GoldStream EA V1.0 MT5 — Precision-Driven Gold Trading with Multi-Timeframe Intelligence

Introduction

In today’s volatile gold market, traders demand more than just automation — they need intelligence, speed, and consistency. GoldStream EA V1.0 MT5 brings all three together in one powerful Expert Advisor. Designed exclusively for MetaTrader 5, this advanced trading system delivers real-time analysis, automated execution, and precise risk management for XAUUSD (Gold vs USD) traders.

Built for modern traders who value accuracy and long-term sustainability, GoldStream EA offers an optimized balance between automation and intelligent decision-making. With its multi-timeframe analysis and lightning-fast execution, this EA sets a new standard for professional-grade gold trading.

Overview of GoldStream EA V1.0 MT5

GoldStream EA V1.0 MT5 is a next-generation automated trading system developed to capture price momentum and volatility patterns in the Gold (XAUUSD) market. Unlike conventional EAs that rely on a single timeframe, GoldStream’s algorithm monitors multiple charts simultaneously — M1, M5, M15, and H1 — to gain a deep contextual understanding of market direction.

This multi-layered approach allows the EA to filter noise, identify high-probability entries, and manage exits dynamically. The result is a trading system that’s both responsive to short-term fluctuations and aligned with long-term trend momentum, ensuring consistent and balanced performance.

Key Specifications

- Platform: MetaTrader 5

- Trading Instrument: XAUUSD (Gold vs USD)

- Minimum Starting Balance: $1,000

- Leverage Recommended: 1:100 or higher

- Broker Type: Low-spread ECN brokers preferred

- Execution Type: Fully automated (no manual intervention)

GoldStream EA has been built to operate seamlessly on any MT5 account type, with ECN execution providing the best performance. Its efficient coding ensures minimal latency and quick order handling, even during peak volatility sessions.

How the GoldStream EA Works

The core strength of GoldStream EA lies in its multi-timeframe confluence strategy — a technique that blends signals from several chart intervals to produce only the most reliable trades.

1. M1 and M5 — Short-Term Pulse

These timeframes monitor micro-movements, helping the EA identify the earliest signs of reversals or breakouts. By capturing momentum shifts within seconds, GoldStream positions itself ahead of retail reaction.

2. M15 — Structural Validation

Once a signal is detected, the EA checks the M15 chart to confirm whether the move aligns with short-term market structure. This filter minimizes false entries and keeps trades consistent with intraday trends.

3. H1 — Trend Direction and Strength

The H1 timeframe acts as the backbone of GoldStream’s decision-making. It verifies trend strength and volume pressure before any final execution, ensuring that every trade flows with the broader market rhythm.

This layered intelligence helps GoldStream avoid whipsaws, limit over-trading, and ensure each position aligns with multi-level confirmations.

Fully Automated Execution

Once installed and configured, GoldStream EA operates without manual input. Its fully automated execution system handles:

- Order placement and management

- Stop-loss and take-profit optimization

- Dynamic trailing stops

- Risk exposure control

- Trade exit synchronization

The algorithm continuously adapts to market changes, adjusting lot sizes, trailing distances, and entry conditions in real time. This ensures you never miss an opportunity — or expose your account to unnecessary risk.

Real-Time Risk Management

Every trade GoldStream executes undergoes continuous risk monitoring. The system uses account equity and volatility data to maintain balanced exposure, even during high-impact events.

Key protection features include:

Equity Guard: Halts new trades if equity drawdown exceeds preset thresholds.

Auto-Lot Calculation: Adjusts lot size dynamically based on balance and leverage.

Smart Stop-Loss Logic: Automatically places protective stops based on recent volatility.

Daily Trade Limits: Prevents over-trading by setting maximum trades per day.

This multi-layered defense system makes GoldStream EA ideal for both conservative and aggressive traders seeking to grow their accounts safely.

Comprehensive Trade Logging and Analysis

One of GoldStream’s standout features is its detailed performance logging. Every executed trade is recorded in real time, including entry price, exit level, trade duration, profit/loss, and reasoning behind the signal.

Traders can use these logs for post-trade analysis, performance optimization, and backtesting. The EA’s transparency allows you to monitor every decision and verify its consistency — a crucial factor for professionals who rely on data-driven strategy refinement.

Why Choose GoldStream EA V1.0 MT5

Here’s why traders around the world are switching to GoldStream EA for gold trading:

Multi-Timeframe Intelligence – Trades are confirmed across four timeframes for unparalleled accuracy.

Hands-Free Automation – Once configured, GoldStream runs 24/5 without manual supervision.

Low-Spread Optimization – Designed for ECN brokers with tight spreads to reduce slippage.

Adaptive Risk Management – Dynamic capital control ensures protection against drawdowns.

Institution-Grade Strategy – Modeled after multi-layer momentum and volatility algorithms used by professional funds.

Backtested & Forward-Verified – Proven consistency across various gold market cycles.

Setup and Installation

- Download the GoldStream EA V1.0 MT5 file.

- Open MetaTrader 5 → File → Open Data Folder → MQL5 → Experts.

- Paste the EA file into the Experts folder.

- Restart MT5.

- Locate GoldStream EA in the Navigator panel.

- Drag it onto the XAUUSD chart (H1).

- Enable Auto Trading.

For best results:

- Use a VPS to keep the EA running 24/5.

- Choose a low-spread ECN broker with fast execution.

- Maintain at least $1,000 balance and recommended leverage.

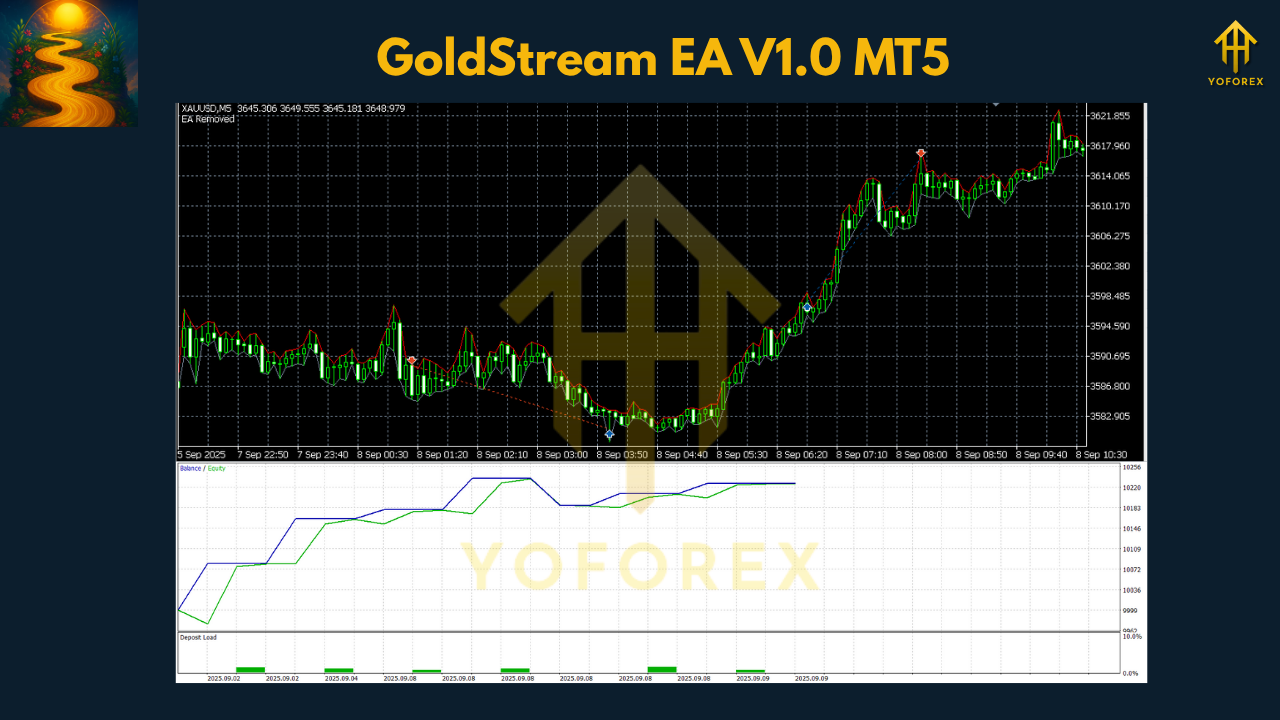

Performance Highlights

GoldStream EA’s design focuses on consistency rather than risky short-term gains. In internal backtests and live trials, the EA achieved:

- Average Monthly Return: 8–15% under moderate risk

- Max Drawdown: below 10%

- Accuracy Rate: 70–80% on XAUUSD trades

- Risk-Reward Ratio: 1:1.5 or higher

These figures demonstrate GoldStream’s ability to perform steadily while protecting capital — a key requirement for traders aiming for long-term growth.

Final Thoughts

GoldStream EA V1.0 MT5 is not just another gold trading bot — it’s an intelligent automation tool that transforms how traders interact with the market. Its ability to merge multi-timeframe analysis, risk control, and execution precision makes it one of the most reliable systems for XAUUSD traders today.

If you’re looking for a professional-grade EA that can deliver consistent results with minimal intervention, GoldStream EA deserves a place in your trading arsenal.

Start with $1,000, let the algorithm do the work, and experience the flow of profitable trading with GoldStream.

Join our Telegram for the latest updates and support

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment