Content

Gold trading has evolved rapidly in recent years, and algorithmic tools built for MetaTrader 4 have become an essential part of many traders' strategies. Among the emerging automated systems, Gold Aurefix EA V1.10 for MT4 has gained significant attention for its structured approach to trading XAUUSD using adaptive algorithms. This guide provides a detailed review, including how the EA works, its configuration principles, advantages, risk considerations, optimization steps, and what users should know before integrating it into a trading environment. The purpose of this article is to provide clarity for new and experienced traders who want a deeper understanding of this Expert Advisor and its practical usage.

Gold Aurefix EA V1.10 is designed specifically for the gold market, targeting short-term opportunities while maintaining a disciplined risk structure. Its architecture focuses on systematic entries, dynamic stop-loss and take-profit adjustments, and conditions that aim to minimize exposure during periods of irregular volatility. Since gold tends to move sharply during news events and liquidity imbalances, the EA incorporates filters intended to prevent trades in unfavorable environments. These design elements make it attractive for traders seeking consistency rather than aggressive, high-risk growth.

What Makes Gold Aurefix EA V1.10 Unique

The EA is structured around volatility analysis, pattern recognition, and adaptive scaling logic. Instead of relying on grid or martingale techniques, it focuses on single-trade execution with controlled risk. This design helps maintain drawdown at manageable levels and reduces the dependency on large capital to withstand recovery cycles.

The algorithm evaluates short-term price impulses on the M1 timeframe, identifying potential breakout or retracement opportunities. By combining multiple internal filters, the EA attempts to avoid entering trades during phases where gold typically produces unpredictable spikes. These filters work to ensure that trade entries are not only technically aligned but also supported by a stability threshold.

One highlight of Gold Aurefix EA is its dynamic risk approach. Lot sizing is calculated based on account conditions rather than fixed increments. When volatility expands, the EA adjusts its protective levels accordingly to maintain proportional risk. When conditions are calm and orderly, the system tightens its execution rules for more refined entries. This approach allows the EA to interact with the market environment intelligently rather than using static configurations.

Core Strategy Overview

Although the internal logic of Gold Aurefix EA V1.10 is proprietary, its behavior aligns with structured breakout methodology. The system monitors micro-trend formation and liquidity shifts. When price forms a trigger structure, the EA evaluates several confirmation elements before initiating an order. It also incorporates continuous monitoring during open trades, adjusting protective parameters as new market data emerges.

The strategy typically aims to capture short bursts of momentum that occur after price compression zones. These opportunities are common in gold trading, especially during session overlaps and high-volume market windows. The EA is also designed to avoid over-trading. One of its strengths is selective participation, reducing excessive exposure that often leads to drawdowns in many automated systems.

Installation and Setup Guide

Setting up Gold Aurefix EA V1.10 MT4 involves several steps to ensure proper alignment with broker conditions and system requirements. Users should follow these steps for optimal performance:

- Install MetaTrader 4 on a stable VPS or local system.

- Place the EA file into the Experts directory inside the MT4 installation folder.

- Enable automated trading and allow DLL imports if required.

- Attach the EA to an XAUUSD M1 chart.

- Configure the risk parameters, lot sizing method, and operational settings.

- Ensure that the trading account uses tight spreads and fast execution, ideally an ECN environment.

The EA is designed for continuous operation. Running it on a dedicated VPS ensures uninterrupted execution and reduces the impact of latency. Due to its reliance on fast decision-making processes, execution quality plays a major role in performance. A stable environment with minimal slippage is recommended.

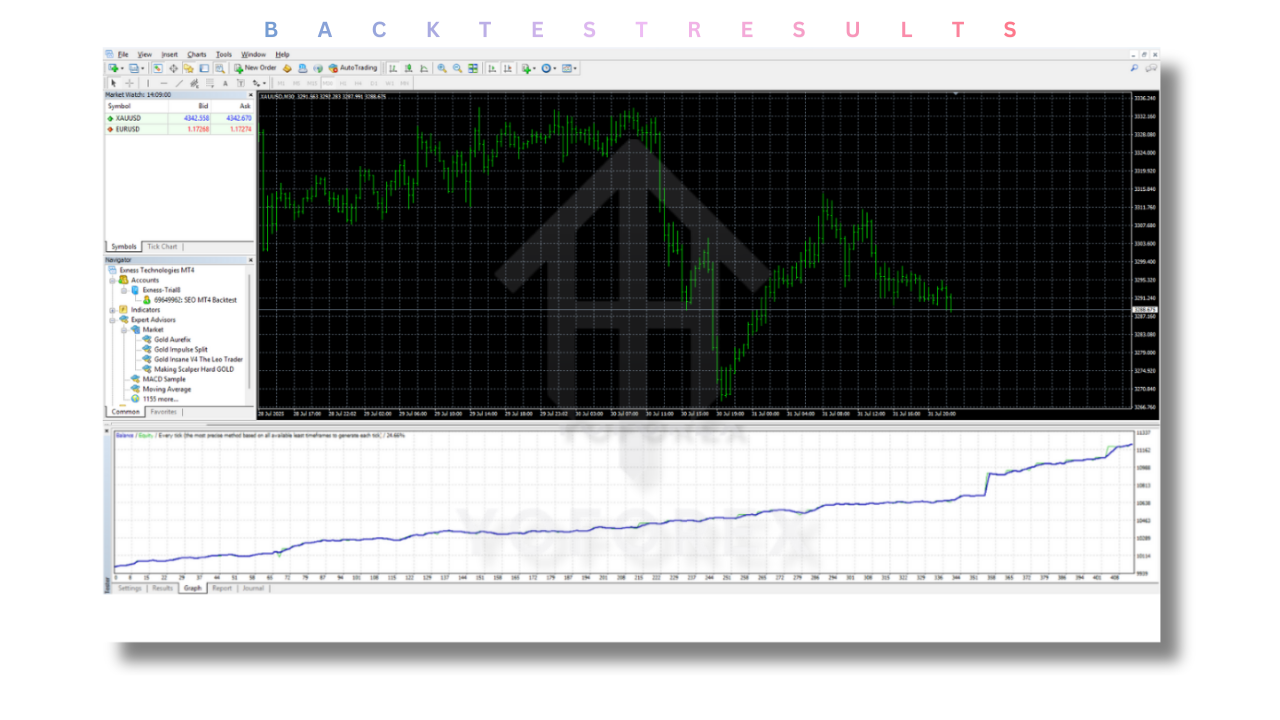

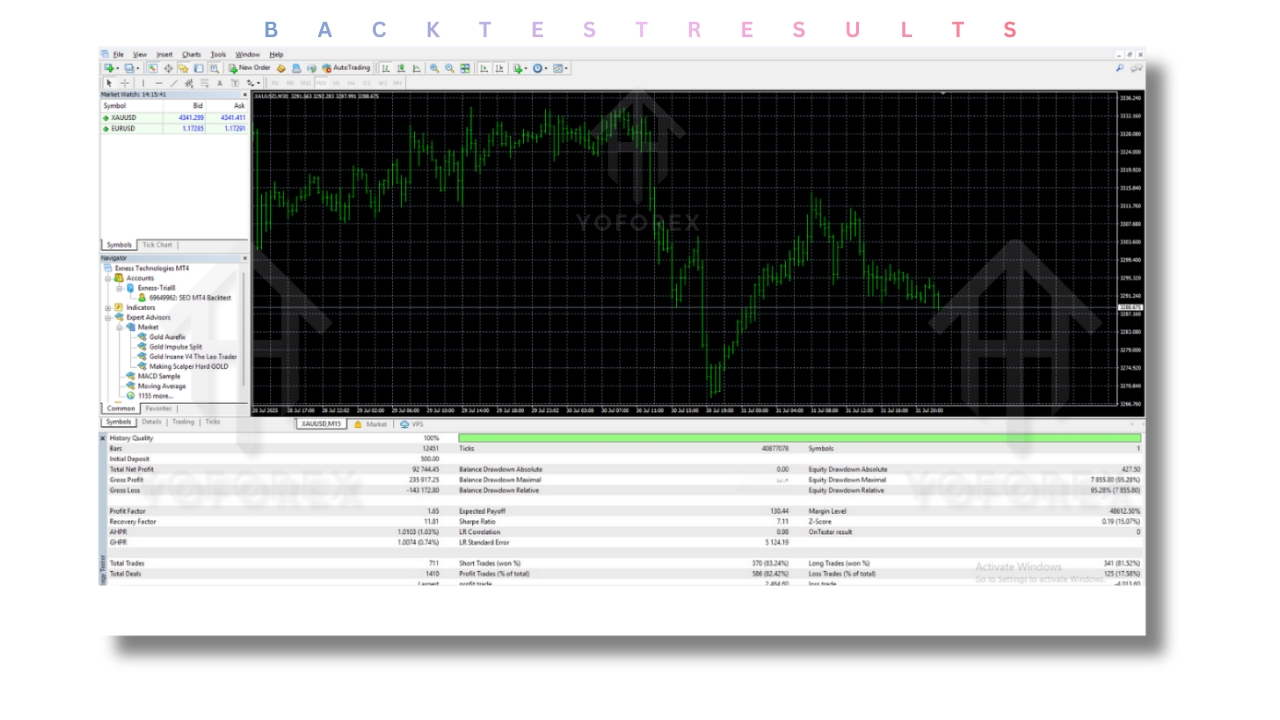

Backtesting Considerations

Backtesting gold EAs can be challenging because gold’s micro-movement structure is sensitive to tick quality. To obtain meaningful results, traders should use high-quality historical data and real-tick modeling. During backtests, users should verify the following:

- Whether the EA’s logic produces realistic execution behavior.

- How it performs during volatile periods, including news releases.

- Whether risk exposure remains within acceptable limits.

- How often the system trades and how long trades remain open.

- The relationship between long-term drawdown and net growth.

Forward testing on a demo account is essential before moving to a live environment. Backtests show how the strategy interacted with past market conditions, but forward tests reveal how the EA handles real-time price flow and slippage. Running a trial for several weeks helps identify whether the EA aligns with user expectations.

Risk Management Philosophy

Risk management is one of the defining areas of Gold Aurefix EA. Unlike systems that rely on aggressive averaging techniques, this EA emphasizes a controlled approach. Each trade includes a predefined stop-loss. The risk per position can be adjusted depending on the user’s preference, account size, and trading style.

Although the EA attempts to operate safely, gold trading inherently carries higher volatility. Users must ensure that their risk allocation aligns with the instrument’s nature. Small position sizes, conservative risk percentages, and well-defined capital thresholds create a more stable long-term experience.

Another advantage is the absence of impulsive entry stacking. Many high-risk EAs continue adding positions during adverse price movements, which may lead to significant losses. Gold Aurefix EA follows a structured, single-engagement method. This lowers cumulative exposure and makes risk more transparent and predictable.

Best Practices for Optimal Results

To maximize the EA’s potential, traders should follow several operational guidelines:

- Use a spread-friendly trading environment to allow cleaner entries.

- Maintain a stable connection using a reliable VPS.

- Avoid interfering manually with open trades unless necessary.

- Review performance metrics weekly to ensure consistency.

- Keep your MT4 terminal updated and free from unnecessary indicators or scripts that may strain resources.

The EA performs best when it operates continuously without manual interruptions. Turning it off frequently may disrupt its internal cycle recognition and trade timing models.

Who Should Use Gold Aurefix EA V1.10

This Expert Advisor is suitable for traders who prefer a structured and disciplined approach. It is ideal for those who:

- Want steady, controlled engagement with gold.

- Prefer automated strategies that avoid martingale or grid systems.

- Seek an EA designed specifically for XAUUSD trading.

- Understand the importance of proper risk management.

- Are willing to run the EA on a stable trading environment.

It may not be suitable for individuals seeking extremely fast, aggressive gains or those who frequently interrupt automated systems with manual interventions.

Limitations and Considerations

No Expert Advisor is perfect, and Gold Aurefix EA V1.10 is no exception. Its selective approach means there may be periods of inactivity when market conditions do not match its criteria. This is intentional but may not appeal to traders who prefer high-frequency engagement.

Market conditions also evolve. Although the system is designed to adapt within a certain structure, long-term profitability depends on broader market cycles. Users should periodically review its performance to ensure alignment with their trading goals.

Furthermore, since gold reacts strongly to major economic events, traders must remain aware of global news. While the EA contains protective logic, external risk awareness remains essential.

Final Verdict

Gold Aurefix EA V1.10 MT4 presents a disciplined and strategically built approach to trading gold. Its focus on volatility patterns, clean execution logic, and controlled risk structure makes it appealing for traders wanting a well-organised automated solution. While no EA guarantees profits, Gold Aurefix EA offers a balanced methodology that prioritizes long-term sustainability over aggressive tactics.

Traders should combine it with responsible risk management, continuous testing, and proper infrastructure to achieve the best results. When integrated correctly, the EA can serve as a valuable addition to a trader’s toolkit, especially for those focused on XAUUSD.

Users interested in exploring the EA further can download the file, test it in demo environments, and evaluate its performance over different market conditions before deploying it in live accounts.

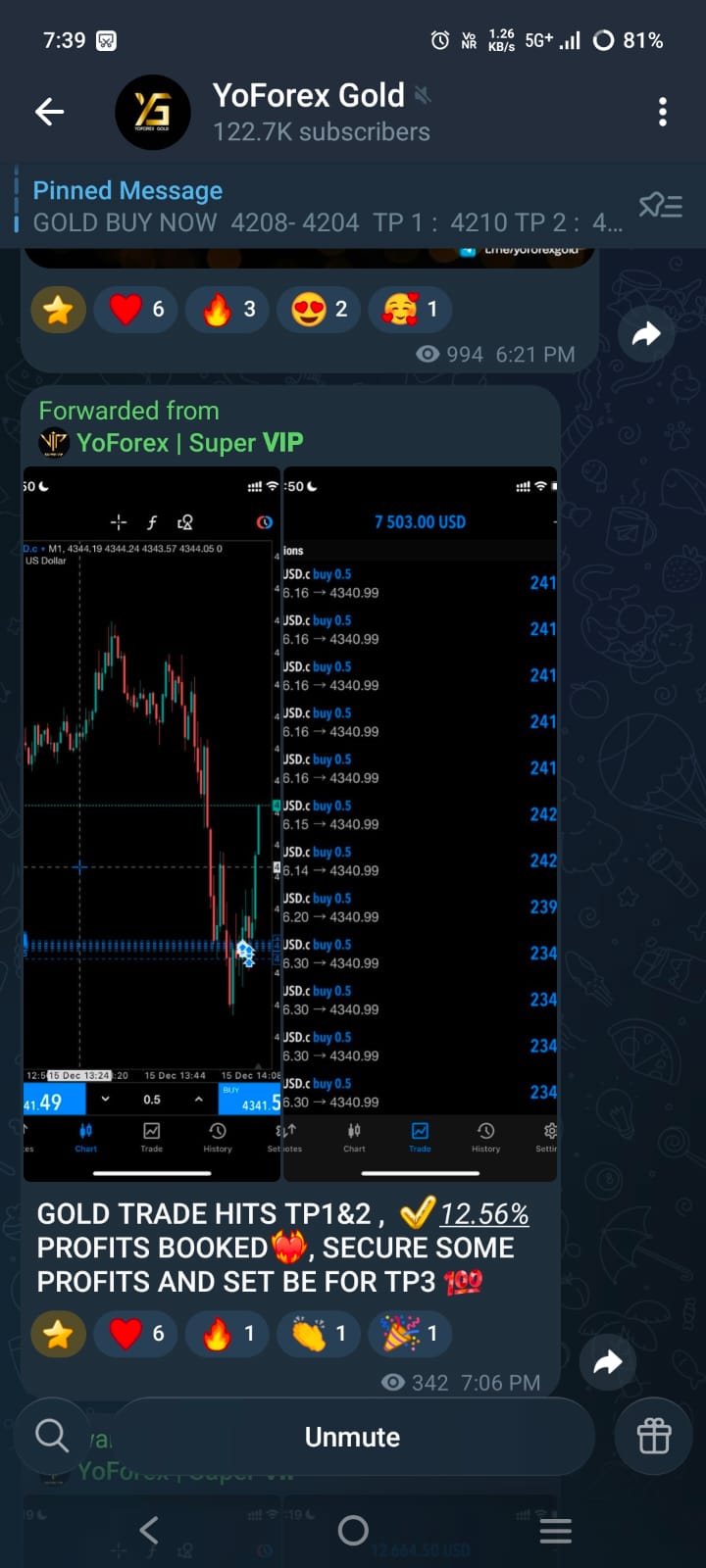

For inquiries or community discussions:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment