Introduction: Because the Market Was Never “Random,” You Just Weren’t Invited

For years, retail traders have been told that the market is unpredictable, chaotic, and driven by “news.” This is, of course, a comforting story—much like telling yourself you meant to enter late. In reality, price moves with structure, intent, and a suspicious obsession with liquidity.

This is exactly where Liquidity Engine SMC ICT EA V1.15 MT4 enters the room, adjusts its tie, and politely explains that the market has been engineered all along. Built on Smart Money Concepts (SMC) and ICT methodology, this Expert Advisor is designed to trade where institutions operate, not where retail traders panic.

It does not chase price.

It does not revenge trade.

And it definitely does not rely on hope.

What Is Liquidity Engine SMC ICT EA V1.15 MT4?

Liquidity Engine SMC ICT EA V1.15 MT4 is an automated trading system developed for MetaTrader 4 that applies institutional trading logic to real market conditions. Instead of guessing direction, it focuses on liquidity pools, market structure shifts, inducements, and smart money footprints.

In simpler terms, it trades where the market is designed to move—after liquidity has been collected and before retail traders realize what happened.

This EA does not pretend to be a miracle machine. It behaves more like a disciplined institutional assistant that waits patiently, executes precisely, and exits without drama.

The Philosophy Behind Liquidity Engine SMC ICT EA

Most retail systems are reactive. Liquidity Engine SMC ICT EA V1.15 MT4 is anticipatory. It operates on the idea that large players move the market deliberately to capture liquidity before true price expansion occurs.

By analyzing structure shifts, premium and discount zones, and liquidity sweeps, the EA identifies high-probability execution zones rather than random entries.

It does not trade often.

It trades when it matters.

How Liquidity Engine SMC ICT EA V1.15 MT4 Works

The EA continuously scans the market for institutional behavior patterns. It focuses on:

Market structure changes that indicate smart money entry

Liquidity grabs above highs or below lows

ICT-based premium and discount zones

Confirmation logic before execution

Once conditions align, trades are placed with predefined stop loss and take profit logic. Risk is calculated systematically, not emotionally. No impulsive entries. No chart decorations. Just execution.

Key Features of Liquidity Engine SMC ICT EA V1.15 MT4

Liquidity-Based Trade Logic

Trades are executed around liquidity zones where institutional activity is most likely to occur.

SMC and ICT Framework

Uses Smart Money Concepts combined with ICT principles for structured market analysis.

Automated Risk Management

Position sizing, stop loss, and take profit are handled automatically to maintain account discipline.

Market Structure Awareness

The EA avoids trading against confirmed structure, reducing unnecessary exposure.

Emotionless Execution

It never hesitates, second-guesses, or breaks its own rules—unlike most humans.

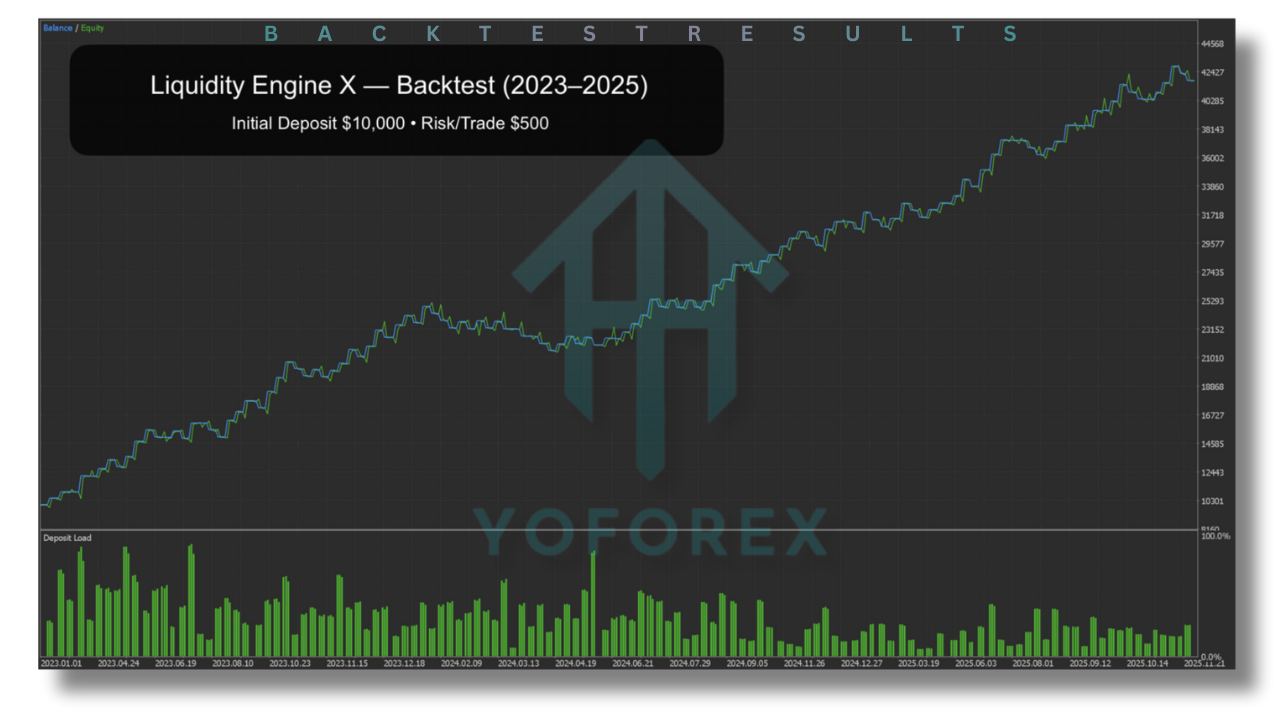

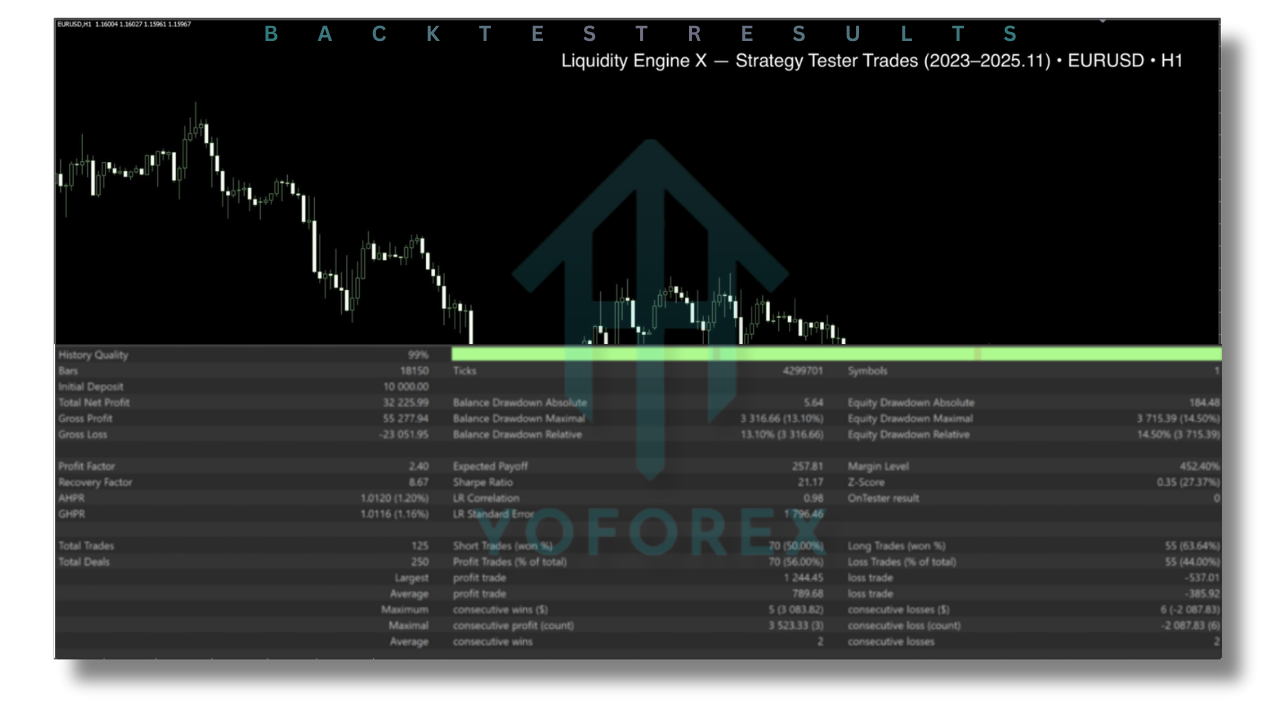

Performance Overview and Trading Behavior

Liquidity Engine SMC ICT EA V1.15 MT4 prioritizes quality over quantity. Trades are selective, aiming for favorable risk-to-reward scenarios rather than frequent scalps.

Drawdowns are controlled through strict entry filtering and risk logic. Profits are designed to compound steadily rather than spike unpredictably.

This is not an EA for traders who want constant trade notifications.

It is for traders who prefer results without noise.

Who Should Use Liquidity Engine SMC ICT EA V1.15 MT4

This EA is ideal for traders who:

Understand or appreciate Smart Money and ICT concepts

Prefer structured, rules-based trading

Value consistency over excitement

Want automation without abandoning logic

Advantages and Limitations

Advantages

Institutional-grade trading logic

Low emotional interference

Structured risk management

Adaptable to changing market conditions

Limitations

Not a high-frequency trading system

Requires patience and realistic expectations

Best performance depends on broker conditions and spreads

In other words, it behaves like a professional—calm, selective, and unapologetically disciplined.

Why Liquidity Engine SMC ICT EA V1.15 MT4 Stands Out

While many EAs rely on indicators that react late, Liquidity Engine SMC ICT EA V1.15 MT4 focuses on why price moves, not just how it looks after the fact.

It does not promise guaranteed profits.

It promises structured execution.

And in trading, that distinction matters more than marketing slogans.

Final Verdict: Smart Money Logic Without the Ego

Liquidity Engine SMC ICT EA V1.15 MT4 is not loud, flashy, or obsessed with unrealistic claims. It is calm, calculated, and quietly confident—much like institutional traders themselves.

If you are tired of guessing, overtrading, and blaming the market, this EA offers a more refined approach: follow liquidity, respect structure, and let automation handle the discipline you promised yourself you would maintain.

It does not trade emotions.

It trades intent.

- Whatsapp Support: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment