Gann Fan EA V1.0 (MT4): Angle-Driven Entries for GBPUSD, EURUSD & XAUUSD

Tired of chasing trendlines that keep drifting? If you’ve ever drawn a perfect line only to watch price “respect” a slightly different angle, you’re not alone. Gann traders solved this ages ago by using angles instead of arbitrary lines. Gann Fan EA V1.0 (MQ4) brings that idea into automation for MetaTrader 4—so your entries, exits, and risk controls can follow a proven geometric logic on GBPUSD, EURUSD, and XAUUSD across H1 to M15. No hype; just clean, rules-based decisions anchored to price–time balance. And yep, it’s built with a YoForex-powered approach to testing and iteration, so you’re not flying blind.

Overview

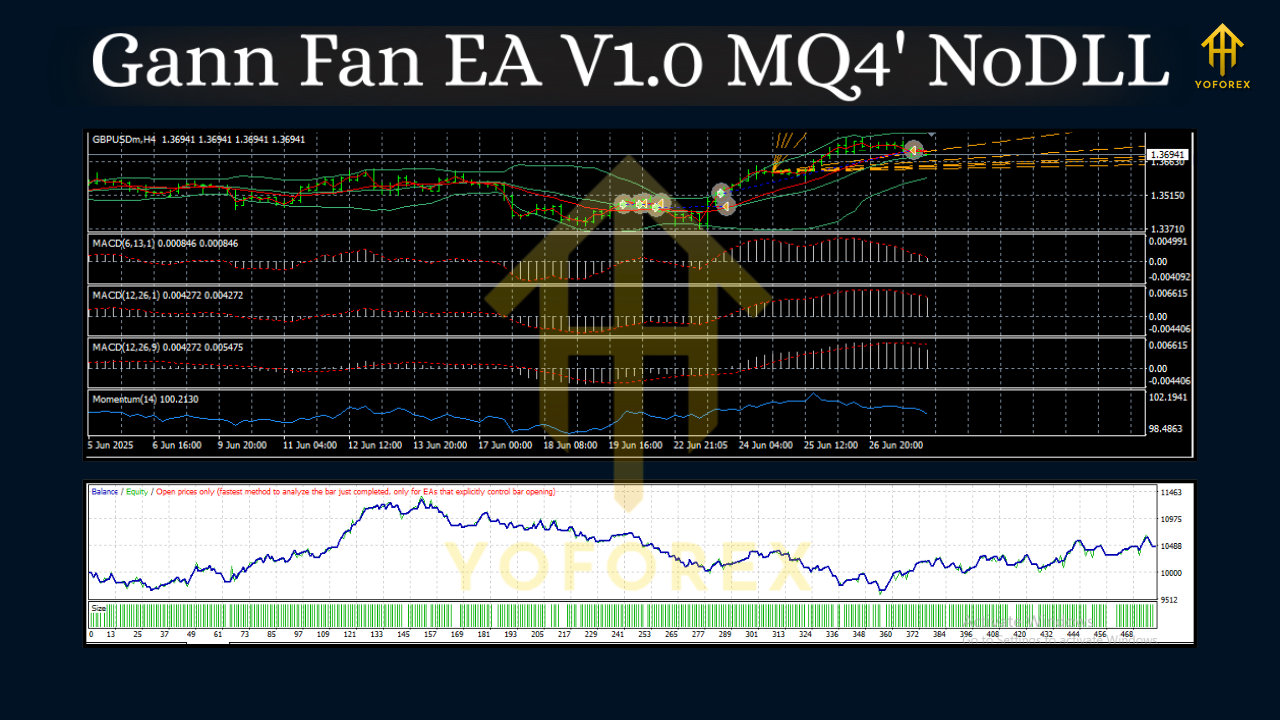

Gann Fan EA V1.0 applies dynamic fan angles derived from recent swing structures, then times entries when price interacts with those angles alongside basic momentum confirmation. The result is a lightweight, angle-aware robot you can run on M15, M30, or H1—choosing faster signals on M15 or more selective, swing-style signals on H1. It’s suited to GBPUSD and EURUSD for their generally clean intraday rotations, and XAUUSD (Gold) for traders who love volatility but still want a framework that keeps risk sane.

What sets it apart? Instead of slapping on a hundred indicators, this EA keeps a core concept front and center: price moves in relation to time. Gann angles give you a grid to judge whether a move is accelerating, decelerating, or reverting. Add in tight SL/TP logic, an optional breakeven bump, and a simple news-pause filter (if you want it), and you’ve got a practical toolkit. You decide whether to let it trade during sessions with more volume (London/NY overlap) or keep it on conservative during sleepy hours.

YoForex’s team validated the logic with iterative walk-forward checks and forward monitoring; we prefer straightforward confluence over secret sauce. If you’re after an EA that you can actually understand, tweak, and explain to yourself later, this is it.

How the Strategy Works (in plain English)

How the Strategy Works (in plain English)

- Anchor swing detection: The EA finds a recent market structure pivot and projects a Gann Fan with key angles (think 1×1, 1×2, 2×1, etc.).

- Angle interaction: When price interacts with one of those fan lines, we read the context: above vs below the 1×1, angle slope, and how candles close relative to the angle.

- Momentum check: A compact momentum filter (e.g., short-term slope/volatility pulse) helps avoid blind touch trades.

- Risk framing: Each trade has a predefined stop-loss (beyond the opposite angle or recent swing) and take-profit (toward the next angle or a fixed R-multiple).

- Trade management: Optional breakeven once price moves in your favor; partial close on touch of intermediate angles; and trail if you prefer to squeeze strong trends.

You’re not buying a black box. You’re adopting a consistent geometry that’s been around since W.D. Gann; the EA simply does the boring math 24/5.

Why These Pairs & Timeframes?

- GBPUSD & EURUSD: Liquid, well-behaved trends and rotations; Gann angles often hold meaning on H1 and M15 without crazy slippage.

- XAUUSD (Gold): Greater volatility, yes, but angles still matter. You’ll likely pick tighter risk on M15 and a bit wider on H1.

- H1 to M15: M15 gives more setups (and occasionally more noise), H1 filters out a lot of chop; M30 is a sweet middle ground. Choose the chart that matches your patience and VPS latency.

Key Features

- • Angle-aware entries based on authentic Gann Fan geometry

- • Pairs: GBPUSD, EURUSD, XAUUSD; Timeframes: H1, M30, M15

- • Fixed SL/TP with optional R-multiple targeting (e.g., 1:1.5, 1:2)

- • Breakeven & trailing toggles for hands-off management

- • Session filter to focus on London/NY or your preferred hours

- • Optional news pause to avoid major spikes (user-controlled)

- • No martingale, no grid, no hedging—clean risk, period

- • Max spread guard so it won’t enter during widening spreads

- • Daily trade cap to prevent over-trading on lower timeframes

- • Comment & Magic Number controls for multi-chart setups

- • Equity-based protection (daily loss limit; auto-stop for the day)

- • YoForex-guided testing methodology and ongoing refinements

Suggested Risk & Money Management

Keep it simple. For most accounts, 0.5%–1% risk per trade is sensible when you’re starting out. If you’re on XAUUSD M15, consider staying on the lower end till you gauge the EA’s rhythm with your broker’s feeds. On H1 for GBPUSD/EURUSD, you might allow a slightly wider stop with the same % risk so volatility isn’t knocking you out prematurely. Use max daily loss controls (e.g., 3%–4%) to protect your equity curve, coz no strategy wins every day.

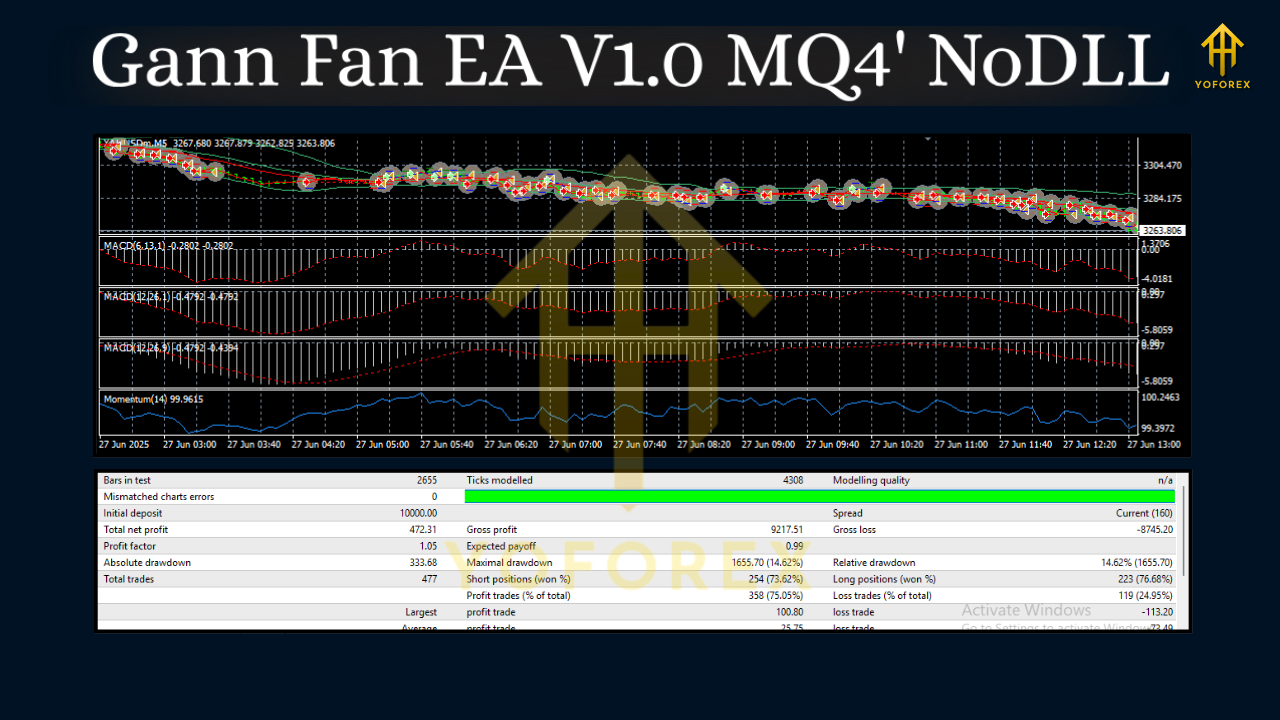

Backtesting & Forward-Style Validation (what to expect)

We recommend you run modeling quality at the highest level your data allows and test 2019–2024 at minimum, including all market regimes. Sensible parameters tend to show a smooth but not perfectly linear equity curve—Gann angle systems do catch trends nicely but will chop during dead ranges. That’s okay. What you want to see:

- A steady equity curve with moderate pullbacks rather than moonshots followed by cliffs.

- Distinct edge on sessions with volume (London/NY).

- Lower trade frequency on H1 with higher average R-multiple vs M15’s higher count and smaller winners.

Then do a forward demo for at least 2–4 weeks on your broker before going live. YoForex’s internal checks mirrored this rhythm: M15 on Gold is active but needs spread control; H1 on majors is calmer and cleaner.

Quick tip: If your backtest looks too perfect, it’s probably over-optimized. Loosen parameters and seek robustness across years, not just one quarter that looks amazing.

Installation & Setup (MT4, MQ4)

- Download the EA file and place it in MQL4/Experts inside your MT4 data folder.

- Restart MT4; open Navigator → Expert Advisors and find Gann Fan EA V1.0.

- Enable AutoTrading and Allow DLL/Algo Trading if prompted.

- Open GBPUSD, EURUSD, or XAUUSD on M15, M30, or H1.

- Drag the EA onto the chart; confirm Magic Number, Lot/Risk mode, Session filter, SL/TP, Breakeven, Trail, and Max Spread.

- If you use a news filter EA/utility, set the News Pause option accordingly.

- Start on a demo or a small live account with conservative risk; monitor for a week before scaling.

Parameter Notes (what most traders tweak first)

- Risk Mode: Fixed lots vs % risk; % risk is safer for growing/variable equity.

- Angle Sensitivity: Controls how strict the angle touch/close rules are; stricter = fewer but cleaner signals.

- TP Strategy: Fixed R target vs staged exits at subsequent fan angles.

- Breakeven Trigger: Often at +0.8R to +1R; you can nudge it based on your pair/timeframe.

- Trailing Behavior: Trend followers like a slow trail tied to angle progression; scalpers prefer partial closes + quick BE.

- Session Times: Many prefer London open through NY mid-session; turn off during Asia unless your tests prove otherwise.

Best Practices & Common Pitfalls

Best Practices & Common Pitfalls

- Don’t martingale it manually. This EA is designed for straight-edge risk.

- Use a VPS close to your broker if you trade M15 on Gold; latency matters on volatile spikes.

- Keep spread filters realistic. Too tight and you’ll miss good entries; too loose and fills can be sloppy.

- Update only after testing. If you change parameters, re-check on a small lot size first.

- Respect news. If you see spreads exploding around NFP/CPI/FOMC, let the EA sit out—angles don’t protect you from slip.

Who This EA Is For

- Traders who like structure—you want entries that make sense when you review them later.

- Fans of price action who don’t want 10 oscillators blinking.

- Swing-to-intraday profiles: M15 for active days, H1 for bigger, calmer swings.

- Anyone who prefers clean risk—no grid, no hedge, no doubling down.

Disclaimer & Support

Trading involves risk. Past performance doesn’t guarantee future results. Always test on demo first and go live only when you’re comfortable with the behavior on your broker and timeframe. If you need help with setup, optimization ideas, or risk tuning, YoForex’s team is around to assist—short, practical answers rather than long lectures.

Call to Action

Ready to give Gann Fan EA V1.0 a spin? Set it up on a demo for GBPUSD/EURUSD H1 first, keep risk tiny, and let it run through a few sessions. If it clicks with your style, scale calmly. You don’t need to “force” trades—let the angles do the talking. And hey, if you get stuck, just reach out; we’ll guide you through.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment