DEEP TRADING EA1 PRO V3 MT4: In-Depth Analysis & Review on MQL5.Software

Introduction

In today’s fast-paced forex market, automation and AI-driven decision-making have become critical tools for traders seeking consistency and efficiency. One expert advisor that has generated significant interest is the DEEP TRADING EA1 PRO V3 MT4. In this article, we break down every aspect of this EA—from its strategy and features to its performance metrics and risk management—so you can determine if it’s the right fit for your trading needs.

This comprehensive review is tailored for users on MQL5.Software who value transparent performance data and detailed insights before investing in any automated trading tool. Whether you are an experienced trader looking to refine your portfolio or a newcomer eager to explore algorithmic trading, this review offers all the technical and practical details you need to get started.

Overview of DEEP TRADING EA1 PRO V3 MT4

DEEP TRADING EA1 PRO V3 MT4 is the latest iteration of the EA1 PRO series designed for MetaTrader 4. This version is refined and optimized with AI-driven algorithms, ensuring a more adaptive trading approach compared to earlier models. The bot’s primary focus lies in executing a retracement strategy that is based on technical indicators such as the Supertrend and the Relative Strength Index (RSI). These indicators help identify entry and exit points mainly on popular currency pairs like EURUSD and USDCHF, particularly on the M5 timeframe.

What sets this EA apart is its multi-tiered trading system. With options ranging from Basic to Pro modes, the system enables traders to adjust the aggressiveness of the trading strategy based on their risk appetite and market conditions. Despite its promising backtesting results, it’s essential to understand that real-time performance can vary. That said, its initial data—recording high win rates and an impressive profit factor—make it a subject of considerable discussion within the forex community.

Key Features and Trading Strategy

Fully Automated Operation

One of the greatest strengths of DEEP TRADING EA1 PRO V3 MT4 is its ability to run with minimal human intervention. Once set up, it automatically manages trade entries, exits, and even recovery trades if the market moves contrary to an initial position. This “set-and-forget” nature makes it particularly appealing to busy traders who cannot monitor the markets around the clock.

AI-Enhanced Trading Logic

Unlike EAs that rely on hard-coded rules, this expert advisor leverages AI to refine its trading decisions. The underlying algorithm is designed to recognize market patterns and adapt to changing conditions, reducing the risk of “curve-fitting” that is common in some backtested systems. By integrating AI, the EA can dynamically tweak its parameters, potentially improving its reliability over extended periods.

Multi-Tiered Trading Modes

The EA1 PRO V3 comes with three trading modes:

- Basic Mode: Tailored for conservative traders or beginners, this mode employs lower risk settings.

- Premium Mode: Balances risk and reward more evenly, suitable for traders who want moderate exposure.

- Pro Mode: Aimed at aggressive traders seeking higher returns, albeit with increased risk levels.

These modes adjust essential variables such as trade frequency, lot size, and recovery logic. Thus, whether you’re trading live on a prop firm account or testing on a demo account, you can choose a mode that aligns with your risk management strategy.

Retracement and Recovery Strategy

The core strategy of the EA revolves around retracement trading. It capitalizes on short-term market corrections during prevailing trends. For instance, if the market is trending upwards, the EA seeks opportunities to enter long positions during a brief pullback. The combination of RSI to gauge momentum and Supertrend for trend direction helps the bot decide optimal entry points. Additionally, a built-in recovery mechanism kicks in if a trade moves against your position. This recovery logic typically targets a fixed number of pips (around 60 pips), aiming to mitigate drawdown risks and steadily recover losses.

Risk Management and Performance Metrics

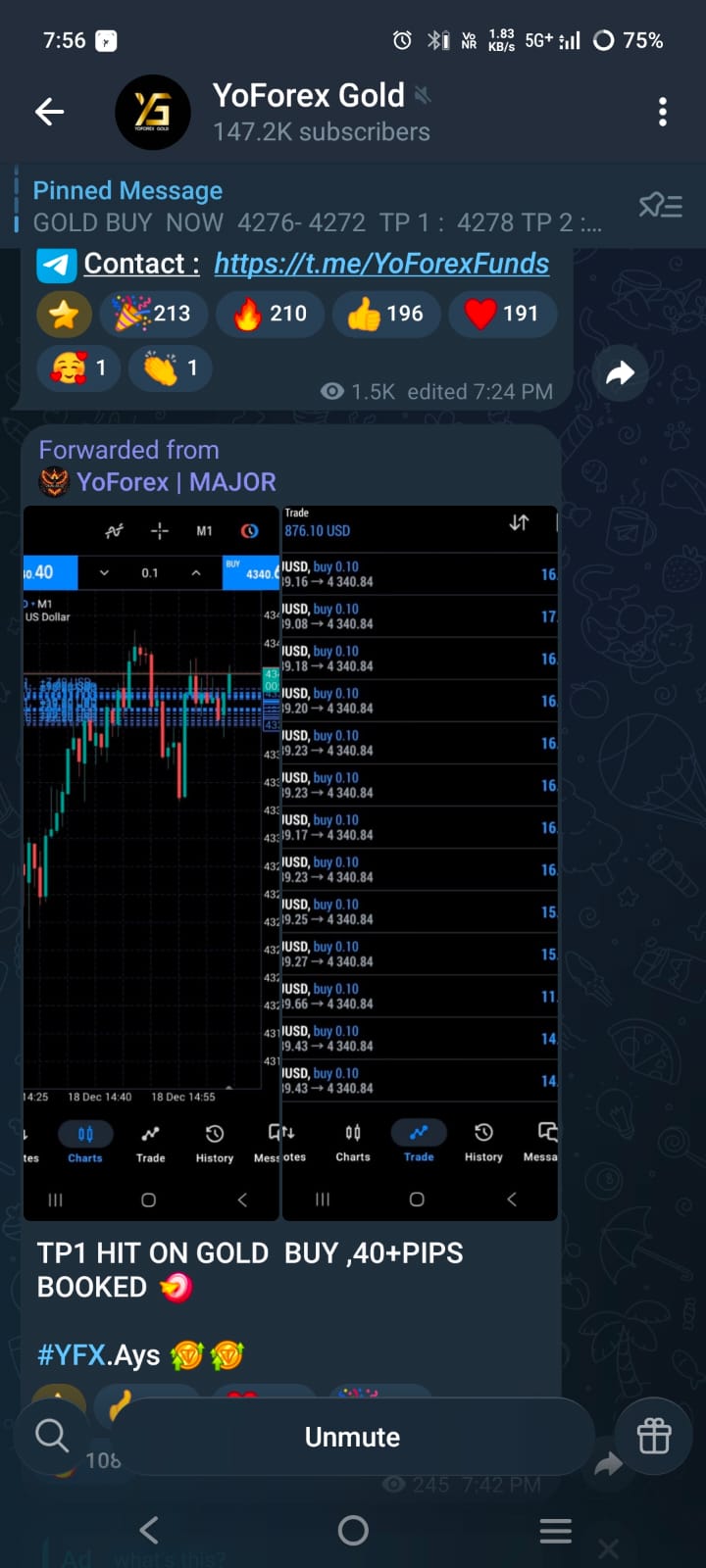

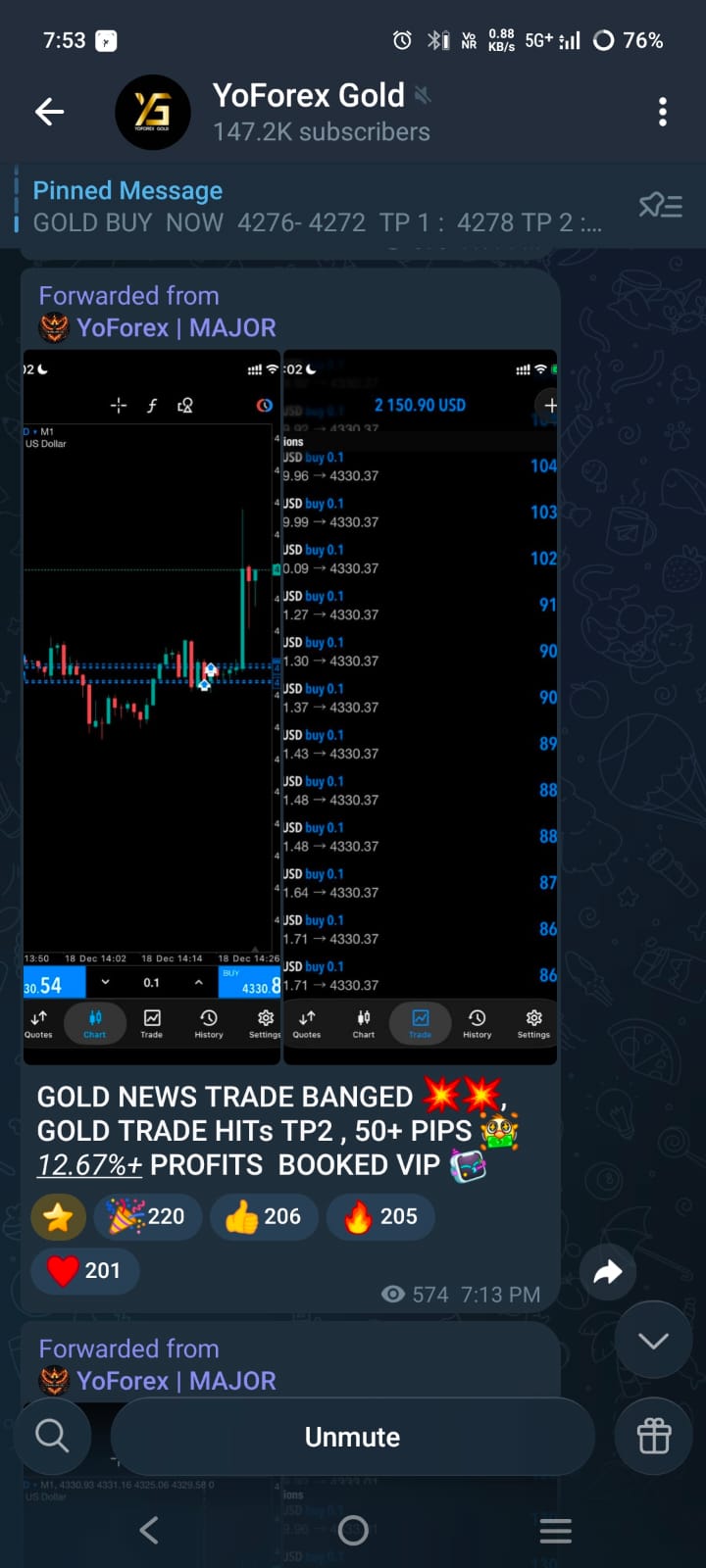

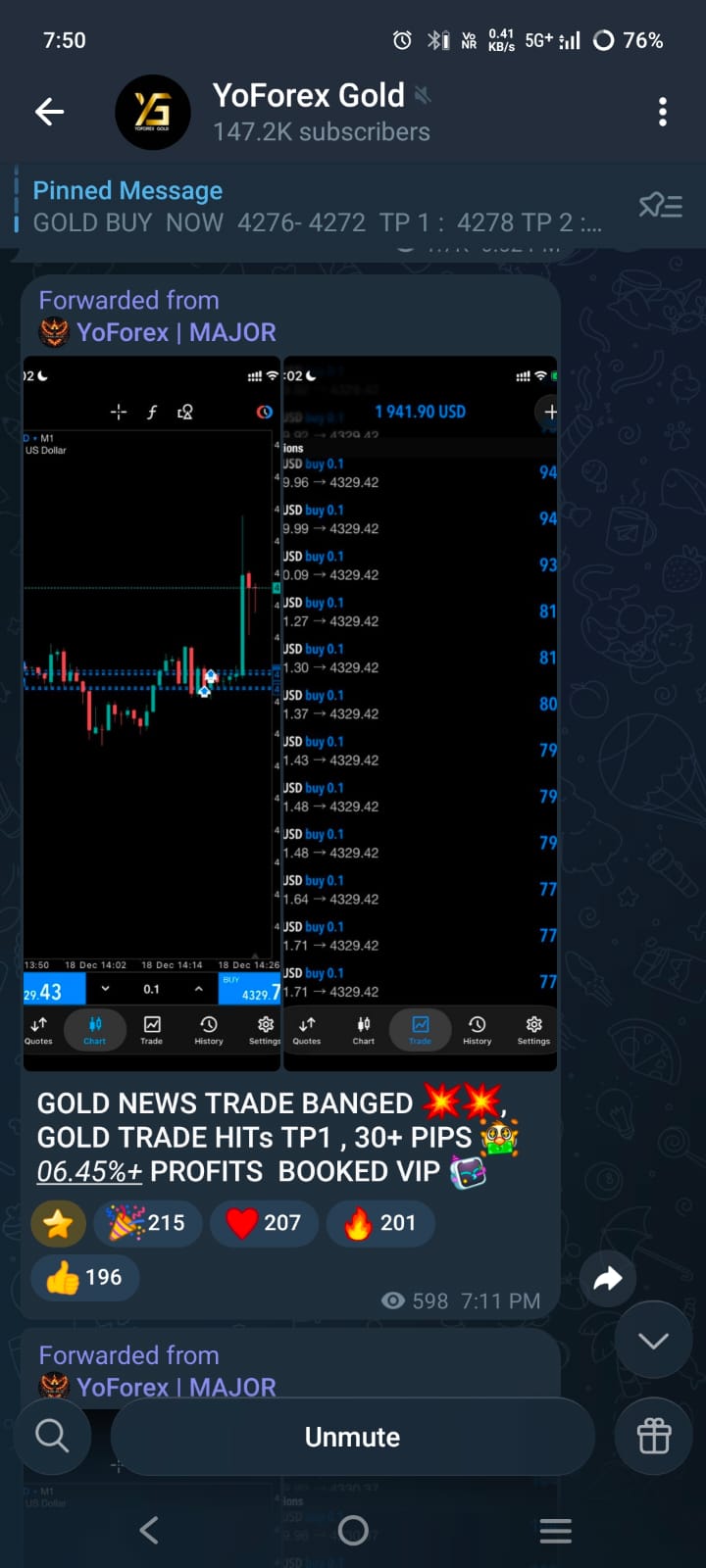

According to data sourced from various backtests and Myfxbook reports:

- Total Return: Historical simulations have recorded returns upwards of +1600%, though note that these figures are based on backtested data.

- Monthly Gains: Averaging around 3-4%, the EA appears consistent in its performance.

- Maximum Drawdown: Approximately 17%, which is relatively low compared to some grid or Martingale systems.

- Profit Factor: Often reported above 5.0, indicating a potentially favorable risk/reward ratio.

These metrics suggest that DEEP TRADING EA1 PRO V3 MT4 might offer a compelling balance between profit potential and risk mitigation. However, as with any automated trading system, it is critical to validate these numbers with live or forward testing.

Installation and Setup Process

Setting up the EA is straightforward, even for those new to automated trading on MetaTrader 4. Here’s a step-by-step guide:

Download the EA File

Obtain the latest version of DEEP TRADING EA1 PRO V3 MT4 from an authorized vendor. Ensure you get the genuine file to avoid pirated or outdated versions.

Install the EA in MT4

- Place the EA file in the Experts folder within your MT4 directory.

- Restart MT4 to recognize the new expert advisor.

Attach to a Chart

- Open a chart for either EURUSD or USDCHF on the M5 timeframe.

- Drag and drop the EA onto the chart.

Configure Settings

- Choose the appropriate trading mode (Basic, Premium, or Pro) according to your risk tolerance.

- Adjust settings such as lot size, stop-loss, and take profit levels as required.

- Enable ‘Auto Trading’ and allow DLL imports if prompted.

Test on a Demo Account

Before switching to live trading, run the EA on a demo account for at least one month to understand its behavior under varying market conditions.

Pros and Cons

Advantages

- Automation and Ease of Use: With minimal intervention needed, the EA is ideal for traders who want to automate their trading process without constant supervision.

- Adaptive Trading Logic: The AI-powered engine allows the EA to adjust dynamically to market conditions, potentially offering better performance over time.

- Multiple Trading Modes: The availability of different modes caters to traders with diverse risk profiles.

- Robust Risk Management: The built-in recovery logic and low reported drawdowns are appealing features for risk-conscious traders.

- User-Friendly Interface: Easy-to-read dashboards and clear performance metrics help traders monitor trade performance effortlessly.

Limitations

- Reliance on Backtest Data: While historical performance is impressive, live trading results might vary.

- Limited Live Performance Feedback: As of now, there is a scarcity of verified live user feedback and forward testing data.

- Vendor Authenticity: Due to the existence of multiple sellers—some of which might offer outdated or pirated versions—it is crucial to purchase from reputable sources.

- Market Conditions Sensitivity: Like most EAs, its performance can be affected by market volatility and extreme events; hence, continuous monitoring and risk adjustment are recommended.

How Does DEEP TRADING EA1 PRO V3 Compare to Other EAs?

The market is inundated with numerous automated trading systems, but DEEP TRADING EA1 PRO V3 distinguishes itself with its focus on AI-driven logic and robust recovery systems. When comparing it to other popular EAs on the market:

- Adaptive vs. Rigid Logic: Many EAs rely strictly on predefined rules, whereas DEEP TRADING EA1 PRO V3 adapts its strategy as market conditions evolve.

- Risk Control: Its recovery mechanism is more refined compared to some grid-based systems, offering a controlled approach to mitigating losses.

- Ease of Setup: The user-friendly installation and configuration process ensures that even beginners can get started with relative ease.

Ultimately, the EA’s flexibility and innovative design make it a strong contender for traders aiming to integrate AI-based strategies into their trading routine.

User Experiences and Community Insights

Despite the promising backtest data, user experiences can vary. Several discussions on online forums and trading communities indicate that while many traders appreciate the EA’s ease of use and consistent strategy, there is a call for more live forward testing evidence. Some users have reported steady gains in demo accounts, while others suggest caution due to market unpredictability.

These mixed reviews are common among automated trading systems, and potential buyers should engage in thorough testing and community research before committing substantial capital. Participating in forums on MQL5.Software can be invaluable. Reading through verified user reviews and discussing experiences can give you insights into how the EA performs under live market conditions.

Best Practices for Using DEEP TRADING EA1 PRO V3

For traders considering integrating this EA into their strategy, here are some practical tips:

- Start with a Demo Account: Before trading real money, test the EA extensively in a demo environment.

- Set Realistic Expectations: Understand that while historical data may show impressive returns, no system is foolproof—especially during high volatility.

- Monitor Regularly: Although the system is fully automated, periodic review of performance metrics and system logs is recommended.

- Adjust Risk Parameters: Customize the risk settings to suit current market trends, especially during major economic announcements or geopolitical events.

- Use a Reliable Broker: Ensure your broker supports MT4 with tight spreads and efficient trade execution to maximize the EA’s potential.

By following these best practices, you can maximize the advantages offered by the DEEP TRADING EA1 PRO V3 while keeping risk at manageable levels.

Conclusion

DEEP TRADING EA1 PRO V3 MT4 represents a significant development in AI-powered automated trading. Its sophisticated retracement strategy combined with multiple trading modes and a robust risk management framework makes it an attractive option for both novice and experienced traders. Although the majority of performance data stems from backtests and simulated environments, the available statistics, along with its adaptive logic, provide a compelling case for its potential.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment