Elliot Oscillator Waves Indicator V1.03 MQ4 – Complete Trading Guide

Forex traders have always searched for tools that help decode market structure and predict the next big price wave. One such powerful tool is the Elliot Oscillator Waves Indicator V1.03 MQ4, a custom MetaTrader 4 indicator based on Elliott Wave theory. If you’ve struggled to spot wave cycles manually or missed big reversal opportunities coz charts looked confusing, this indicator simplifies everything by automatically detecting wave patterns for you.

Wave-based trading is one of the oldest yet most effective ways to understand market psychology. But doing it manually? Honestly… it’s tough, time-consuming, and error-prone. This indicator solves that problem by visually marking wave phases, highlighting momentum strengths, identifying impulse and corrective waves, and giving you a clear roadmap of where price might move next.

In this blog, you’ll learn how the Elliot Oscillator Waves Indicator V1.03 MQ4 works, its features, benefits, installation steps, trading applications, and why it’s popular among both beginners and experienced Elliott Wave traders.

What is Elliot Oscillator Waves Indicator V1.03 MQ4?

The Elliot Oscillator Waves Indicator V1.03 MQ4 is an MT4 custom technical indicator that merges Elliott Wave principles with oscillator-based momentum analysis. Instead of drawing manual wave counts, the indicator:

- Automatically marks possible wave structures

- Shows oscillator momentum for each wave

- Identifies overextended impulse zones

- Highlights corrective patterns

- Helps predict trend continuation or reversal

It’s designed for traders who follow wave structure but want something more systematic, more visual, and easier to interpret. Whether you're a day trader, swing trader, or position trader, this indicator gives you clarity across market cycles.

The tool works on all major currency pairs, commodities like gold, indices, and even crypto charts on MT4.

How the Indicator Works (Simple Explanation)

The logic behind the indicator combines:

1. Elliott Wave Logic

The market moves in cycles of:

- Five-wave impulse

- Three-wave correction

The indicator tries to find these sequences using price swings and momentum patterns.

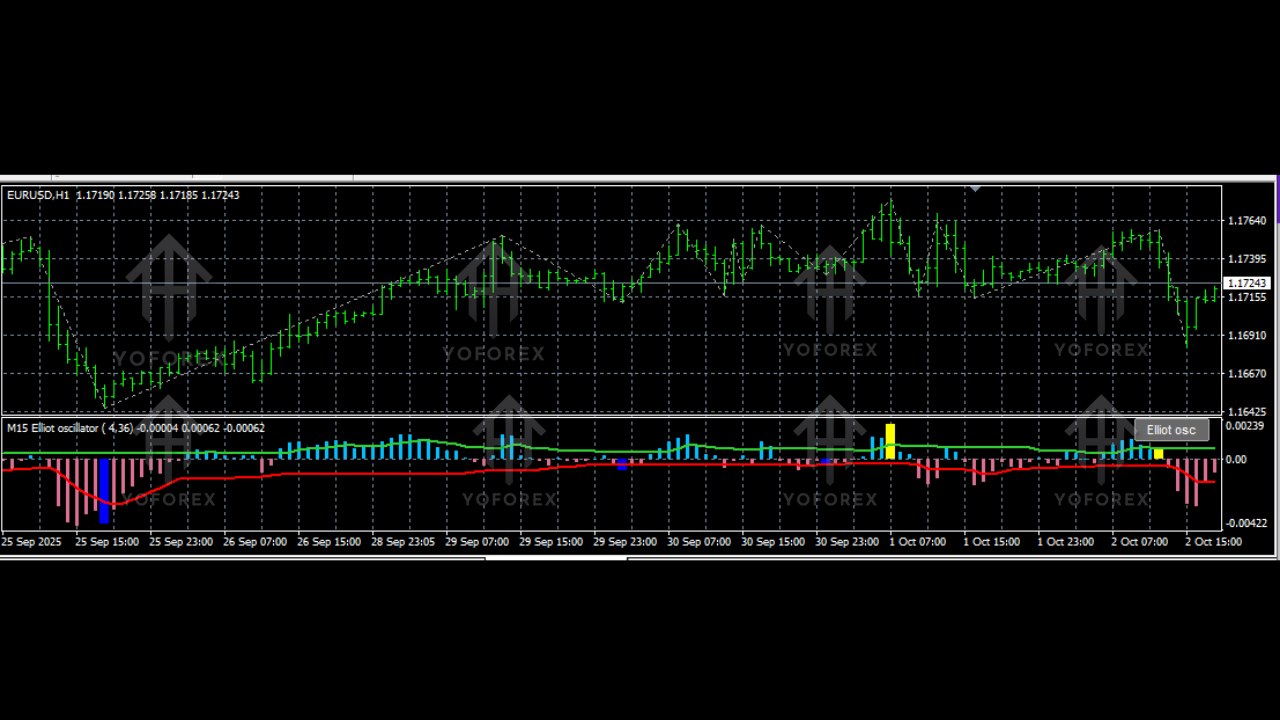

2. Oscillator Momentum

It uses a modified oscillator to measure the strength of each wave:

- High positive values → strong bullish wave

- High negative values → strong bearish wave

- Weakening oscillator → beginning of correction

- Oscillator divergence → possible reversal

3. Wave Color Labelling

Each wave is shown with a different color so you can visually track the cycle.

This combination gives traders a dynamic wave map, making it easier to catch the strongest parts of the trend.

Key Features of Elliot Oscillator Waves Indicator V1.03 MQ4

Here are the main features traders love:

• Automatic Elliott Wave detection

• Impulse & corrective wave labeling

• Custom oscillator showing momentum strength

• Color-based wave identification for quick reading

• Alerts for wave completion or possible reversal

• Works on all timeframes (M1–MN)

• Supports all currency pairs, gold, indices, crypto

• Simple plug-and-play installation

• Beginner-friendly visual interface

• No repainting after candle close

• Lightweight indicator that doesn’t slow MT4

• Suitable for trend trading & reversal setups

Whether you follow strict Elliott counting or just want a cleaner trend confirmation tool, this indicator delivers both clarity and confidence.

Why Use an Elliott Oscillator Instead of Manual Wave Counting?

Manual wave counting is honestly tiring. Traders often mess up due to:

- Wrong wave labelling

- Emotional bias

- Missing extensions or irregular corrections

- Incorrectly timing entries

This indicator removes that guesswork.

Benefits include:

- More consistent wave identification

- Faster decision-making

- Objective analysis not influenced by emotions

- Ability to backtest wave behavior

- Cleaner confirmation for buy/sell setups

If you’ve ever thought Elliott Waves were “too complicated”, this indicator will change your mind.

How to Trade Using Elliot Oscillator Waves Indicator V1.03 MQ4

Here’s how traders usually apply the indicator:

1. Trading Impulse Waves

When oscillator bars rise strongly above the base line:

- Wave 1 → Early signal

- Wave 3 → Best high-momentum trade

- Wave 5 → Trend exhaustion warning

Entry Idea: Enter during pullbacks in Wave 3 or Wave 5.

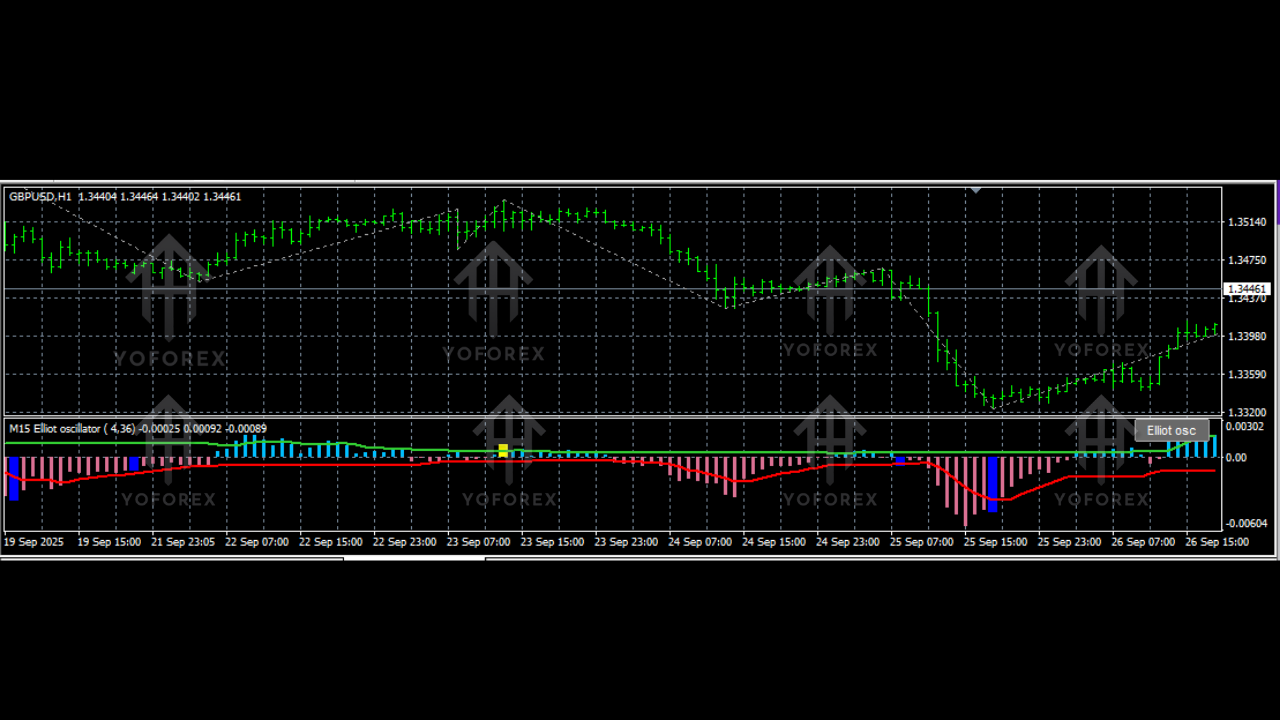

2. Trading Corrections

When oscillator weakens:

- ABC correction appears

- Market consolidates or retraces

Entry Idea: Wait for the end of “C” wave before trend continuation.

3. Using Divergence

A divergence between price and oscillator often signals:

- Wave 5 top

- Wave C bottom

These are high-probability reversal zones.

4. Multi-Timeframe Alignment

Higher timeframe wave direction + lower timeframe entries = extremely powerful strategy.

Example:

H4 shows Wave 3 up → Take M15 Wave 2 pullbacks for sniper entries.

Installation Guide (Step-by-Step)

Installing Elliot Oscillator Waves Indicator V1.03 MQ4 is very simple.

Step 1: Download the indicator (.mq4 file)

Step 2: Open MT4 → Go to File > Open Data Folder

Step 3: Navigate to MQL4 > Indicators

Step 4: Paste the indicator file

Step 5: Restart MT4

Step 6: Attach the indicator from Navigator > Indicators

Use default settings at first, then adjust wave sensitivity or oscillator smoothing to suit your style.

Best Settings & Tips

Although the default settings work well, you can fine-tune it:

1. Wave Sensitivity

- Lower value → identifies fewer, but stronger waves

- Higher value → identifies more wave patterns

2. Oscillator Period

- Short period → more reactive signals

- Long period → smoother trend view

3. Timeframe Tip

Use M15, H1, or H4 for the most consistent wave formations.

Backtest & Trading Performance Overview

Although indicators don’t generate trades automatically, traders using Elliot Oscillator Waves Indicator V1.03 MQ4 typically see improvements in:

• Trend accuracy

Wave identification improves trend confirmation.

• Reversal timing

Oscillator momentum shifts help spot turning points earlier.

• Entry precision

Wave-based pullback entries reduce unnecessary losses.

• Risk-to-reward ratio

Identifying impulse waves often increases RR to 1:3 or more.

• Trading confidence

Maps out clear wave structure, reducing emotional mistakes.

Many traders report smoother trend-following strategies and better reversal identification after switching to this indicator.

Who Should Use This Indicator?

The indicator is ideal for:

- Wave traders

- Trend followers

- Price action traders

- Swing traders

- Beginners learning Elliott Wave patterns

- Forex, gold, and indices traders

If you prefer structured market analysis instead of random entries, this is perfect for you.

Final Thoughts

The Elliot Oscillator Waves Indicator V1.03 MQ4 combines the strength of Elliott Wave theory with visual oscillator analysis, making it one of the easiest ways to understand market cycles. It simplifies wave counting, highlights trends, shows momentum, and helps you plan trades with better logic and timing.

Instead of getting confused by chart noise, traders can now clearly see how price waves evolve.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment