Introduction – Why Quantum MatriX EA V3.3 MT5 Stands Out

Every trader dreams of a forex robot that can handle the hard work: analyzing price action, filtering out bad setups, and executing trades with discipline 24/5. Quantum MatriX EA V3.3 MT5 is built exactly for that purpose. Running on the powerful MetaTrader 5 platform, this Expert Advisor blends grid-style position management with strong trend filters and risk controls, giving traders a smarter way to automate their strategies.

Instead of random entries or blind martingale, Quantum MatriX EA V3.3 MT5 uses price structure, volatility readings and dynamic step sizes to scale positions in a controlled way. The idea is simple: catch trends, manage pullbacks intelligently, and let the EA handle entries, exits and protection while you focus on overall account management.

Whether you’re a swing trader looking for steady growth on higher timeframes or a more active intraday trader on M15–H1, Quantum MatriX EA V3.3 MT5 is designed to adapt across different market phases and volatility conditions.

What Is Quantum MatriX EA V3.3 MT5?

Quantum MatriX EA V3.3 MT5 is an automated trading system built exclusively for the MetaTrader 5 platform. It is primarily designed for:

- Major currency pairs such as EURUSD, GBPUSD, USDJPY and sometimes XAUUSD (gold)

- Timeframes: M15, M30 and H1

- Minimum deposit: typically from $200–$300 (depending on risk settings and broker conditions)

At its core, Quantum MatriX EA V3.3 MT5 combines three main components:

1. Trend Direction Filter

The EA analyzes higher timeframe direction using moving averages, price channels or custom filters to determine if the market is trending or ranging. It only opens grid sequences in the dominant direction, which helps reduce unnecessary trades against strong moves.

2. Smart Grid Engine

Instead of doubling lots randomly, Quantum MatriX EA V3.3 MT5 can place a sequence of trades at predefined steps, with optional dynamic spacing based on ATR or volatility. This lets the EA cost-average positions in pullbacks while still respecting overall risk limits.

3. Risk & Equity Control

A key focus of Quantum MatriX EA V3.3 MT5 is controlled drawdown. You get features like global equity stop, per-pair max lots, maximum number of active grid levels and optional daily loss limits. So even if the market behaves unpredictably, you remain in control of risk.

The combination of these elements makes Quantum MatriX EA V3.3 MT5 suitable for traders who want more structure and less guesswork in their automated trading.

Supported Pairs, Timeframes & Setup

While you can technically attach Quantum MatriX EA V3.3 MT5 to many symbols, the most stable performance is usually seen on:

- EURUSD – primary recommended pair

- GBPUSD – works well in trend-friendly conditions

- USDJPY – suitable for breakout and trend continuation setups

- XAUUSD (optional) – for traders comfortable with higher volatility

Recommended timeframes:

- M15 for more frequent trades

- M30 for balanced risk-return

- H1 for more conservative traders

Typical technical requirements:

- Platform: MetaTrader 5 (hedging account preferred)

- Minimum deposit: $200–$300 per pair at low risk

- Leverage: 1:100 or higher (1:200–1:500 ideal)

- Broker: Low-spread ECN/Raw account with fast execution

- VPS: Strongly recommended if you cannot keep your terminal online 24/5

By running Quantum MatriX EA V3.3 MT5 on a quality VPS with a low spread broker, you give the EA the environment it needs to perform at its best.

Key Features & Highlights

Some of the standout features of Quantum MatriX EA V3.3 MT5 include:

- Multi-pair support for major forex symbols

- Grid logic with trend filters (not random averaging)

- Optional news protection to pause trading during high-impact events (if enabled via filters or manual schedule)

- Dynamic lot sizing based on balance, equity or fixed-lot mode

- Maximum number of grid levels to cap exposure

- Global equity stop and per-pair safety limits

- Optional daily profit and loss targets for session control

- Compatible with most ECN/Raw spread MT5 brokers

- Fully automated – just attach to chart and let it run

- Comprehensive input parameters, giving you control over risk, grid step, filters and trade management

- Works with both 4-digit and 5-digit quotes (auto-adjusted)

Together, these features make Quantum MatriX EA V3.3 MT5 a flexible tool that can be tuned to aggressive, balanced or conservative styles, depending on your personal risk appetite.

Strategy Logic – How the EA Trades

To understand Quantum MatriX EA V3.3 MT5 properly, it’s helpful to break down the typical trade lifecycle:

1. Market Scan

The EA constantly scans price action, moving averages and volatility to detect if the market is trending, pulling back or ranging.

2. Initial Entry

Once favorable conditions are identified, Quantum MatriX EA V3.3 MT5 places a first position in the direction of the dominant trend. Filters can include candle confirmation, oversold/overbought levels or custom internal signals.

3. Grid Expansion (If Needed)

If price moves against the first trade by a specified distance (grid step), the EA can open additional positions with controlled lot increments. This is not pure martingale; lot growth can be fixed, linear or mildly progressive and is limited by the parameters you set.

4. Exit & Profit Taking

Quantum MatriX EA V3.3 MT5 typically targets basket take-profit levels, closing all grid positions together when combined profit reaches a defined threshold. This helps in turning temporary drawdowns into net positive cycles.

5. Risk Controls

At any point, if drawdown, max lots or equity conditions are breached, Quantum MatriX EA V3.3 MT5 can close all trades and stop or pause trading, depending on your configuration.

The goal of the system is to harvest pips from frequent market swings while following the broader trend and keeping risk under tight control.

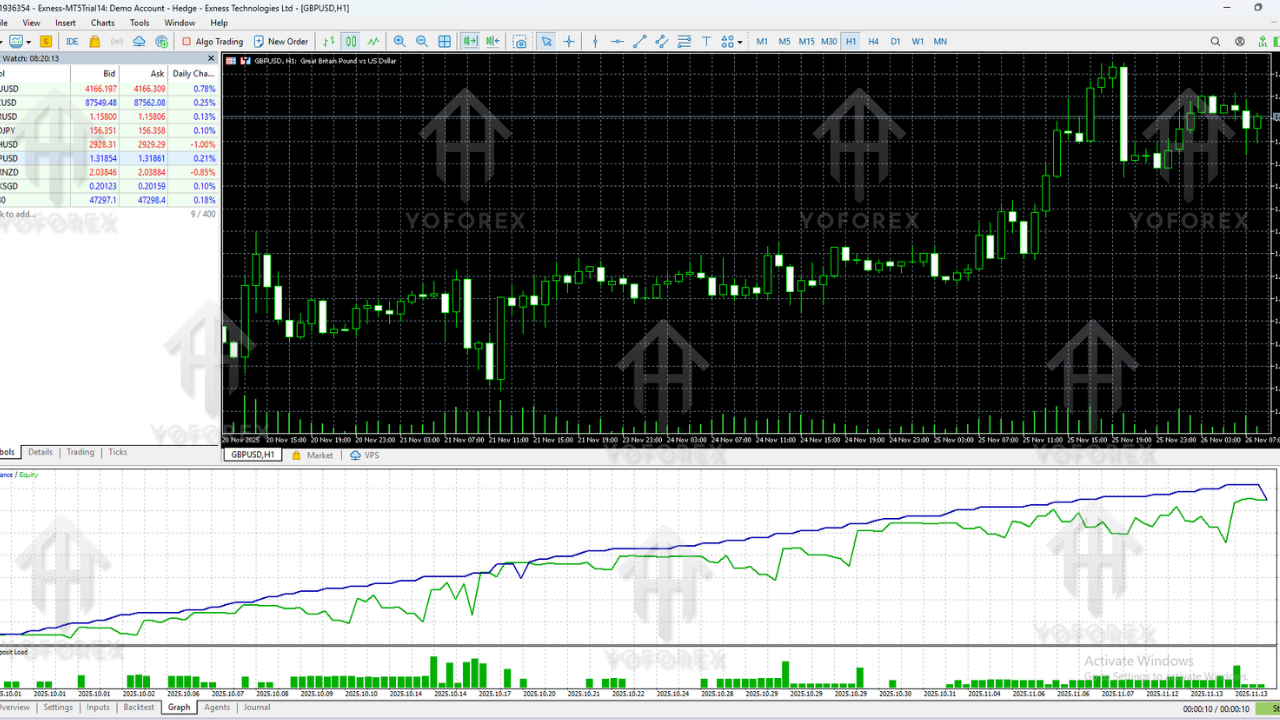

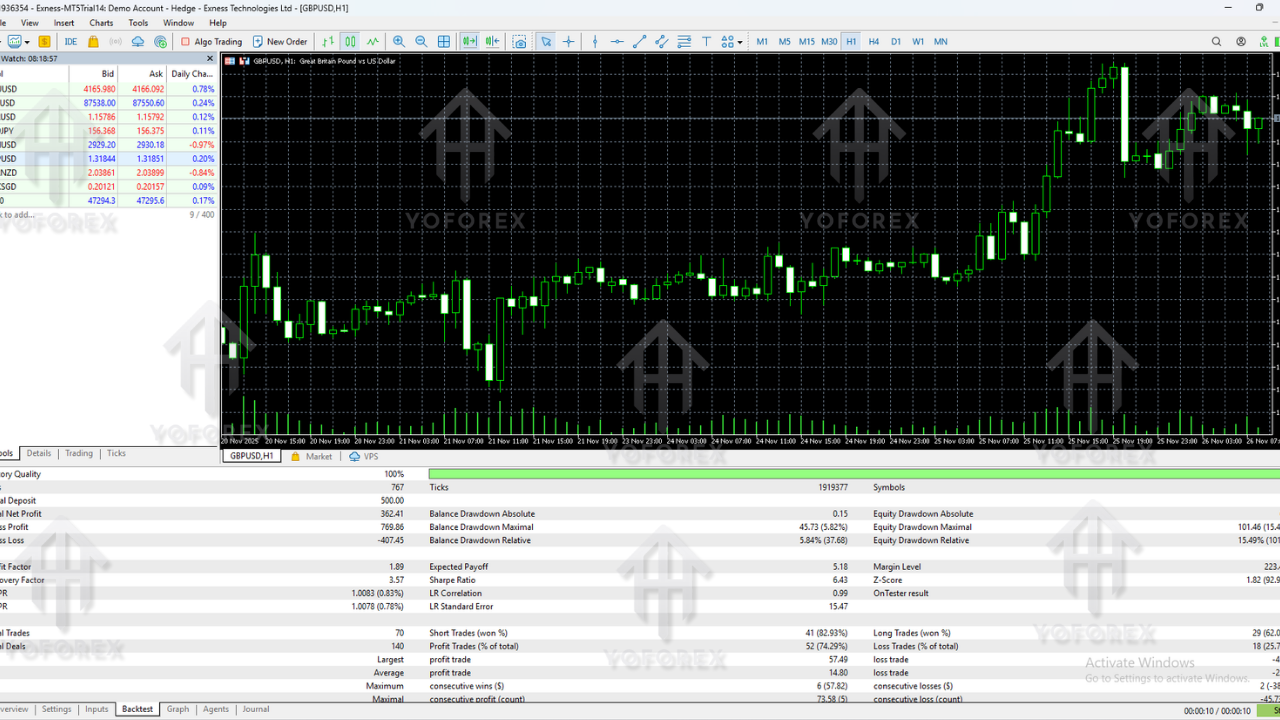

Backtesting & Performance Style (Overview)

While exact numbers will vary depending on settings, broker and test period, a typical backtest scenario for Quantum MatriX EA V3.3 MT5 might look like this:

- Test pair: EURUSD

- Timeframe: M15 or M30

- Period: 3–5 years of historical data

- Initial balance: $1,000

- Risk mode: Low to medium

- Modelling: Every tick or high-quality tick data

In a well-optimized run, you would expect to see:

- Smooth upward-sloping equity curve (with some understandable grid-related swings)

- Monthly returns in the range of 5–15% under moderate risk

- Max relative drawdown typically capped under 20–30% if configured conservatively

- Reasonable trade frequency with dozens to hundreds of trades per month

The strength of Quantum MatriX EA V3.3 MT5 is not in unrealistic “1000% in a month” style results, but in consistent compounding under controlled drawdown. When combined with proper lot sizing and diversification across pairs, the EA can become a core engine for steady growth.

Live forward performance will always differ from backtests, but the purpose of testing is to verify that the logic is stable and robust across different market phases, including trending, ranging and volatile conditions. Quantum MatriX EA V3.3 MT5 is designed with robustness in mind, not just curve-fitting.

Recommended Settings & Best Practices

Here are some practical tips for configuring Quantum MatriX EA V3.3 MT5:

Start on a Demo Account

Always begin with demo or cent accounts to become familiar with how Quantum MatriX EA V3.3 MT5 behaves under live data. Test different pairs and timeframes before going full-size.

Use Low to Medium Risk at First

Set modest lot sizes or risk-percentage. For example, 0.01 lots per $200–$300 of balance per pair is a conservative starting point.

Limit Number of Pairs

Instead of attaching Quantum MatriX EA V3.3 MT5 to 10 charts, start with 1–3 major pairs. Too many correlated pairs can stack drawdown during strong trends.

Configure Max Grid Levels

Define a maximum number of grid steps (for example, 5–7) to prevent runaway exposure. More levels equals more risk, so don’t go crazy with it.

Enable Equity Protection

Use global or per-pair equity stop settings, so the EA closes all trades and stops trading if a predefined drawdown level is hit.

Avoid Major News if Possible

Either disable trading during high-impact news or reduce risk so that sudden spikes don’t cause uncomfortable drawdown.

By following these best practices, you give Quantum MatriX EA V3.3 MT5 a better chance to deliver stable, long-term results instead of chasing short-term, high-risk thrills.

Installation & Setup (MT5 Guide)

Installing Quantum MatriX EA V3.3 MT5 is straightforward:

- Download the EA file

Save the Quantum MatriX EA V3.3 MT5 file into your computer from your trusted source. - Open MetaTrader 5

Launch your MT5 terminal and go to “File” → “Open Data Folder”. - Copy the EA

In the data folder, navigate to: MQL5 → Experts and paste the Quantum MatriX EA V3.3 MT5 file into the Experts directory. - Restart MT5

Close and reopen your MetaTrader 5 terminal, or right-click in the Navigator and choose “Refresh”. - Attach to Chart

From the Navigator window, find Quantum MatriX EA V3.3 MT5 under “Expert Advisors” and drag it onto the desired chart (e.g., EURUSD M15). - Enable Algo Trading

Make sure algorithmic trading is allowed (the “Algo Trading” button in MT5 should be green). - Configure Inputs

In the EA’s input settings, configure lot size, grid step, max levels, take-profit, equity stop and other parameters according to your risk profile.

Once you’re satisfied with your configuration, let Quantum MatriX EA V3.3 MT5 run continuously on a VPS or a machine that stays online to ensure it can manage positions at all times.

Who Is This EA Best Suited For?

Quantum MatriX EA V3.3 MT5 is best for traders who:

- Prefer a semi-passive or fully automated trading style

- Are comfortable with grid-style strategies but still respect risk limits

- Want to compound accounts gradually rather than chase “moonshot” gains

- Understand that all EAs experience drawdowns and that money management is crucial

- Are willing to test on demo, optimize parameters and then move to live once confident

If you’re completely new to forex, Quantum MatriX EA V3.3 MT5 can still be useful, but you should invest time in learning the basics of lot sizes, margin and drawdown so you know how to set appropriate risk.

Pros and Cons Summary

Pros of Quantum MatriX EA V3.3 MT5

- Fully automated – minimal manual intervention needed

- Multi-pair support with flexible risk options

- Grid logic combined with trend filters (more intelligent than random averaging)

- Strong equity protection features

- Can be tuned from conservative to aggressive modes

- Suitable for both small and medium-sized accounts

Cons to Keep in Mind

- Grid strategies will always face periods of floating drawdown

- Requires discipline to stick with settings and not over-leverage

- Needs stable trading conditions (good broker + VPS) for best results

- Not a “get rich overnight” EA – focuses on steady growth, not lottery gains

Understanding these pros and cons helps set realistic expectations when you trade with Quantum MatriX EA V3.3 MT5.

Final Conclusion

Quantum MatriX EA V3.3 MT5 is a solid option for traders looking for a structured, grid-based Expert Advisor with a strong emphasis on trend filtering and risk control. When configured sensibly, it can act as a reliable background engine, generating frequent trades and gradual equity growth over time.

As with any forex robot, the key is not just the code but how you use it: choice of broker, VPS, risk settings, number of pairs and your own discipline all play a massive role. If you’re prepared to treat Quantum MatriX EA V3.3 MT5 as a professional tool rather than a magic money machine, it can become an important part of your automated trading portfolio.

Always remember: past performance is not a guarantee of future results. Test thoroughly, start small, and scale up only when you’re fully confident with how Quantum MatriX EA V3.3 MT5 behaves in live market conditions.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment