The forex market thrives on innovation, and traders today demand tools that not only react to market movements but also anticipate them. One such trading solution is Ninja Forex EA V5.0, a MetaTrader 4 expert advisor built on reverse-logic principles. This version continues to gain attention for its ability to open trades differently from conventional EAs, using contrarian strategies to capture market opportunities.

In this guide, we will break down how the Ninja Forex EA V5.0 functions, its special features, and why it has become popular among traders who seek alternative approaches to algorithmic trading.

Introduction to Ninja Forex EA V5.0

Ninja Forex EA is an automated system designed to run exclusively on the MetaTrader 4 platform. Unlike trend-following robots that aim to ride momentum, this EA specializes in detecting potential reversal areas and setting pending orders in the opposite direction of the current trend. The design caters to traders who prefer shorter timeframes and who want exposure to multiple pairs without relying solely on trend continuation.

Core Concept of Reverse Trading

The philosophy behind this EA is simple yet bold. When most traders see a bullish setup, Ninja Forex EA prepares a pending sell order; if the conditions appear bearish, it sets a pending buy order. This contrarian method attempts to capture retracement and reversal points, areas where quick profits can be generated if the market overextends in one direction before correcting.

Such logic is especially effective on the M5 timeframe, where short-term market swings can be exploited without requiring the trader to manually enter or exit.

Supported Pairs and Market Coverage

The EA is primarily optimized for major and cross pairs including:

- GBPUSD

- GBPJPY

- GBPAUD

It also includes support for gold (XAUUSD), though users should approach precious metals with caution due to their volatility. Currency pairs respond more consistently to the EA’s spacing system, whereas gold requires wider intervals to account for its price range.

Step Spacing and Trade Execution

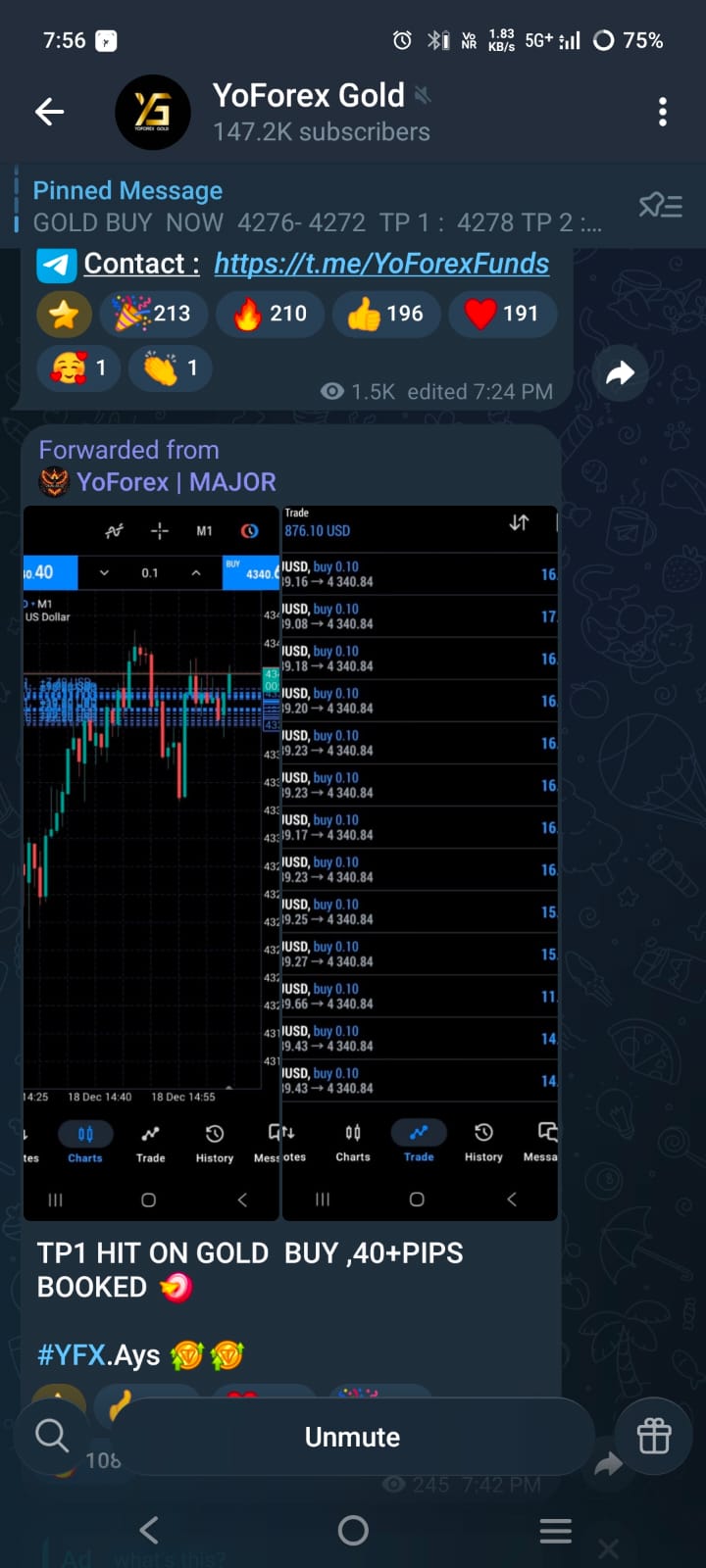

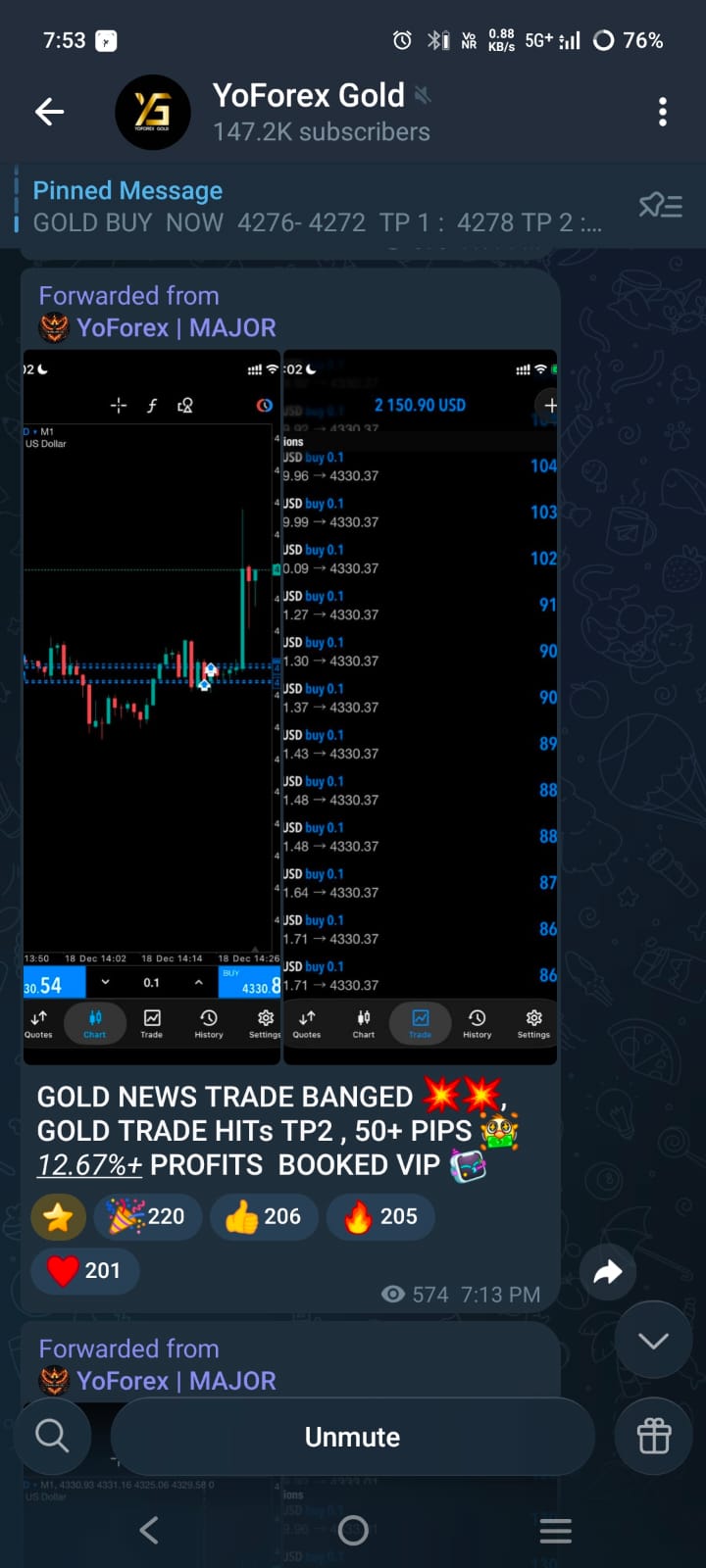

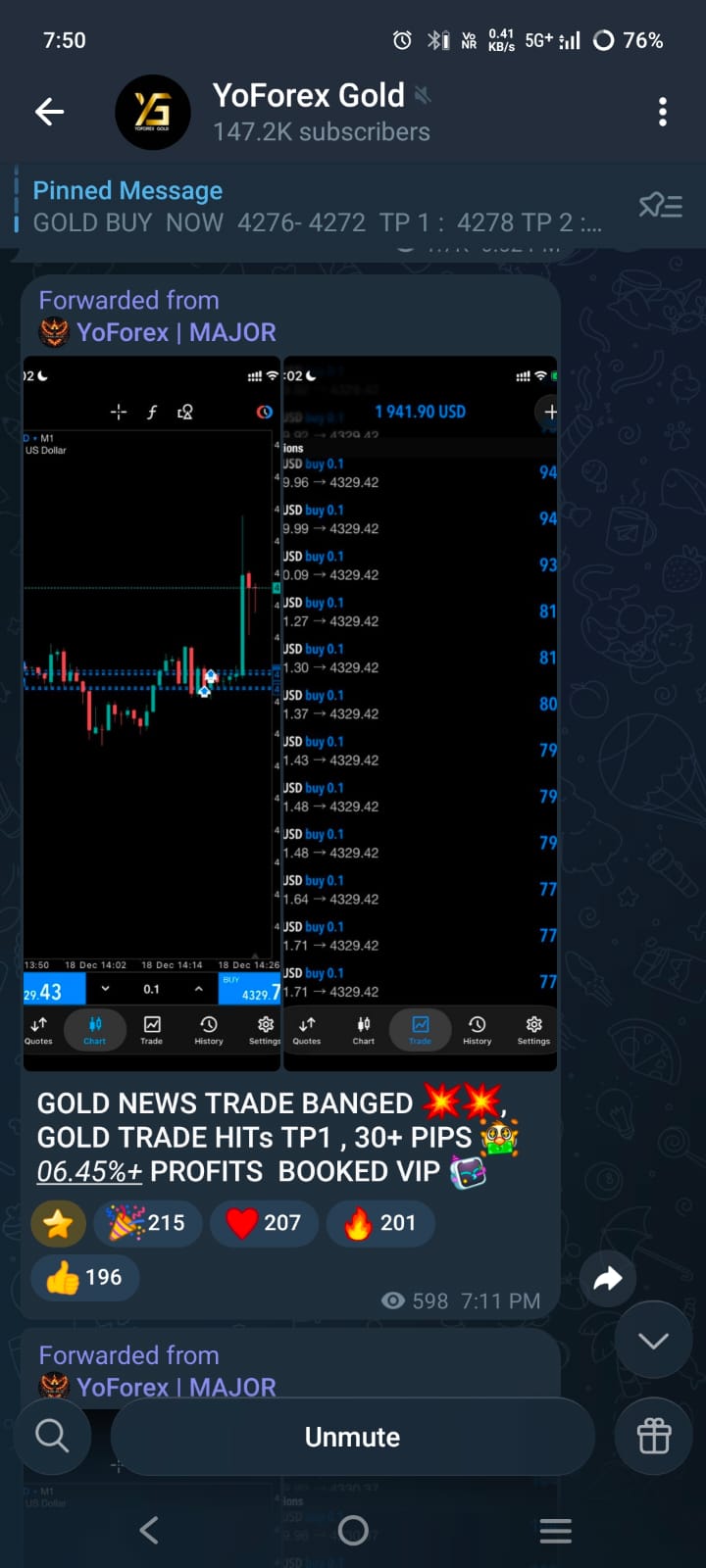

The execution method relies on what is known as a step system. For currencies, trades are typically placed with about 10 pips of spacing. For gold, the distance is much larger, around 100 points, in order to prevent overexposure.

When the EA identifies conditions to engage, it can open a series of trades—sometimes up to 8 in succession. Each trade uses the same lot size, and as new positions are layered, the system keeps track of overall profitability. Once the latest trades begin to turn in favor, the EA can close earlier ones or exit all open positions, securing profit across the board.

Closing Logic Without TP/SL

One of the defining elements of Ninja Forex EA V5.0 is the absence of fixed Take Profit and Stop Loss values. Instead, the EA relies on equity-based exits and trailing profit mechanisms. As market conditions improve, the robot looks for opportunities to lock in gains and reduce exposure, closing trades when a specific profit or equity threshold is reached.

This dynamic exit management allows flexibility, but it also means traders should maintain strong risk control on their accounts. Without hard stops, drawdowns can expand if the market trends persistently against open positions.

What’s New in Version 5.0

The V5.0 upgrade focuses on refining profit-taking and closure logic. The EA is now better at chasing profits by identifying when to close earlier trades once newer ones show gains. This adjustment gives traders a more responsive and potentially more profitable trading cycle compared to earlier releases.

Previous versions introduced features such as capital-based trade closure (for example, closing all trades when balance increases by a certain percentage). Version 5.0 extends these improvements with smarter handling of trade sequences and profit capture.

Benefits of Using Ninja Forex EA V5.0

- Contrarian Strategy Advantage

By trading against market sentiment, the EA aims to capture quick reversals and retracements, offering opportunities when trends exhaust. - Automation and Efficiency

Traders no longer need to monitor charts around the clock. The EA executes pending orders and manages trailing closures automatically. - Scalping and Short-Term Focus

The five-minute timeframe focus makes it appealing for traders who prefer fast entries and exits. - Adaptability Across Pairs

While optimized for GBP pairs, the EA also adapts to gold and potentially other instruments if parameters are adjusted carefully.

Risks and Considerations

Every trading system comes with risks, and Ninja Forex EA V5.0 is no exception. Some important points to consider include:

- No Fixed Stops: Without stop losses, the system relies entirely on its trailing logic. This can lead to larger drawdowns.

- Volatility Impact: Instruments like gold can trigger wider and riskier positions if not managed properly.

- Licensing Limits: Versions of the EA often come with a cap on the number of account activations, so plan account usage wisely.

- Broker Conditions: High spreads or poor execution speed may reduce the efficiency of the step system.

Practical Setup and Testing

For beginners, it is highly recommended to test Ninja Forex EA V5.0 on a demo account before moving to live funds.

- Start with GBPUSD M5: This is the most stable and optimized setup for observing how the EA works.

- Adjust Step Settings: Ensure the pip spacing fits your broker’s spread and volatility levels.

- Monitor Trade Sequences: Watch how multiple trades open and how the EA decides when to close them.

- Forward Test Over Time: Allow the EA to run for several weeks, capturing different market conditions before committing capital.

Why It Appeals to Beginner Traders

Although reverse trading may seem advanced, the Ninja Forex EA’s automated logic makes it approachable for newer traders. Beginners who often struggle with emotional decision-making can benefit from an EA that removes hesitation and acts strictly according to predefined rules.

With the right setup, even newcomers can explore strategies that would otherwise be difficult to execute manually.

Conclusion

Ninja Forex EA V5.0 for MT4 offers a unique perspective on automated trading. Its contrarian design, step-based execution, and trailing equity closure make it distinct from trend-following robots. While risks exist—particularly around volatility and lack of fixed stops—the EA can serve as a powerful tool for those who understand and respect its logic.

As always, practice on demo accounts first, adjust settings to your comfort level, and deploy cautiously in live trading. Ninja Forex EA V5.0 represents not only a software upgrade but also an opportunity for traders to think differently about automation in the forex market.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment