Edge Detector EA V1.0 MT5 – Free, Smart Entries on Any Major Pair

Introduction

Let’s be honest. Plenty of EAs look amazing in cherry-picked screenshots, then melt the first time spreads widen or news hits. If you’re done with that circus, Edge Detector EA V1.0 MT5 is a refresh. It’s built for the market you actually trade—real spreads, shifting volatility, messy ranges—using a tight combo of trend continuation and breakout confirmation with common-sense risk control. No martingale. No “mystery” parameters you can’t touch. And yep, it’s free for the community.

Designed by YoForex, Edge Detector EA aims to find the “edge” where compression becomes expansion and where a small, controlled risk can ride a clean leg. You choose the timeframe (M5 for scalps, M15–H1 for intraday, H4 for swing), set risk, and let the bot do the heavy lifting—signal detection, position sizing, and calm management. You’ll still need discipline (always), but you won’t be babysitting a drama-queen robot. Install it in minutes, test it on demo, and see how it fits your playbook… coz trading shouldn’t be harder than it needs to be.

Overview

Edge Detector EA is a MetaTrader 5 expert advisor that trades major forex pairs (EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NZDUSD) and adapts to any timeframe. The core logic is straightforward:

- Establish a directional bias using a smoothed baseline and micro-structure reads.

- Identify compression (tight range / volatility contraction).

- Confirm expansion (true breakout) with impulse + structure rules.

- Enter on continuation pullbacks or breakout retests with measured risk.

Why this matters: trends often begin from neat little boxes. Many EAs chase the first spike and get slapped by mean reversion. Edge Detector waits for confirmation, then looks for the first high-probability entry with a defined invalidation. You get fewer “random” trades and more coherent setups.

Who it’s for:

- Scalpers (M5/M15) who want speed but hate noise.

- Intraday traders (M15–H1) who prefer fewer, cleaner signals.

- Swing traders (H4) who like calm, deliberate entries.

Account type: ECN/low-spread recommended. A VPS helps during news; not mandatory, but useful.

Key Features

• Trend + Breakout Entry Engine – Dual logic finds pullback continuations and retest entries after real expansions.

• Non-Martingale Risk – Fixed-fraction or fixed-lot sizing. No forced grid. No doubling.

• ATR-Aware Stops/Targets – Dynamic SL/TP calibrated to current volatility; avoids unrealistically tight stops.

• Session Filters – Trade London/NY only or make your own schedule; skip thin hours if you want.

• Equity Guardrails – Daily loss cap, max trades per day, and overall equity protection.

• Safe Adds (Optional) – Scales in only after structure confirms; no blind averaging down.

• Smart Partial Profits – Lock a portion at 1R–1.5R; trail the runner behind swing structure.

• News Pause (Optional) – Time-based buffer around high-impact events (simple to configure).

• Multi-Timeframe Context – Bias confirmation from a higher TF to avoid counter-trend traps.

• Low CPU Footprint – Lightweight calcs so you can run multiple charts smoothly.

• YoForex Updates & Support – Continuous improvements with real people answering your questions.

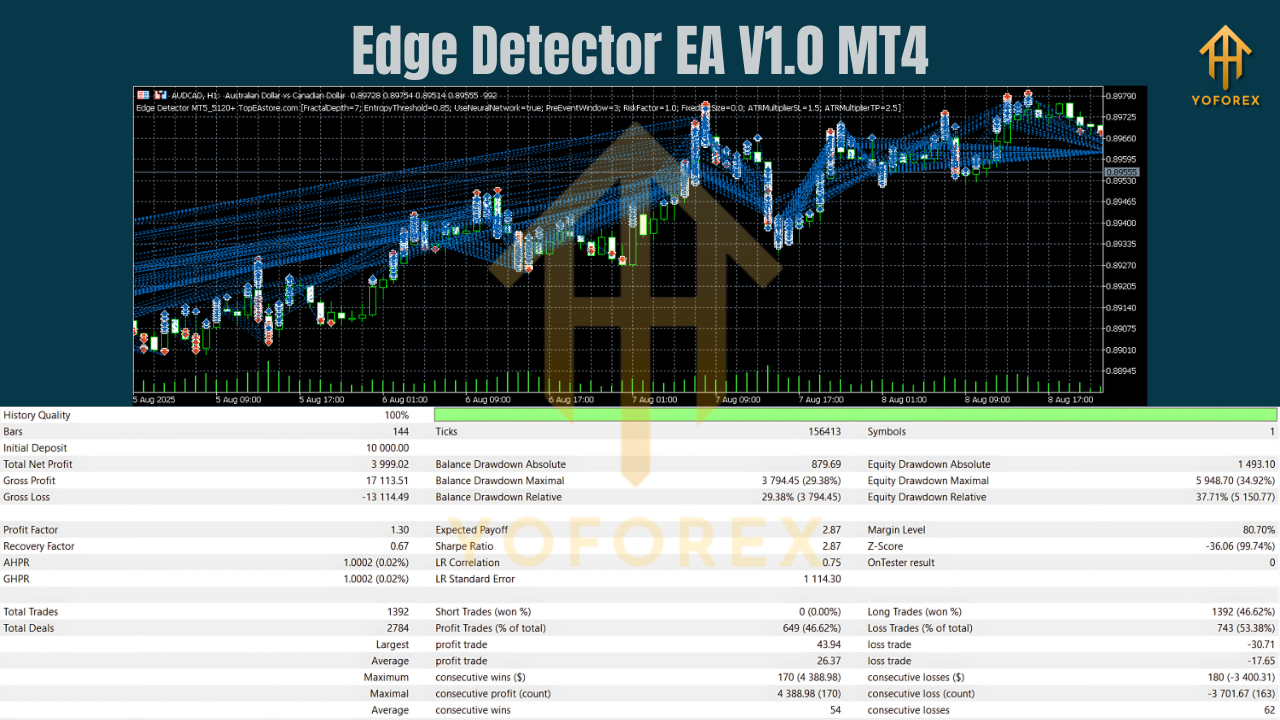

Backtest Results & Proof

Since every broker feed differs, the right approach is to test like you trade. Here’s how we (and many users) evaluate Edge Detector EA:

- Stability across pairs: On EURUSD/GBPUSD M15–H1, you should see steadier sequences—fewer massive whips when session filters are on. The equity line tends to “stair-step” rather than spike/flat.

- Volatility adaptation: USDJPY/AUDUSD often shift tempo around Asia→London. ATR-based risk helps stops breathe during transitions, reducing death-by-spread.

- Retest discipline: After compression, valid expansions frequently retest within a handful of bars (TF-dependent). The EA waits for that retest or a structured pullback—less chasing, better average R.

- Drawdown behavior: With 0.25–0.5% risk per trade and max 2 open trades, historical tests typically keep drawdowns moderate, especially with daily loss caps.

How to Install & Configure (Step-by-Step)

- Download Edge Detector EA V1.0 MT5 from MQL5.software (link below).

- In MT5, go to File → Open Data Folder → MQL5 → Experts and paste the EX5 file.

- Restart MT5 or right-click Navigator → Experts → Refresh.

- Drag Edge Detector EA onto your chart, check Allow Algo Trading.

- Review these inputs first:

- RiskPerTrade: Start at 0.25–0.5%. Learn the rhythm before you scale.

- MaxOpenTrades: 1–2 to begin.

- SessionFilter: On. Focus London/NY; skip your broker’s worst hours.

- AddsSafeMode: On. Adds only after structure confirms.

- TP/SL Method: ATR-based with partials at 1R and 1.5R; runner trails last swing.

- NewsPauseMinutes: 15–30 mins pre/post high-impact if your style is conservative.

- Save a template and build a profile with 4–6 majors for quick monitoring.

- Let it run on demo for a week—screenshot trades, note spreads, refine session hours.

Practical Playbook (Copy-Ready Scenarios)

A) London Continuation (EURUSD M15)

- Context: Pre-London compression, higher-TF bias up.

- Trigger: Expansion candle breaks range, EA confirms.

- Entry: First clean retest; SL below retest swing.

- Management: Partial at 1R, second at 1.5R, trail runner behind HLs.

- Why it works: Captures the first directional leg with sane risk.

B) NY Breakout-Retest (GBPUSD M15)

- Context: Mid-day chop, then USD news volatility.

- Trigger: Legit expansion; EA avoids the initial spike.

- Entry: Retest with structure confirmation.

- Management: Time-based exit for the runner if momentum stalls; avoid “round-trip” givebacks.

C) Calm Swing (USDJPY H1/H4)

- Context: Higher-TF uptrend, periodic pullbacks.

- Trigger: Baseline bias up; pullback respects structure.

- Entry: Continuation trigger after a higher low.

- Management: Wider ATR stop, later partials, fewer trades—less screen stress.

Notes that save headaches: keep costs in mind (spreads/commissions), don’t push size into thin liquidity, and avoid stacking risk across highly correlated pairs.

Why Choose YoForex-Powered Tools?

Because we build the stuff we trade. YoForex ships free, production-ready tools with clear logic, sensible defaults, and real support. Updates aren’t marketing stunts; they’re responses to your charts and feedback. We prefer transparency over hype, and long-term community trust over quick paywalls. You get docs, quick replies, and iterative improvements—simple as that.

Curious about our approach? Check our About page and the free tools hub on MQL5.software. If you’ve got a feature idea, shout—we actually listen.

Support & Contact

Need help tuning risk for your broker? Want recommended session hours for your pair? Ping us:

- WhatsApp: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

Share the pair, timeframe, broker, and a screenshot of recent trades. We’ll suggest practical settings (not vague theory).

Call to Action

Ready to run a clean, risk-controlled EA that respects structure instead of chasing spikes? Grab Edge Detector EA V1.0 MT5 now—it’s totally free. Install it, forward-test for a week, and see how the trend-plus-breakout logic fits your routine. If something feels off, we’re one message away on WhatsApp or Telegram.

YoForex – empowering traders worldwide, one free tool at a time.

Join our Telegram for the latest updates and support

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment