The rise of algorithmic trading has changed the way traders interact with the forex market. Instead of manually analyzing every chart, modern traders now rely on intelligent systems to automate their strategies. Among these systems, Guardian Trader EA V1.3 MT5 stands out as a professional-grade Expert Advisor designed to deliver accuracy, risk control, and consistent profitability through retracement-based trading logic.

Built exclusively for MetaTrader 5, this EA represents a well-balanced mix of precision and discipline. It doesn’t flood the market with random trades — instead, it waits for strategic moments when the market offers optimal opportunities. Its primary goal is to preserve capital while generating steady profits by identifying pullback entries within strong trends.

What Is Guardian Trader EA V1.3 MT5

Guardian Trader EA V1.3 MT5 is an automated Expert Advisor programmed to detect and trade retracements that occur within established market trends. Its approach is based on a simple yet highly effective principle: when price moves temporarily against a prevailing trend, it often provides the best entry point for continuation.

The EA combines real-time trend detection, automatic lot sizing, and safety filters to create a controlled trading environment. Instead of chasing volatile moves, it focuses on trading opportunities that offer a clear directional bias. Guardian Trader’s emphasis on protection, accuracy, and stability makes it suitable for both novice and professional traders seeking disciplined automation.

Core Features and Functionality

1. Retracement-Based Trading Logic

At the heart of Guardian Trader EA lies a trend-following system that executes trades during retracement phases. By buying at dips in uptrends and selling at peaks in downtrends, it captures profitable continuation movements while minimising risk exposure.

2. Dynamic Risk Management

The EA includes a built-in capital protection system. Users only need to set their preferred risk percentage, and the EA automatically calculates trade volume accordingly. If the risk value exceeds safe limits, it restricts new entries to maintain account safety.

3. Smart Trend Recognition

Guardian Trader analyses real-time price data to determine the market’s directional bias. It avoids trading in sideways or indecisive phases, ensuring that every trade aligns with the dominant momentum.

4. Safety Filters and Trade Control

Several internal filters — including time restrictions, price-gap detection, and volatility checks — are implemented to block trades under unfavourable conditions. These protective layers prevent unnecessary drawdowns during uncertain periods.

5. Plug-and-Play Setup

The EA is user-friendly, requiring minimal input for operation. Traders simply define the risk level, attach it to their desired chart, and let the EA handle all technical aspects of execution, management, and exit.

6. Low Drawdown Strategy

Unlike aggressive martingale or grid systems, Guardian Trader EA focuses on sustainability. Its conservative trade frequency and risk-aware logic keep drawdowns to a minimum, making it suitable for traders managing prop accounts or capital-intensive portfolios.

How Guardian Trader EA V1.3 Works

Guardian Trader EA follows a structured and logical trading process designed around patience and accuracy.

Step 1: Trend Identification

The EA begins by analysing the market to confirm a directional trend. It filters out choppy or range-bound conditions and prepares to act only when a stable trend is detected.

Step 2: Retracement Detection

Once the primary direction is established, Guardian Trader monitors for retracements — temporary pullbacks that create ideal entry zones for trend continuation.

Step 3: Risk-Based Position Entry

When a retracement meets all internal criteria, the EA calculates the position size automatically based on the user’s risk setting and executes the trade in the direction of the trend.

Step 4: Trade Management

Guardian Trader employs automated stop loss and take profit mechanisms to manage open positions. In addition, internal filters monitor volatility and liquidity to protect profits during unpredictable moves.

Step 5: Intelligent Exit Handling

The EA closes trades using dynamic logic that prioritises capital safety. When volatility spikes or conditions reverse, it exits positions promptly to prevent large drawdowns.

This system of confirmation, execution, and management allows Guardian Trader to maintain a professional level of consistency while minimizing emotional interference from human traders.

Advantages of Using Guardian Trader EA V1.3 MT5

- Strong Emphasis on Risk Management

Every trade is calculated with account protection in mind. The EA enforces strict risk parameters to prevent overexposure and safeguard profits. - Consistency Over Aggression

Guardian Trader does not rely on frequent trading or high-risk tactics. Its long-term focus on precision allows it to deliver smoother equity growth. - Beginner-Friendly Interface

Its setup simplicity makes it accessible for traders with limited technical experience. Just install, configure the risk level, and let it run. - Designed for Real Market Conditions

The EA performs efficiently under trending conditions and adapts to market volatility through its integrated filters. - Reduced Emotional Trading

By automating decisions, Guardian Trader removes the psychological stress of manual trading, helping traders maintain consistency and discipline. - Professional-Grade Algorithm

The internal logic uses structured trend recognition and entry management, reflecting the kind of data-driven precision used by institutional systems.

Limitations to Consider

No Expert Advisor is flawless, and Guardian Trader EA is no exception. While it offers strong protection and precision, traders should be aware of a few limitations:

- The EA performs best in trending markets. During range-bound phases, it may execute fewer trades or stay inactive.

- The settings are mostly locked for stability, which limits user customisation.

- Proper testing is recommended before live use to ensure compatibility with specific broker conditions.

- As with any automated strategy, traders must maintain reasonable expectations and monitor performance periodically.

Understanding these boundaries allows traders to use Guardian Trader EA more effectively and manage expectations responsibly.

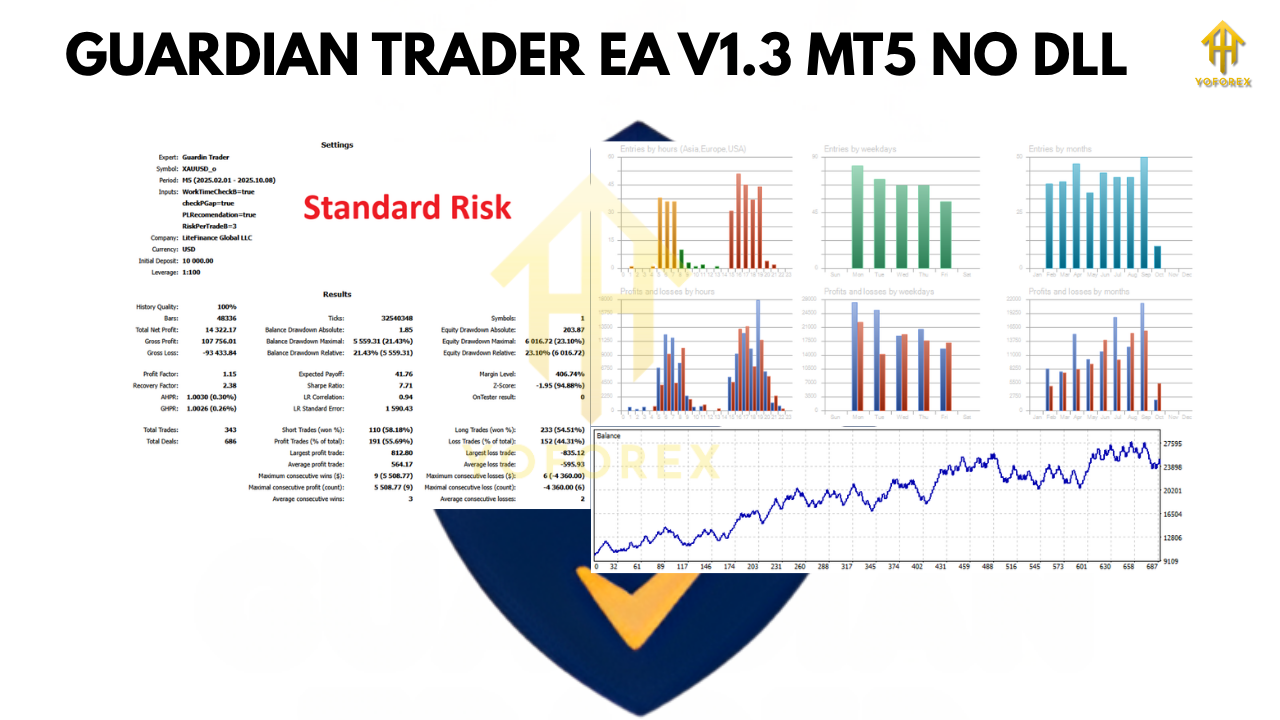

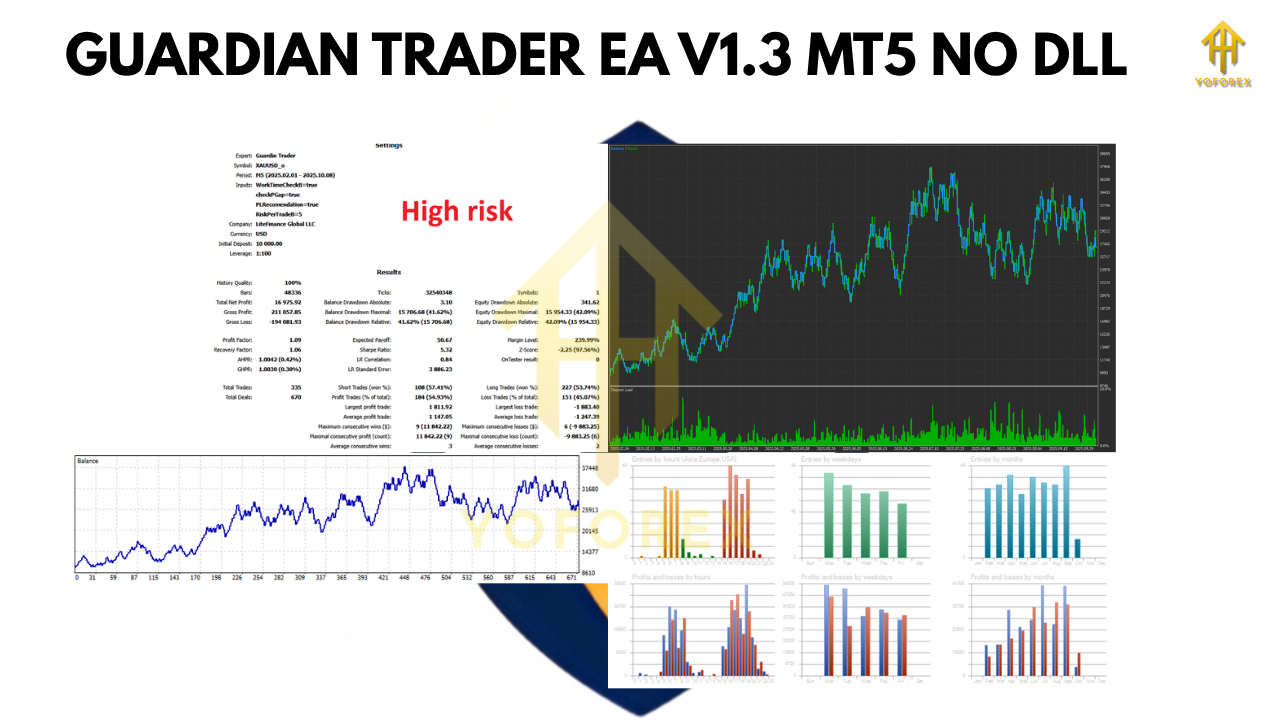

Recommended Usage and Risk Settings

To get the best results from Guardian Trader EA V1.3 MT5, adhere to the following best practices:

- Start with a low risk (1%–2%) per trade to build consistency.

- Run the EA on a VPS for stable 24/7 performance.

- Choose brokers that provide low spreads and fast execution to minimise slippage.

- Avoid using it across multiple correlated pairs simultaneously to reduce drawdown correlation.

- Regularly backtest and optimise settings if market volatility shifts significantly.

Following these guidelines helps maintain long-term profitability and ensures the EA performs optimally under evolving market conditions.

Who Should Use Guardian Trader EA V1.3 MT5

This EA is suitable for traders who prefer a balanced approach to automation — individuals who want a reliable system that manages risk carefully while capturing meaningful market opportunities.

It’s an excellent choice for:

- Traders running a prop firm or funded accounts with strict drawdown rules.

- Beginner traders looking for an automated yet safe trading solution.

- Professional investors seeking algorithmic stability without complex configurations.

- Anyone focused on consistent, steady account growth rather than short-term gains.

Guardian Trader EA’s methodology fits perfectly with traders who believe in patience, accuracy, and risk awareness.

Why Guardian Trader EA V1.3 Stands Out

The forex market is filled with bots that promise huge profits but ignore risk management. Guardian Trader EA V1.3 takes the opposite approach. It prioritises discipline over hype, delivering reliability through logic, not luck.

By combining retracement-based analysis, automated risk control, and a minimalist design, it creates an environment where profitability is achieved through structure rather than speculation. This commitment to long-term sustainability makes Guardian Trader EA a standout choice among modern MT5 trading systems.

Final Verdict

The Guardian Trader EA V1.3 MT5 is a powerful and efficient Expert Advisor that proves automation can be both intelligent and secure. It doesn’t overtrade, doesn’t rely on dangerous averaging systems, and doesn’t expose traders to excessive risk. Instead, it focuses on quality over quantity — identifying high-probability retracement trades that align with dominant trends.

For traders who want a smart, disciplined, and risk-managed approach to forex automation, Guardian Trader EA V1.3 is an investment in reliability. With careful use and proper capital allocation, it has the potential to deliver consistent, professional-grade performance.

If you value precision, consistency, and security in your trading strategy, Guardian Trader EA V1.3 MT5 deserves a place in your portfolio.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment