VPS is advisable for stable execution and uninterrupted trading.

How to Set It Up

- Download and install SMART TRENDGRID EA on your MT5 terminal.

- Load the EA onto a chart with an M30 timeframe.

- Configure your preferred settings: lot size, grid distance, SL/TP, trade limits.

- Test the EA in the strategy tester with historical data.

- Go live with real capital once satisfied with performance.

Suggested Tips for Best Performance

- Avoid running during high-impact news events.

- Use wider grid spacing on volatile pairs.

- Monitor the drawdown percentage weekly and adjust limits if needed.

- Combine with a trend filter on a higher timeframe (e.g., H1 or H4) for better entry precision.

- Review results monthly to tweak settings based on market changes.

Final Verdict

SMART TRENDGRID EA V1.0 MT5 is a carefully designed trading robot that offers a logical and risk-conscious way to trade trending markets using grid techniques. Its strategy is rooted in trend confirmation, and its execution logic handles pullbacks in a calculated manner.

By combining entry filters, structured grid layering, and dynamic trailing exits, it offers a more stable alternative to traditional grid bots, while staying flexible in unpredictable markets.

If you're looking to move beyond one-dimensional robots and want something that's both responsive and logical, SMART TRENDGRID EA could be the right fit for your automated trading toolkit.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment