Introduction

The forex market never stops moving, and gold (XAUUSD) is one of the most volatile instruments in the game. Traders who want to take advantage of these strong moves often rely on automated strategies to remove emotions and maintain discipline. Golden Mirage EA V2.0 MT4 is designed for exactly that purpose – a gold-focused Expert Advisor built to capture structured price movements while controlling risk on a MetaTrader 4 account.

Instead of guessing entries or manually chasing candles, Golden Mirage EA V2.0 MT4 uses predefined rules, technical logic, and risk filters so that traders can trade with consistency. This detailed review explains how the EA works, its key features, ideal settings, risk profile, and what type of trader can benefit from it.

What Is Golden Mirage EA V2.0 MT4?

Golden Mirage EA V2.0 MT4 is an automated trading system created for the MetaTrader 4 platform, focused primarily on gold trading, but it can also be adapted to other major forex pairs depending on strategy settings. The EA scans the market for high-probability setups based on price action, momentum, and volatility conditions.

Instead of randomly opening trades, Golden Mirage EA V2.0 MT4 waits for specific conditions such as:

- Strong directional structure (short-term trend confirmation)

- Pullbacks into key zones or liquidity areas

- Volatility expansion after consolidation

- Confluence of indicators for added confirmation

Because everything is coded, the EA can execute trades instantly, manage stop loss and take profit levels, and apply trailing logic without hesitation or emotional bias.

Key Features of Golden Mirage EA V2.0 MT4

Golden Mirage EA V2.0 MT4 comes with a set of features designed to support both conservative and aggressive traders:

- Fully automated trading logic

Once installed and configured, the EA can monitor the chart 24/5, open and close trades, and manage risk automatically. - Optimised for gold and volatile pairs

The algorithm is tuned for instruments like XAUUSD, where sharp moves and liquidity spikes are common. - Smart entry and exit filters

The EA looks for clean entries based on price structure, moving averages, and volatility filters, aiming to avoid choppy ranges. - Built-in risk management

You can define fixed lot size or lot size based on percentage risk per trade. Stop loss and take profit levels are automatically calculated by the EA. - News and high-volatility awareness (depending on settings)

Many traders prefer to avoid trading during high-impact news. Golden Mirage EA V2.0 MT4 can be configured to pause trading during specific time windows. - User-friendly inputs

All key parameters like lot size, maximum open trades, magic number, spread filter, and trading hours can be adjusted from the EA settings window.

How Golden Mirage EA V2.0 MT4 Approaches the Market

The main strength of Golden Mirage EA V2.0 MT4 lies in its structured approach to gold price movement. The EA typically focuses on:

- Trend Direction

It first identifies whether the market is in a bullish or bearish phase using trend filters such as moving averages or custom trend indicators. - Pullback Zones

Instead of entering at the extreme, Golden Mirage EA V2.0 MT4 looks for price retracements into areas where institutions might be adding or offloading positions. - Volatility Confirmation

Once price reacts from the zone, the EA checks volatility and momentum conditions to confirm that a real move is starting rather than a minor correction. - Smart Exit Logic

Take profit levels are typically based on recent structure highs/lows or volatility projections. The EA may also use trailing stop features to lock in profit when price moves strongly in your favour.

This structured logic makes the EA suitable for traders who want a rule-based approach instead of pure scalping or random grid trading.

Recommended Account & Timeframe Guidelines

While every trader has a different risk appetite, here are some general guidelines when using Golden Mirage EA V2.0 MT4:

- Minimum deposit:

A starting balance of at least $200–$300 is recommended for micro or cent accounts. For standard accounts, a higher balance is more comfortable if you plan to use larger lot sizes. - Timeframe:

Golden Mirage EA V2.0 MT4 is usually best on M15, M30, or H1 charts, where noise is reduced but intraday opportunities are still available. - Leverage:

Higher leverage such as 1:200 or 1:500 may be beneficial, but it must be combined with responsible lot sizing. - Broker conditions:

A low-spread, fast-execution broker is ideal for running any EA, especially one trading gold. Always check spreads, commissions, and swap charges. - VPS (Virtual Private Server):

To keep the EA running 24/5 without interruption, many traders host Golden Mirage EA V2.0 MT4 on a VPS with stable internet and low latency.

Risk Management with Golden Mirage EA V2.0 MT4

No Expert Advisor is risk-free, and Golden Mirage EA V2.0 MT4 is no exception. However, its design allows traders to shape their risk profile. Some key risk controls include:

- Adjustable lot size (fixed or percentage based)

- Maximum number of open trades

- Maximum daily loss or equity drawdown (if you configure such rules)

- Trading session filters (London, New York, or custom hours)

You should regularly monitor the EA, review its performance, and adjust risk parameters if volatility increases or market conditions significantly change.

Pros and Cons of Golden Mirage EA V2.0 MT4

Advantages:

- Fully automated strategy for busy traders

- Optimised for gold and other high-volatility instruments

- Reduces emotional and impulsive trading decisions

- Customisable risk settings and trading hours

- Can be suitable for both small and medium-sized accounts

Disadvantages:

- Performance depends on market conditions; no EA wins every day

- Requires disciplined risk management from the user

- Needs a stable platform (MT4 on PC or VPS) running 24/5

- Past results do not guarantee future performance

Who Should Use Golden Mirage EA V2.0 MT4?

Golden Mirage EA V2.0 MT4 is ideal for:

- Traders who like gold but struggle with emotional entries and exits

- Part-time traders who cannot sit in front of charts all day

- Traders who prefer a defined set of rules rather than discretionary trading

- Those who are willing to test, optimise, and monitor an automated system over time

- On the other hand, traders who frequently interfere with open positions, change settings every hour, or expect guaranteed profits may not benefit from any EA, including Golden Mirage EA V2.0 MT4.

Best Practices Before Going Live

Before running Golden Mirage EA V2.0 MT4 on a real account, it is wise to:

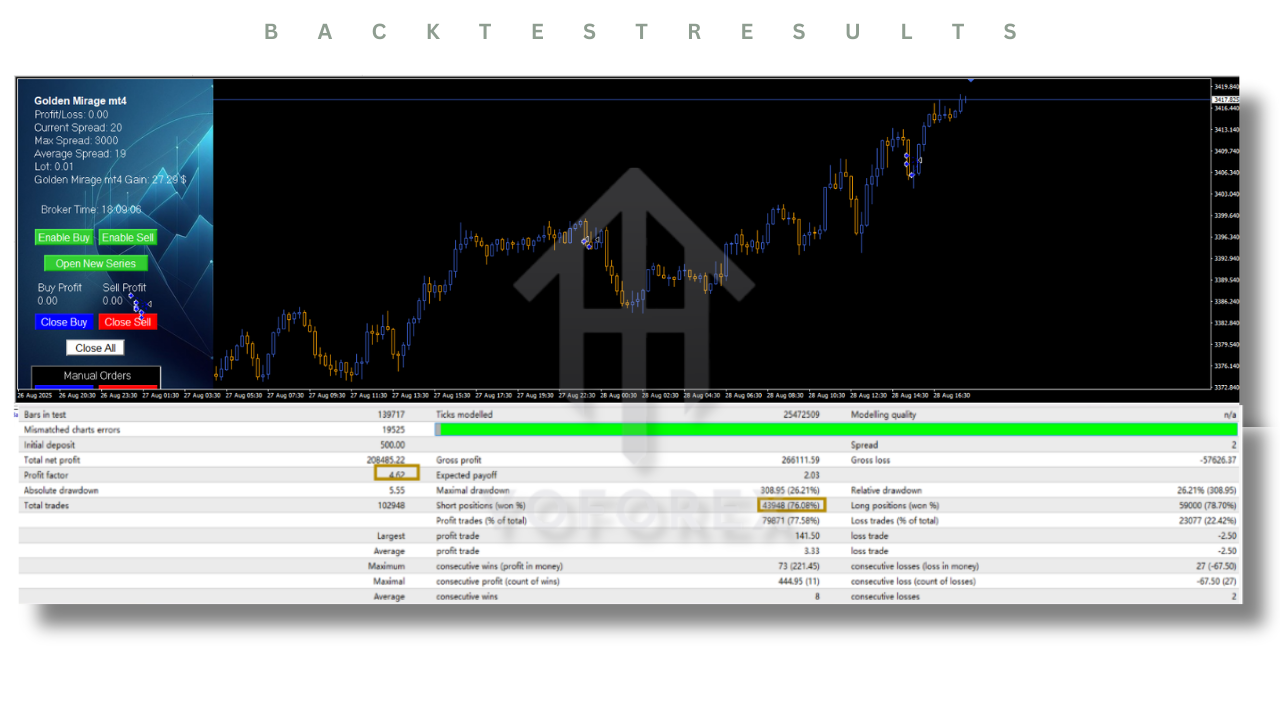

- Backtest the EA on your preferred pair and timeframe to understand its historical behaviour.

- Run it on a demo account to watch how it behaves in live market conditions.

- Start with low risk and gradually scale up only after you are satisfied with its consistency.

- Maintain a trading journal to track performance, settings used, and any modifications made.

Following these steps reduces surprises and helps you build confidence in the EA’s behaviour.

Final Thoughts on Golden Mirage EA V2.0 MT4

Golden Mirage EA V2.0 MT4 is designed to give traders a structured, rules-based approach to trading gold and other volatile symbols on MetaTrader 4. While no system is perfect, its combination of trend logic, pullback entries, and risk management tools makes it a solid option for traders who want to automate part of their strategy.

Used with patience, realistic expectations, and strict risk control, Golden Mirage EA V2.0 MT4 can become a useful component of a larger trading plan rather than a “get-rich-quick” shortcut. As always, treat it like a professional tool—test it, monitor it, and let data guide your decisions.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment