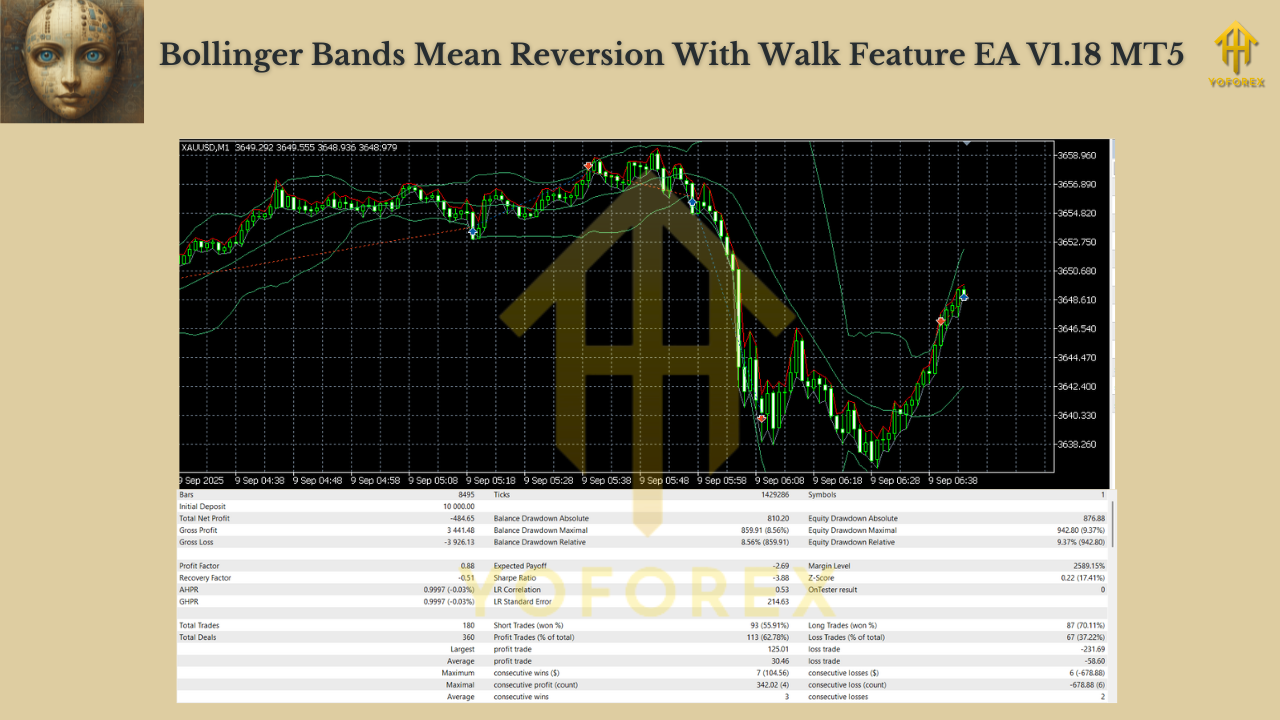

Bollinger Bands Mean Reversion w/ Walk Feature EA V1.18 MT5 — Smart Pullbacks on XAUUSD M1

When gold is flying, fading every touch of a band is a fast track to ruin. But when XAUUSD chops and stretches, a disciplined mean-reversion engine can milk those elastic snaps. Bollinger Bands Mean Reversion With Walk Feature EA V1.18 (MT5) leans into that edge—waiting for price to “walk” the band for N bars before it even thinks about entering. That small delay filters tons of fakeouts on noisy timeframes like M1, where impatience costs real money.

Quick take: set the walk sensitivity (N) to 3–4 bars on M1 Gold for an optimal balance between catch-rate and quality. The EA won’t jump on the first poke outside the band—it lets price prove it’s extended, then times reversion entries with volatility-aware stops and staged exits.

What This EA Does (and why it works)

Classic Bollinger Band fades assume mean reversion is immediate. On Gold M1, that’s rarely true—price often “walks the band” for a bit before snapping back. The EA’s Walk Feature forces a patience window:

- Price must remain outside the upper or lower band for N consecutive bars (your setting).

- Only after those N bars print can the EA arm a counter-move entry (sell near upper band walk, buy near lower band walk).

- That extra confirmation filters early fades and helps enter closer to exhaustion, not the start of a squeeze.

Couple that with ATR/structure-based SL, partial take-profits, and an optional trail, and you’ve got a mean-reversion bot tuned for fast tape, small edges, and strict risk.

Core Features

- Walk Feature (N bars): Delay entry until price “walks” a band for N consecutive closes.

- BB Logic: Uses classic Bollinger Bands (Period/Deviations configurable) as the stretch detector.

- Volatility-Aware Risk: ATR-scaled stop so SL isn’t parked on random noise.

- Staged Exits: Optional partial at 1R or at the middle band; trail the remainder.

- Spread/Slippage Guards: Skip entries in toxic conditions.

- Session Window: Prefer liquid periods (London/NY overlap).

- No martingale/grid by default: Keep sizing clean; let the stats do the work.

- Symbol focus: Built for XAUUSD M1, but can run on other TFs/pairs after testing.

Recommended Starter Settings (XAUUSD, M1)

- Walk sensitivity (N): 3–4 bars (sweet spot for M1 Gold).

- Bollinger Period: 20 (baseline), Deviations: 2.0–2.2 (try 2.1 on some brokers).

- Risk per trade: 0.25–0.40% (M1 is spiky—keep it light).

- SL: 1.6–2.0 × ATR(14) (M1), placed beyond the walked side.

- TP style:

- Conservative: Full exit at Middle Band or +1.5R (whichever first).

- Hybrid: Partial at Middle Band, trail remainder with ATR or band-following trail.

- Max concurrent positions: 1 per side (avoid stacking into squeezes).

- Max spread: Broker-dependent, but be strict on M1.

- Session filter: Enable London + NY overlap; consider pausing during Asia unless your broker’s spreads are excellent.

- News buffer: 15–30 minutes around CPI/NFP/FOMC—skip entries if spreads balloon.

Tip: If you see late entries during ultra-fast spikes, raise N from 3 → 4. If you’re missing too many good snaps, drop N to 3 and tighten your spread cap.

How Entries & Exits Play Out (step-by-step)

- Detect the walk: Close is outside the band for N bars.

- Arm reversion: On the next signal bar, the EA readies a counter-direction trade near exhaustion.

- Place order + SL: ATR-scaled stop sits beyond the walked side to avoid getting clipped by one more push.

- Manage the win:

- First target: Middle band or 1R—bank something quickly on M1.

- Then trail: If you keep a runner, trail by ATR or band slope, tightening as price normalizes.

- Stand down after hit: If SL is hit, the EA won’t immediately “revenge trade”; walk conditions must reset.

M1 is brutal. Here’s how to tame it.

- Use a proper ECN/RAW account on Gold; spreads + slippage are half the game.

- Run on a VPS; low latency helps fills on short TFs.

- Keep risk tiny; your edge is frequency + discipline, not giant size.

- Respect the calendar: gold + red news = lotto. Sit it out.

- Don’t stack positions into a one-direction walk; the Walk Feature is about patience, not pyramids.

Install & First Run (MT5)

- Download the EA file.

- MT5 → File → Open Data Folder → MQL5 → Experts → paste EA.

- Restart MT5; drag the EA onto XAUUSD, M1.

- In Inputs set:

- WalkN = 3 or 4

- BB Period = 20; Deviations = 2.0–2.2

- Risk %, ATR-SL multiple, TP/Trail style

- Max spread/slippage, Session window, News buffer

- AutoTrading ON → Forward-test on demo for 1–2 weeks, then go live with half risk.

Backtesting the Right Way (then forward test)

- Tick model with realistic spread/commission over 3+ years including shock events.

- Track max DD, avg hold time, PF, win rate by session, and sensitivity to N (try 2–5).

- Parameter sanity: If a tiny tweak to N or deviations flips results massively, you’re too curve-fit.

- Forward test on your actual broker—execution reality always differs.

Troubleshooting Cheatsheet

- Too many early fades? Increase N (3 → 4) or raise BB deviations slightly.

- Missing juicy snaps? Lower N or relax max spread a touch (careful).

- Death by a thousand cuts? Increase ATR SL multiple; consider a partial at 1R to lock a base hit.

- Live ≠ backtest? Welcome to fills. Tighten session window, improve VPS, and lower risk till behavior stabilizes.

FAQ (quick)

Q: Can I run it on M5/H1?

A: Yes, but the N=3–4 guidance is for M1 Gold. For higher TFs, N=2–3 often suffices. Always forward-test.

Q: Is this a grid?

A: No. Default is one position per side; you can enable more only if you truly know what you’re doing.

Q: Fixed lot or % risk?

A: % risk adapts to volatility/stop distance and is generally safer on M1.

Final Word

Bollinger Bands Mean Reversion With Walk Feature EA V1.18 MT5 cuts the classic M1 Bollinger problem—entering too soon. By forcing 3–4 consecutive bar closes outside the band before entry, it aims to catch late-stage extensions and fade them with volatility-aware risk and staged exits. Keep risk small, trade peak liquidity, avoid red news, and let the Walk Feature do its job: patience first, entries second.

Join our Telegram for the latest updates and support

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment