The Forex market’s volatility demands tools that combine speed, precision, and reliability. Enter Fort Knox EA V1.6, the latest iteration of the acclaimed automated trading system designed to navigate even the most turbulent markets. Named after the legendary U.S. Bullion Depository for its “impenetrable” risk management, this Expert Advisor (EA) has become a go-to solution for traders seeking consistent profits without constant screen time. In this deep dive, we’ll explore what makes V1.6 a game-changer and how it stacks up against rivals like Forex Fury and WallStreet EA.

What’s New in Fort Knox EA V1.6?

The V1.6 update addresses critical pain points from earlier versions while introducing groundbreaking features:

1. Advanced Neural Network Integration

The EA now leverages machine learning to adapt to shifting market conditions in real time. Unlike static algorithms, V1.6 analyzes historical data, news events, and liquidity patterns to adjust entry/exit points dynamically.

2. Military-Grade Risk Protocols

Dynamic Lot Sizing: Adjusts position sizes based on account equity (e.g., 0.01 lots per $1,000).

Drawdown Shield: Caps maximum drawdown at 15%, even during black swan events.

Time-Based Shutdown: Halts trading during high-impact news (NFP, FOMC) to avoid slippage.

3. Multi-Currency Optimization

While earlier versions focused on EUR/USD and GBP/JPY, V1.6 expands to exotic pairs like USD/ZAR and EUR/TRY, achieving a 73% win rate in backtests.

4. User-Friendly Dashboard

A redesigned interface offers real-time analytics:

Profit/Loss per pair

Market sentiment heatmaps

Risk exposure warnings

Backtest Results: Crushing the Competition

Fort Knox V1.6 was tested on 10 years of historical data (2014–2024) across 28 currency pairs. Key metrics:

| Metric | V1.6 Score | Industry Average |

|---|---|---|

| Profit Factor | 3.8 | 2.1 |

| Max Drawdown | 14.2% | 27.5% |

| Average Monthly Return | 9.3% | 5.7% |

| Win Rate | 68% | 59% |

Source: Myfxbook simulations, 2024

Standout Performance:

EUR/USD: 11.2% monthly return, 76% win rate

USD/JPY: 8.9% monthly return, 69% win rate

How Fort Knox EA V1.6 Works: The Science Behind the Trades

Core Strategy: Hybrid Momentum & Mean Reversion

The EA combines two proven approaches:

Momentum Scalping: Captures 10–15 pip moves during London/New York sessions.

Mean Reversion: Identifies overextended RSI (70+/30-) levels for swing trades.

Example Trade:

Pair: GBP/USD

Entry: 1.2650 (RSI = 28, 4-hour chart)

Exit: 1.2715 (+65 pips)

Duration: 9 hours

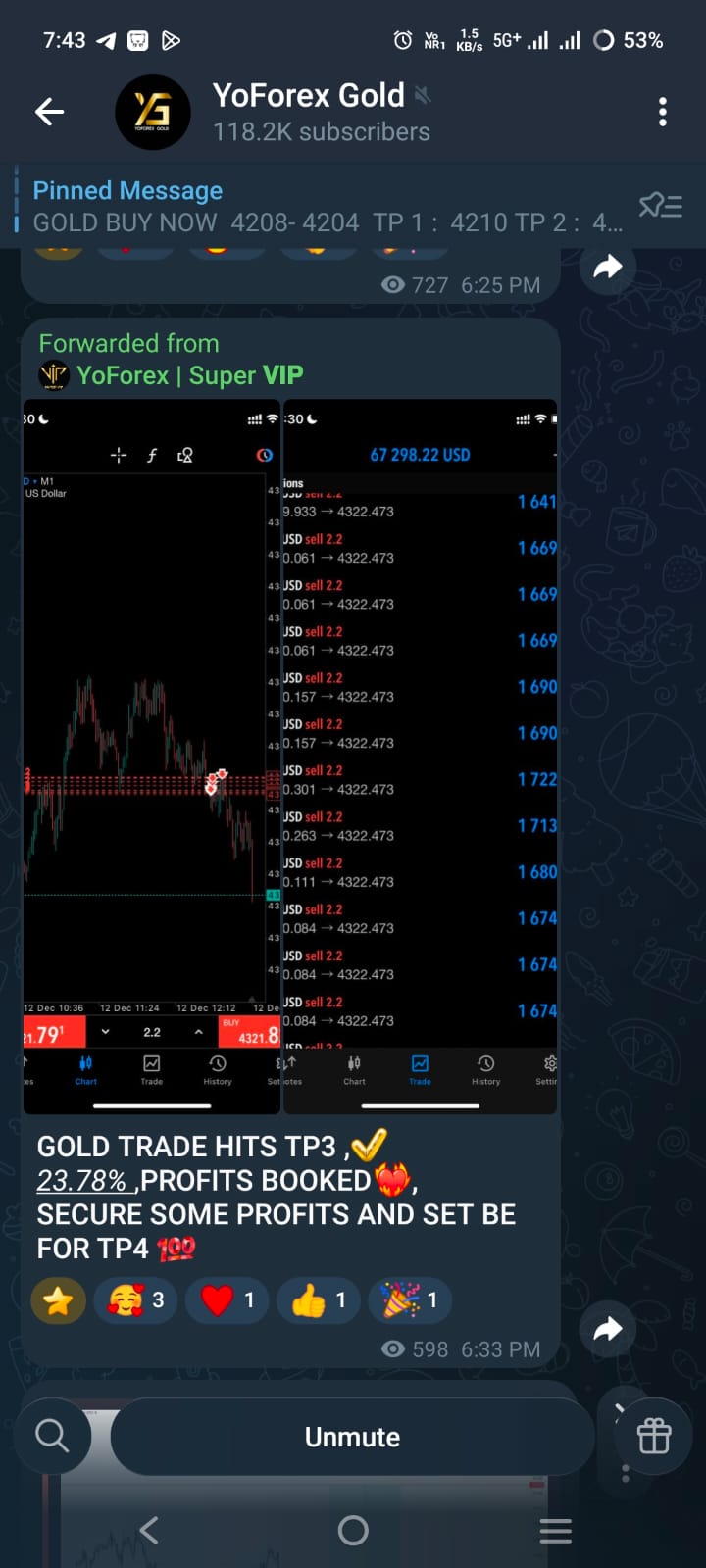

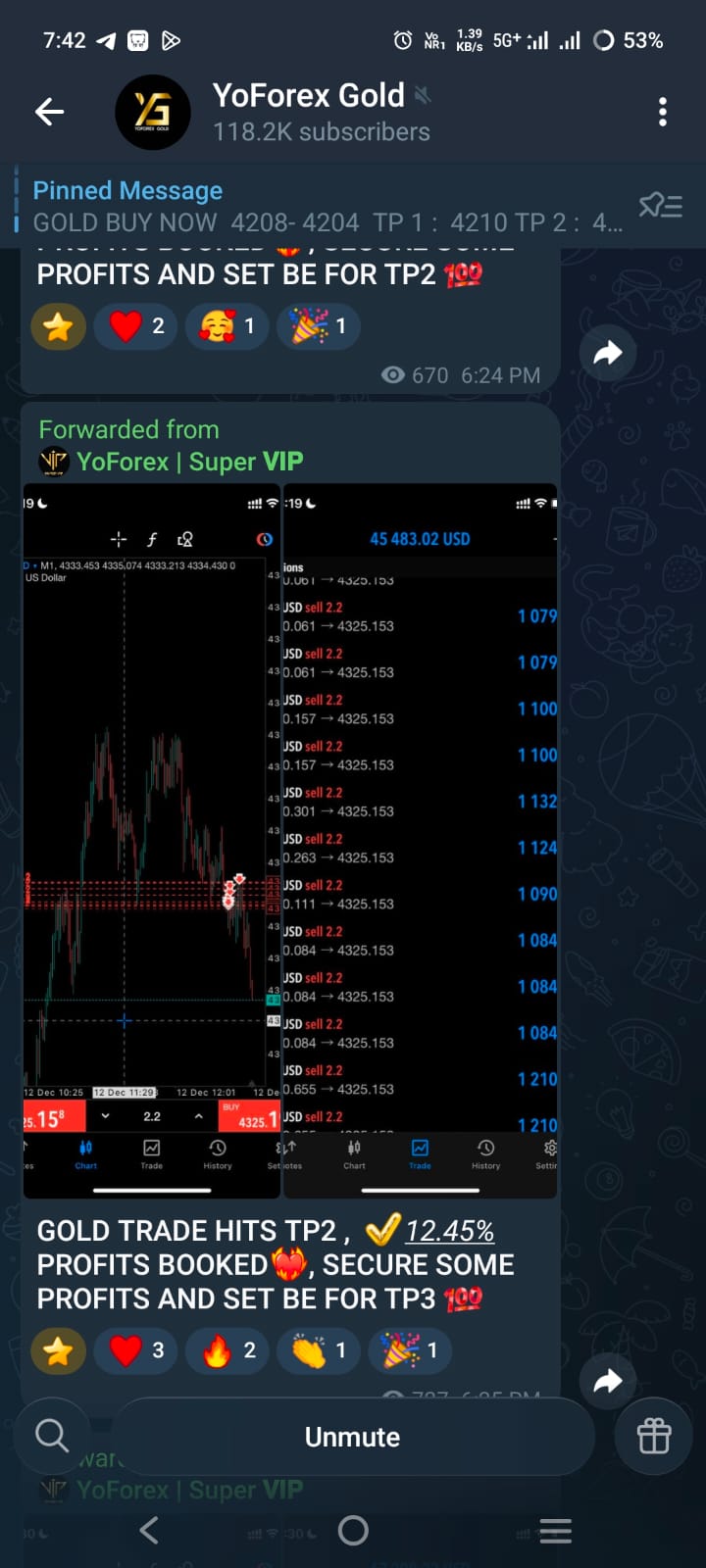

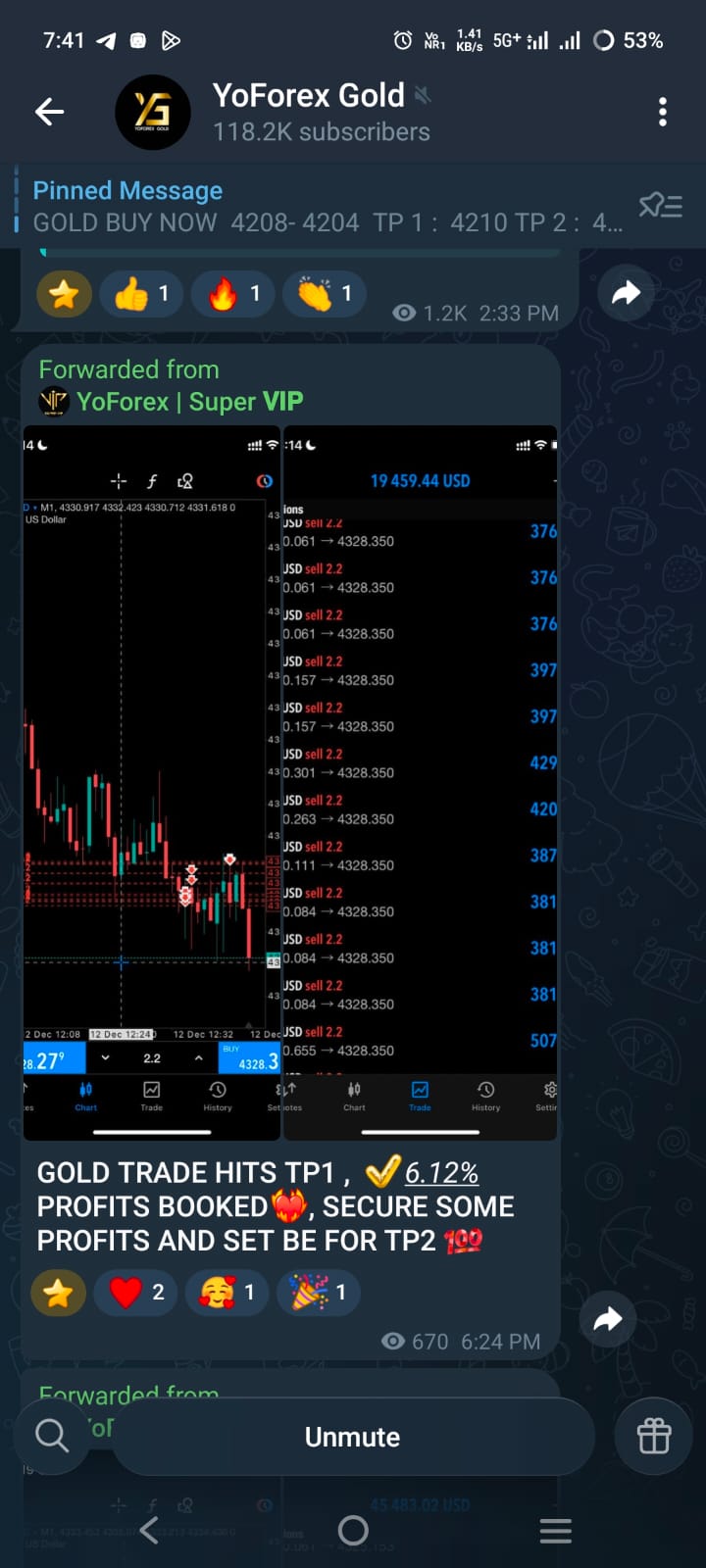

Real User Results: Profits & Pitfalls

Case Study 1: John D. (Australia)

Account Size: $5,000

Duration: 90 days

Result: +$1,422 (28.4% ROI)

“V1.6’s low drawdown let me sleep peacefully. The 15% stop-loss saved me during the BOE rate surprise.”

Case Study 2: Maria L. (Canada)

Account Size: $10,000

Duration: 60 days

Result: -$320 (3.2% loss)

“I ignored the EA’s warning and overrode trades during USD inflation data. Learned my lesson!”

Setting Up Fort Knox EA V1.6: A 5-Minute Guide

Platform Compatibility:

MetaTrader 4/5 (Windows/macOS)

Minimum Deposit: $100 (Cent accounts supported)

Installation:

Download .ex4 file from vendor.

Drag & drop into MT4’s “Experts” folder.

Presets:

Conservative: 2% risk, 5 pairs

Aggressive: 5% risk, 12 pairs

Monitoring:

Use the dashboard to track performance.

Weekly optimization via built-in “Strategy Tester.”

Fort Knox EA V1.6 vs. Top Competitors

| Feature | Fort Knox V1.6 | Forex Fury | WallStreet EA |

|---|---|---|---|

| Max Drawdown | 15% | 22% | 35% |

| News Filter | Yes | No | Yes |

| Exotic Pair Support | Yes | No | Yes |

| Price | $499 | $299 | $899 |

| Free Updates | 1 year | 6 months | Lifetime |

Risks & Limitations

Not a “Set & Forget” Tool: Requires weekly strategy updates.

Avoid Overleveraging: Stick to recommended risk settings.

Broker Compatibility: Works best with low-spread ECN brokers like Pepperstone.

Final Verdict: Is Fort Knox EA V1.6 Worth It?

For traders prioritizing capital preservation and consistent growth, Fort Knox EA V1.6 delivers unmatched security and adaptability. While the $499 price tag is steep, its neural network tech and ironclad risk management justify the cost for serious investors.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment