The world of forex and commodities trading has witnessed significant advances with the development of Expert Advisors (EAs) like ECNture Raging Gold EA V1.0 for MetaTrader 4 (MT4). Traders, both novice and professional, are constantly seeking ways to automate their trading to improve efficiency, reduce errors, and maximise profits. The ECNture Raging Gold EA is one such solution specifically designed for trading gold (XAU/USD), offering advanced features and a solid framework for risk management. In this blog post, we will delve into the key aspects of the ECNture Raging Gold EA, highlighting its strengths, performance, and suitability for traders looking to take advantage of automated gold trading.

What is ECNture Raging Gold EA V1.0?

The ECNture Raging Gold EA V1.0 is an automated trading system for MetaTrader 4 (MT4), crafted with the primary objective of automating gold trading (XAU/USD). This EA leverages advanced algorithms and market data analysis to make trading decisions with minimal human intervention. It provides traders with a comprehensive solution to trade gold and other assets efficiently while minimising risk.

The development of the EA is focused on providing users with precise entry and exit points, reliable risk management tools, and an adaptive trading approach that performs well in varying market conditions. Whether you are new to trading or an experienced investor looking to automate your strategy, the ECNture Raging Gold EA has features designed to suit your needs.

Key Features of ECNture Raging Gold EA V1.0

1. Designed for Gold Trading

Gold is a highly volatile asset, and the ECNture Raging Gold EA is specifically optimised to handle the unique characteristics of the gold market. With its ability to analyse price movements, detect patterns, and execute trades based on historical and real-time data, the EA is well-suited for gold traders looking for automated solutions. Its adaptability ensures that it can adjust to different market conditions, whether the market is trending or consolidating.

2. Multi-Asset Trading Functionality

While the EA excels in gold trading, it also offers flexibility for those who wish to trade other assets. Some of its capabilities include:

- Forex Trading: The EA is designed to handle major forex pairs such as EURUSD, GBPUSD, and others. This makes it versatile for traders who wish to diversify their portfolio beyond gold.

- Cryptocurrency and Stock Trading: The system can be configured to trade cryptocurrencies and stocks, offering an extended range of opportunities for traders looking to access different markets.

3. Advanced Algorithmic Strategy

The success of the ECNture Raging Gold EA lies in its sophisticated algorithm. The EA uses a combination of technical analysis, price action patterns, and market signals to generate high-accuracy trade signals. The strategy involves:

- Trend Analysis: The EA continuously analyses the market for potential trends, helping traders capitalise on both bullish and bearish movements.

- Price Action Recognition: By identifying key support and resistance levels, the EA makes informed trading decisions, enhancing the accuracy of trades.

- Dynamic Adjustment: The algorithm adapts to changes in the market, making it a reliable tool during both stable and volatile market conditions.

4. Risk Management Features

Risk management is crucial in trading, especially in volatile markets like gold. The ECNture Raging Gold EA offers several built-in risk management features:

- Drawdown Protection: The EA monitors your trades and ensures that potential losses are controlled by utilizing stop-loss settings and other risk management techniques.

- Adjustable Lot Sizing: The EA allows traders to set the lot size based on their risk tolerance, making it possible to trade small or large positions depending on the trader's preferences.

- Capital Preservation: The EA is designed to protect your trading capital by avoiding high-risk strategies and ensuring that each trade has a defined risk-to-reward ratio.

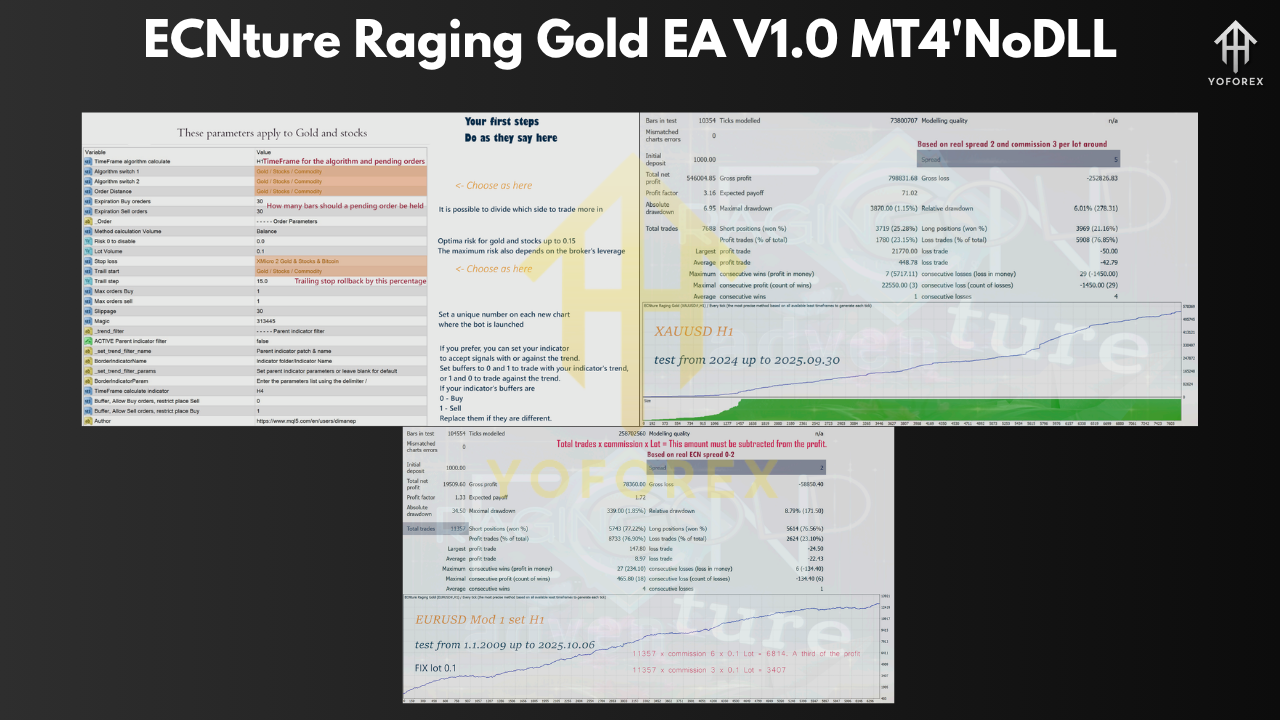

Backtesting and Performance

One of the most important aspects of any trading system is its ability to perform consistently across different market conditions. The ECNture Raging Gold EA has been extensively backtested across various timeframes and market conditions. The results show that the EA can generate positive returns over the long term, though like all trading systems, it’s not without risks.

- Gold Trading Success: The EA has proven to be highly effective in the gold market, where it uses real-time market data and predictive algorithms to execute trades at the best possible price points.

- Forex Performance: The EA’s performance on major forex pairs such as EURUSD has also been positive, demonstrating its ability to adapt to various asset classes.

- Long-Term Performance: As with all automated systems, long-term success is dependent on several factors, including market conditions and proper risk management. The developer recommends running the EA for an extended period (at least two years) to assess its true potential.

How to Install ECNture Raging Gold EA V1.0 on MT4

Setting up the ECNture Raging Gold EA on your MetaTrader 4 platform is a simple process. Here’s a step-by-step guide:

- Install on MT4:

Place the downloaded EA file in your MT4 “Experts” directory. This can usually be found in your platform’s installation folder underMQL4/Experts. - Attach the EA to a Chart:

Open your MT4 platform, select a chart (preferably XAU/USD for gold trading), and drag the EA from the Navigator window onto the chart. - Adjust Settings:

Before activating the EA, adjust its settings according to your risk preferences, such as lot size, stop-loss, and take-profit levels. The default settings are suitable for most traders, but tweaking them can help you align the EA with your individual trading strategy. - Enable AutoTrading:

Ensure that AutoTrading is enabled in MT4 so that the EA can execute trades automatically.

Compatibility with Brokers

For optimal performance, the ECNture Raging Gold EA is best used with brokers that offer:

- Low Spreads and Commissions:

Since the EA is optimised for gold trading, brokers with tight spreads and low commissions will maximise its profitability. High spreads and fees can significantly reduce the overall performance. - Support for MT4:

The ECNture Raging Gold EA operates on the MT4 platform, so it’s essential to choose brokers that support MT4 for seamless integration. - Fast Execution Speed:

Given that the gold market can experience rapid price movements, selecting brokers with low latency and fast execution speeds is crucial.

Conclusion

The ECNture Raging Gold EA V1.0 for MT4 is an advanced, automated trading solution designed specifically for gold trading, but also adaptable for other asset classes like forex, stocks, and cryptocurrencies. With its sophisticated algorithm, customizable risk management settings, and ability to trade multiple assets, it offers a comprehensive solution for traders looking to automate their trading strategies. However, as with all trading systems, it’s important to perform due diligence and test the EA under different market conditions to ensure it aligns with your trading goals.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment